Along with providing data on the size of their operations, many respondents take the time to answer questions about business conditions, their internal investments and plans for expansion. One of the more interesting areas of commentary in this year’s responses was the variety of views on exactly where the electrical economy is at right now. The sales forecasts provided by Top 200 distributors ranging in size from several billion in sales on the high end to approximately $15 million on the low end seem to be much wider than in past Top 200 surveys.

For instance, one large Texas distributor with broad exposure to the oil industry sees a 20% drop for his company, while 39 respondents — 32% of the 121 Top distributors offering a forecast — expect their 2015 sales to increase by at least 10%. Surprisingly, only six respondents expect their 2015 sales to decline from 2014. The market drivers fueling distributors’ forecasts were all over the map. As expected, the plunge in the oil & gas business cut into the forecasts of distributors active in the energy market. But Top 200 distributors had different takes on the health of the commercial, industrial and residential markets.

Jared Colker, president of the 80-year-old West Virginia Electric Supply, Huntington, W.Va., had an interesting perspective in that his company saw some growth over the past year in gas and oil fracking projects and upgrades to industrial facilities and utilities, but wrestled with a decline in the OEM and mining segments of the coal market. One growth sector for him has been LEDs. “Stocking LED was a growth factor with replacement bulbs and lighting fixtures in the educational, commercial and small industrial facilities,” said Colker, who has tweaked his 2015 sales forecast down a few points but still sees single-digit 2015 growth.

Matt Brnik, Schaedler/YESCO, Harrisburg, Pa., also sees a mix of growth opportunities in his company’s core markets. He pegs overall 2015 growth at a solid 6% for his company, but his forecasts for key niches vary, with commercial sales up 22%, government business down 10%, contractor business up 2% and industrial OEM up 2%. “The first quarter was strong across the board but April was horrible industrially,” he said.

Brnik reported that Schaedler/YESCO had a busy year on several fronts. The company celebrated its 90th anniversary; had a big two-day expo that he says created “major buzz” with customers and vendors; added SYDtv to all branches; dramatically expanded its wire and cable series; launched a mobile smart app; and installed a new phone system across the company.

Schaedler/YESCO’s Brnik wasn’t the only Top 200 distributor who sees a variety of sales growth in different niches. Doug Feustel, business analyst, Shealy Electrical Wholesalers, West Columbia, S.C., says the company is looking for total 2015 sales to increase about 8% in 2015, due in part to a 200% increase in Shealy’s international business last year, which had been down 50% in 2014 from 2013. He sees a more moderate 5% to 7% increase in the company’s 2015 construction sales and an increase of 3% to 4% in industrial sales. Shealy made a big acquisition in 2014 with its acquisition of the Charlotte, N.C.-based Nova Lighting and made a move into the industrial market last year, too.

The green growth theme colored forecasts all over the country for both full-line and specialty distributors. Doug Root, CEO, Atlanta Light Bulbs, Tucker, Ga., said the transition from being a light bulb and ballast supply house to an energy solutions provider for lighting retrofits has been a big paradigm shift for the company. This lighting specialist’s MRO, stock-and-flow business for legacy lamp and

ballasts has lagged, but Root has seen an increase in the need for complete lighting audits and energy consulting on lighting upgrades, rebate calculations and installations. “With the company’s transformation into an energy solutions provider have come changes in some customers and personnel and increase in competitors looking to cash in on the LED revolution. The Internet has proven to be a part of our business that has seen decline due to prices declining and customer demand for free shipping and more services,” he says.

Lighting also will continue to provide growth opportunities in Southern California for Mike Pratt, president/CEO, American Electric Supply, Corona, Calif. Pratt expects green business, as well as privately funded new commercial projects and the tenant improvement market to do well in 2015. “Our Green Solutions market through utility-based programs will see 22% plus growth this year,” he said. “The one segment in our market that we participate in that is down is both the state/municipality/school, public works construction and the federal military market. It still has not fully recovered from the recession.

“The key factor that kept our 2013/2014 sales almost identical was the California Energy Regulation Title 24 going into effect on July 1, 2014. This put a stop on the programs until both contractors, distributors and manufacture were able to comply with required technology. We are just seeing this come back in late first quarter of 2015.”

