Electrical distributor consolidation will accelerate and plenty of opportunities will exist for large or mid-size independent electrical distributors to sell over the next five years. The national chains are on the hunt, as are super-regional chains. Strategic buyers and financial buyers such as private equity firms will drive this consolidation.

Some respondents in our survey wondered if Richard Worthy’s return as another strategic buyer with a new company, AMP Electrical Distribution Solutions Inc. (AEDSI), will move selling prices higher. A bigger question is whether a super-regional distributor (a company with operations in several regions of the United States) or several super-regional chains will be acquired by one or more national chains. Other questions respondents had were whether Anixter would buy a super-regional, or if one or more of the super-regional chains might grow into a national chain.

The top targets for acquisition will be the large and mid-size independent electrical distributors. Smaller independent distributors will continue to flourish in niche markets where they can out-service their larger competitors. Said one mid-size regional electrical distributor, “I never looked at this business as an investment before the last few years. My father owned it and I just came to work here. Now I look at it as an investment. Someone once told me, ‘Are your son or daughter at home in the basement playing video games the best fit to run your business someday?’ Very true and I probably will sell this business one day.”

Hybrid distributors taking market share. One of the trends reshaping the consolidation landscape is the competition full-line electrical distributors now see from hybrid distributors like Anixter, HD Supply, Grainger, Fastenal, McMaster-Carr, Ferguson and Kaman Industrial Technologies. Hybrid distributors have chipped away business from electrical distributors over the last decade and will continue to be a force in the electrical distributor (ED) channel for years to come. W.W. Grainger attracts the most attention from this group, in large part because of the significant footprint it has in electrical products and its best-in-class online storefront.

Grainger has a strong presence with end users that electrical distributors will struggle to duplicate due to the broad range of products it offers. End users are comfortable purchasing commodities like lamps, tools and trash cans from them, and Grainger has been very successful in taking away higher margin smaller industrial MRO business from traditional electrical distributors.

Said one rep, “Grainger is already cleaning electrical distribution’s clock. We have responsibility for two product lines with Grainger. At several customers that we visited with in electrical distribution we received no orders. When we went to Grainger there were automatic orders. They have a broader product offering and often credit card contracts that allow for small purchases. Grainger has a large sales force and they are beginning to concentrate on value-add electrical. They will not get into pipe and wire commodities but they are getting into lighting and controls.”

“We see Grainger salespeople crawling all over the towns we are in,” added a distributor. “We see them trying to grab low-hanging fruit with contractors, but their lack of product depth doesn’t take them very far.”

We believe any full-line electrical distributor can follow the same strategies Grainger uses to fend off Amazon’s push into the ED channel: Invest in “brick-and-mortar,” talented salespeople, and continually improve your ecommerce system.

Kaman Industrial Technologies is another well-run company that recently dipped its toe into the ED channel through acquisitions by pursuing OEM and MRO niche in electrical product categories. They are now a Schneider Electric distributor. Acquisitions helped push Kaman Industrial Technologies, the distribution arm of automation giant Kaman Corp., to over $1 billion in 2012 sales. With their power transmission customer base and the relatively weak performance by the majority of the ED channel as a whole in the industrial automation arena, we could see them getting a lot of support from the manufacturers of industrial automation products. In addition to the industrial market, there will be more opportunity for hybrid distributors over the next five years in the commercial space as buildings become more sophisticated and heavily integrated.

Manufacturer

Consolidation & Direct Sales

Manufacturer consolidation will continue at a rapid pace. There will be fewer manufacturers selling a wider breadth of products. Large global manufacturers will rule the business landscape. According to one electrical manufacturer, “The global manufacturers will be the winners!”

The largest global and U.S. electrical manufacturers will continue to strategically grow their product baskets. There will be new global manufacturer entrants from both Europe and Asia entering the U.S. market over the next five years, and we expect there to be big deals to match the size of ABB’s acquisition of T&B and the Eaton’s purchase of Cooper. Additionally, a host of smaller players will be acquired. Our survey respondents’ top acquisition targets are in the full report. Survey participants identified 20 publicly held and privately owned manufacturers as top acquisition targets. The public electrical companies that came up most often as potential acquisitions included Acuity Brands, Littelfuse, Mersen, Rockwell Automation and Hubbell. The privately held or family owned companies named most often included Arlington Industries, Bridgeport Fittings, Erico, Ideal Industries, Intermatic, Ilsco, Leviton, Panduit and RAB Lighting.

