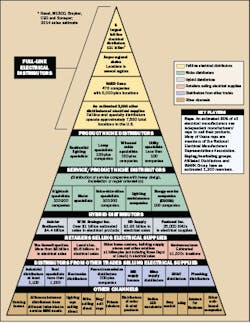

The updated Electrical Wholesaling Electrical Pyramid in last month’s issue offered readers a fresh overview of the many different ways electrical manufacturers can bring their electrical products to market. As we mentioned in that article, traditional full-line distributors still account for between 70% and 80% of a total annual market for electrical products that’s somewhere in the neighborhood of $100 billion.

But that doesn’t mean new channels aren’t providing new options for manufacturers to sell products and new competition for full-line electrical distributors. This article will offer more detail on some of key players selling electrical products that don’t quite fit the profile of the “typical” electrical distributor.

We will be looking first at product specialists and product/service distributors that provide a package of products and installation services. Over a dozen distinct types of electrical product specialists exist, including wholesalers that specialize in residential lighting fixtures, lamps, wire and cable, utility products, motors, industrial controls, solar products, power transmission products, voice/data/video products, reconditioned or surplus electrical equipment or fuses. If you need a copy of the 2015 Electrical Pyramid, check your issue from last month or go to www.ewweb.com and type “2015 Electrical Pyramid” into the search engine.

PRODUCT SPECIALISTS

Residential lighting showrooms. As much as some full-line electrical distributors may worry about big-box home centers like Home Depot or Lowe’s, residential lighting specialists fight an even bigger battle with home centers. When you walk into virtually any home center, you find at least half if not more of the total square footage of floor space in electrical products devoted to residential lighting fixtures. According to Home Depot’s most recent annual report, lighting accounts for 3% of its total sales — a whopping $2.5 billion. Lowe’s probably does slightly less in lighting but you get the picture. Along with these two big-box retailers, independent distributors must compete with two other giants in this niche —LampsPlus, Chatsworth, Calif., which promotes itself as the “nation’s largest lighting retailer,” and lists 35 locations in the western U.S. on its website, and the dozens of local Ferguson Bath, Kitchen and Lighting Galleries run by Ferguson Enterprises, Newport News, Va. The member directory of the American Lighting Association lists 210 individual Ferguson facilities selling residential lighting products.

Another seemingly perpetual challenge in this market is the problem with knock-offs. An industry leader comes out with an innovative lighting fixture design, only to be soon followed by an imitation from offshore. Savvy showrooms compete by concentrating on niche products such as chandeliers; offering enhanced lighting packages to the new construction market; and working harder than ever to target the high-end residential market, where home centers are not as strong.

The American Lighting Association (ALA), Dallas, the largest association for residential lighting distributors, tries to help its members differentiate themselves from home centers by offering high-quality lighting education in the form of its Lighting Associate and Lighting Specialist training programs. Future growth in this business would seem to center on getting the word out to a wider audience on the high ground of the residential lighting market where homeowners need help implementing the latest in dimming systems, LED lighting, landscape lighting and integrating lighting into the residential piece of the Internet of Things.

National association. American Lighting Association (ALA), Dallas, Texas, 214-698-9898, www.americanlightingassoc.com.

Wire specialists. Wire and cable distributors were probably the first of the product specialists in the electrical market. As the oldest product specialty, it has also evolved the furthest, and in its development one may see some trends that could occur in other specialty product channels. For instance, the wire and cable channel has produced several specialists large enough to rank amongst the 100 largest distributors, including Anixter Inc., Skokie, Ill.; Houston Wire & Cable, Houston; Omni Cable, West Chester, Pa.; Allied Wire & Cable, Collegeville, Pa.; and Windy City Wire, Bolingbrook, Ill. These companies all do more than $100 million in annual sales. Wire and cable specialists have the interesting perspective of being involved in both the more traditional products, like power or control cable, as well as new-generation VDV products. Some big news in the wire and cable market was Anixter’s recent acquisition of HD Supply Power Solutions, Atlanta, a move that will make it not only the largest wire specialist but the largest distributor of utility products.

Primary customers. A few companies sell exclusively to other electrical distributors; most sell at least in part to a broad range of end users.

Number of locations. It’s tough to get an accurate count of these specialists because of a lack of a national association of wire distributors, the economic conditions in the wire industry that have driven some companies out of business, and the number of startups in the fast-growing VDV end of the business. There are probably around 200 wire and cable specialists, depending on you defined these companies. Many of them do some manufacturing or relabeling, which may technically make them a manufacturer as much as a distributor.

Lamp specialists. With the onslaught of new LED lighting and other solid-state lighting technologies, these companies are smack dab in the middle of the fastest-changing niches in the entire electrical wholesaling industry.

It’s not like they aren’t used to change in their market segment. Many specialty lamp distributors that historically built their reputation as sources for hard-to-find or oddball light bulbs in the medical, retail store signage, theatrical, audio-visual, and other niche markets, have had to evolve into single-source resources for all things lighting. Most of them now sell not only specialty lamps but fixtures, ballasts, controls and other lighting equipment, and offer on-site and design services.

These distributors tend to be exceptionally technically proficient, as many of them had experience as lighting manufacturers before getting into the specialty distribution business. They also have a great lighting education resource in the National Association of Independent Lighting Distributors (NAILD), Buffalo, N.Y., which offers several levels of technical training for its members in its LS I and LS II program.

Product focus. LEDs and other energy-efficient lighting systems, specialty lamps, ballasts, reflectors, lighting fixtures and lighting controls.

Primary customers. Retail stores and “Main Street” businesses, commercial and industrial users.

Number of locations. About 100 companies in the U.S.

National association. 80-plus lamp specialists belong to the National Association of Independent Lighting Distributors (NAILD), Buffalo, N.Y., 716-875-3670; www.naild.org.

Utility distributors. Distributors of utility products must feel like they are sitting on top of a soon-to-explode volcano. The U.S. electrical grid is in dire need of maintenance and expansion; utility-scale renewables like wind and solar need special care and handling because of the intermittent power profile; major end users of all sorts are looking for ways to create their own power in microgrids; natural gas offers a more cost-effective alternative than coal for power providers; and there’s a little thing called the smart grid now revolutionizing the entire electrical grid.

Historically, utility distributors spent much of their time stockpiling utility products for the expansion of utilities’ power grids in local markets and waiting for storms and other emergency situations to create demand. All the market factors mentioned above create new opportunities on top of this core business.

These companies tend to be either divisions of national distributors like WESCO Distribution Inc., Sonepar or HD Supply; large regional distributors like Kriz-Davis, Grand Island, Neb.; or Shealy Electrical Wholesalers, West Columbia, S.C., or are smaller specialty distributors. Many of utility specialists are members of the North American Association of Utility Distributors (NAAUD), Bridgeton, Mo., which says it has 15 wholesalers as members operating 230-plus locations. One of the unique characteristics of this niche is that NAAUD members share inventory when one of the member companies has to respond to a natural disaster in their region.

Product focus. High-voltage cable for power lines, transformers, pole-line hardware and metering equipment.

Primary customers. Electric utilities.

Number of locations. Up to 300 locations in the U.S.

National associations. The North American Association of Utility Distributors (NAAUD), Bridgeton, Mo., 314-506-0724, www.naaud.org. Specialty utility reps also have an association — the Electrical Equipment Representatives Association (EERA), Kansas City, Mo. 816-561-5323, www.eera.org.

EW’s September issue will take a closer look at Service/Product Niche distributors.