In his Top 200 survey responses over the years, American Electric’s Mike Pratt has often offered some terrific insight into the day-to-day challenges of being an electrical distributor. This year was no different. Even though it hasn’t been unusual for his company has often grown at double-digit annual rate, he still has many of the same challenges as execs managing businesses growing at a more moderate pace. Says Pratt, “We continue to implement lessons we learned from the recession to make our company stronger and leaner without affecting our best of the west customer service model. The recession with all its perils and hardships sent out a wake-up call to all of those that run a business.

“Our generation of business entrepreneurs will look back and remember the lessons learned along with the hardship much as our elders looked back at the lessons and hardships of the depression. We are pleased and proud of our team. Together we have come back to our pre-recession sales to celebrate our 31st year in business.”

Methodology. To compile this listing, in April of this year EW’s editors sent out a survey to several hundred distributors of electrical supplies that have either been on the list in the past or have at least $10 million in annual sales, according to our data sources. In addition, we get data from publicly held distributors and other companies that make their sales and company data public. This year we got information back from 151 Top 200 distributors, our best response ever. Many of these companies ask us to use their sales data confidentially and only for placement on the listing.

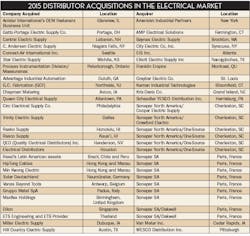

You will also notice that we rank companies that have been acquired in either 2014 or 2015. Our general rule of thumb here is that when a company has been acquired, we include their sales (or a sales estimate) for that calendar year, but take them off the Top 200 listing the next year, when they are fully integrated into the acquirer.

In those situations where a distributor is large enough to make the listing but did not respond to our surveys, if we have reliable sales or employee data from the past few years, we will place them on the listing, using a sales-per-employee average, or the average sales increase based on responses from Top 200 respondents or other EW sales data. However, if we haven’t heard from you for a while and your company is on this year’s listing, there’s no guarantee it will be ranked again next year. We make every effort to make this listing as accurate as possible, and can’t rely on sales estimates or other company data that’s more than a few years old.

Strictly by the numbers. With an estimated $65.3 billion in North American sales, EW estimates the Top 200 distributors controlled approximately 65% of sales through electrical distributors in North America. According to EW estimates, these 200 companies employ at least 103,000 employees and run at least 6,284 North American branches. From the 113 full-line distributors that provided both sales and employee data, we estimate that Top 200 full-line distributors averaged $651,317 in sales per employee.

Distributors Make Their Picks on the Year’s Hottest Products

It always floors EW’s editors that so few new products make an impression with Top 200 distributors. This year was no different, as respondents just mentioned a pretty small handful of new products. The products that did get multiple mentions included RAB’s LED lighting line, the Southwire SIMpull reel, and the Philips Lighting EvoKit LED Retrofit fixture. The folks at Southwire will be delighted to hear what Mike Pratt, CEO/president, American Electrical Supply, Corona, Calif., had to say about SIMpull. “This one simple reel makes it safe and efficient for one person to move a reel up to 6,000 lbs. through 36-inch doors and set up and pull a wire run right beside electrical equipment or conduit. Southwire has changed wire from being a commodity that was all about what price is it today on the market, to where it’s fun to go out and sell their wire with all the labor savings advantages they bring to the market.”

And Doug Borchers, vice president, Dickman Supply Inc., Sidney, Ohio, had this to say about RAB’s LED family: “Pick one, they’ve all been done well. They know how to get the right message out in the right format (and provide samples) such that our people can hit the streets running as soon as they get it.”

Dennis O’Leary, president, FD Lawrence Electric Co., Cincinnati, offered electrical manufacturers some great real-world advice from the point of sale about how to improve their new product marketing strategies. “Too many new products are launched via e-mail due to lack of manufacturer resources,” he wrote. “Successful launches begin with face-to-face discussions, training followed by joint sales calls.”

Other products that distributors mentioned included Lithonia KAD lighting fixture; Osram Sylvania’s Omnipoint LED lighting fixture, which won top honors as the most innovative product at the 2015 LightFair show; and the Philips Lighting EvoKit LED Retrofit fixture, which one respondent said was a “cost-effective non labor intensive LED troffer retrofit.”