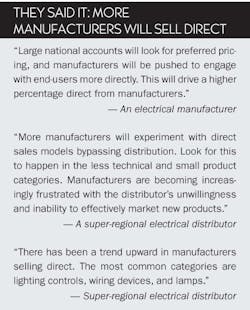

Direct sales will become more common. Research participants believe the ED channel will experience more direct sales in the future, primarily with products where traditional distribution does not add value. As large consumers of electrical products such as original equipment manufacturers (OEMs) become more focused on total cost, they will challenge manufacturers to provide distributor-level service and sell direct. This is taking place in the industrial market and is beginning to take place with large commercial contractors. Large national accounts will look for preferred pricing and manufacturers will be pushed to engage with end-users more directly. Additionally, new foreign manufacturers entering the U.S. market will likely bypass electrical distributors and sell direct. Also, tech giants such as Apple and Google want to buy direct, specifically with lighting, gear, raceway and wire products. Large gear and control manufacturers already have some direct accounts. Said one rep, “We see the large Schneider-type manufacturers selling direct turn-key energy solutions directly to the government and other large-scale entities. Most of these sales are in the energy sector.”

However, the majority of electrical manufacturers will not risk stock-and-flow channel support by selling direct. Electrical distributors need to offer a strong value proposition through product consolidation, jobsite support and project management to justify their value in the chain.

“Based upon intense supply chain scrutiny at the major OEMs and institutions, the electrical distributor’s value is being questioned, and some of this traditional business will be sold direct to the OEMs,” said one electrical manufacturer. “This trend has started with the larger spends (switchgear, lamps and ballasts) and will progress into other electrical product segments based on the next larger spends.”

Agreed an executive from a national chain, “We see more manufacturers negotiating large projects directly and then bringing them through the channel. The margins are low and often rebates and incentives are reduced or eliminated.” Said another manager from a distributor chain, “There will be a higher percent of direct sales from electrical manufacturers in the future as manufacturers act as energy service companies (ESCOs) on major jobs and as more manufacturers come into the U.S. not having previously sold through the electrical distribution channel.”

The impact of direct sales on reps. Research participants see more evidence of electrical manufacturers selling direct, particularly in the energy and retrofit markets, and to a lesser degree in the pre-fab wiring systems market. These electrical manufacturers will bypass independent manufacturers’ representatives and sell direct to electrical distributors, contractors and end-users. If a manufacturer is not a leading name in the industry with existing market share, the investment the rep must make to heighten awareness of that manufacturer is considerable, with a return that is only realized after a lengthy marketing, sales and pay cycle process. Additionally, many new foreign manufacturers entering the U.S. market will likely bypass independent manufacturers’ representatives and sell direct.

Hybrid sales models are evolving where manufacturers are co-invested with the independent reps with more field engineers focused on the specifying engineering community. It’s very expensive for manufacturers to cover many territories because the dollar per square mile is too small. Manufacturers will continue to have direct sales forces in the larger markets and employ reps in smaller markets. Said one independent electrical manufacturers’ representative, “We are definitely seeing an increase in the incidence of direct sales, particularly in the energy and retrofit markets, but some also in the pre-fab wiring systems market.The manufacturers who sell direct are doing so, in some cases, to distributors and contractors, with a smattering of other customers mixed in as well.

“The next few years will tell if the model of selling direct will work for manufacturers. Those manufacturers who sell through manufacturers’ representatives in addition to selling direct are trading short-term sales against long-term growth, as the direct orders they take undermine their relationships with the reps whose attention they desire. Ultimately, in this model the rep finds himself lacking the incentive required to justify making a committed effort to marketing those manufacturer’s products if the manufacturer is unable to adequately protect the rep’s ability to sell product and control margins on the opportunities he worked to generate.”

To receive a copy of this research report, call Farmington Consulting Group at (860) 678-4402 or email Tom ([email protected]) or TJ ( [email protected]).