What’s Hot? Top 200 Distributors Speak Out

Electrical Wholesaling’s editors always find that one of the most interesting facets of analyzing data and market insights from Top 200 distributors each year is learning which end-user markets are providing the most growth opportunities. As in most years, some niches are hot in some regions of the United States but slow in others. Following are some niches that stood out.

Michigan’s auto market. Four Michigan-based Top 200 electrical distributors commented that the state’s auto industry is showing some nice sales growth in 2015. Devin Ezop, general manager for wire specialist Metro Wire & Cable Corp., Sterling Heights, Mich., is looking for sales growth of 5% to 10% in 2015, based in part on an increase in industrial jobs in Big Three auto plants. He is also seeing increases with electrical contractors specializing in industrial and utility work and public utility spending.

Solar in spots. Not everyone is seeing growth in the installation of photovoltaic panels, and in some states like former hotbed New Jersey, some Top 200 electrical distributors said solar work is drying up because of changes in the state’s utility rebate programs and other financial incentives.

That apparently is not the case in Las Vegas, where Steven LaTorra, president, Sun Valley Electric Supply/Energy Electrical Distribution, expects a 12% increase in his company’s 2015 sales, fueled in part on the rise of Las Vegas residential construction and solar. “More opportunities for an upsell of the solar,” he wrote. “In addition, the state rebates and federal incentives combined with ‘cheap money’ allow the solar work ‘to pencil.’ We grew five percent in this product group in 2014.”

And although Matt Brandrup, president and CEO, Rural Electric Supply Cooperative (RESCO), Middleton, Wis., expects business to be flat this year because transmission construction is slowing a bit in his market area in the Upper Midwest region, he is seeing an increase with Rural Electric Cooperatives installing their own “community solar projects” where they build a 40KW or 80KW system and sell/lease the individual panels to their member-customer. “This has resulted in some nominal business for RESCO,” he said.

Electric utilities power sales. Comments on the utility segment were generally quite positive, with some Top 200 electrical distributors mentioning the growth in demand for advanced metering technologies. Timothy Berry, president and CEO, Kriz-Davis Co., Grand Island, Neb., said the company’s recent acquisition of Chapman Metering will help the company increase a diverse revenue channel and extend its service offering for the public power market.

Johnny Andrews, COO, of the utility specialist TEC Manufacturing and Distribution Services, Georgetown, Texas, said in 2014 his company enjoyed some large advanced metering Infrastructure projects and utility system upgrades due to the oil & gas business, and an increase in residential development. He sees 5% 2015 growth from business with his company’s utility customers.

In northern Ohio, Joseph Borkey, president, PEPCO, Eastlake, Ohio, said he expects utility infrastructure work to be strong in 2015. Transmission and substation work fueled some of the company’s 2014 growth, too. Borkey expects 2015 growth to be in the low single digits.

Data centers. Clarence Robie, president, B&S Electric Supply Co. Inc., Atlanta, said the data center construction market was extremely strong for his company in 2014. “Critical power and industrial construction are the most active. Commercial continues to lag,” he said.

LEDs light the way. No surprise to hear many Top 200 distributors talk about LEDs as a key market driver. Kevin Schulte, CFO, for the Atlanta-based lighting specialist E. Sam Jones Distributor Inc. said, “The newest generation of LED are very nice and pricing has improved greatly. LEDs and other related energy-driven products are surging. Traditional incandescent and linear fluorescent sales are dragging.”

But while LEDs have created all sorts of new sales opportunities, they also demand new sales skills and stocking strategies, as we learned from Doug Root of Atlanta Light Bulbs in his comments on page 14.

Mix of marine, commercial and oil & gas. Despite the drop in oil prices, Quentin Walker, vice president, Scurlock Electric, Houma, La., still saw some growth in business related to the oil and gas market in the Gulf Coast region through early in 1Q 2015 and he expects a 15% increase in his overall business this year. The company’s growth last year was related to expansion into a new territory and an increased work force to accommodate larger volume of business. Scurlock Electric also moved its ERP computer system to the cloud and launched an interactive website at www.scurlockelectric.com to enhance its digital presence.