Channel Marketing Group’s recently published research report, “The State of E-Commerce Within the Construction and Industrial Markets,” gauges where distributors are at with e-commerce. David Gordon, Channel Marketing Group’s president, and Stan Rydzynski, the company’s marketing executive, got responses from more than 230 distributors in the electrical, industrial, contractor supply industries and several other niches. Most provided input to all questions. About one-third of respondents were from the electrical wholesaling industry with 50% being contractor-oriented and 50% industrially oriented distributors.

The results of the survey showed that these distribution-based industries each have their own unique dynamics impacting distributor and end-user adoption of e-commerce. There’s no doubt the advent of Amazon Business has motivated distributors in all of the industries surveyed to consider the implications of e-commerce, and many have made major investments in it. But the research shows many if not most distributors still have a way to go before they fully embrace e-commerce.

DEFINING E-COMMERCE

The term “e-commerce” initially appeared in the lexicon of distributors to mean “online ordering via a website.” For the past five or so years, distributors in the construction and industrial trades have been discussing the issue, with some investing in e-commerce sites with a wide range of capabilities. They saw the threat of Amazon Supply (now Amazon Business) and saw B2C (business-to-consumer) online ordering increase. And with the aging customer workforce in their industries and the fact that millennials will eventually control B2B (business-to-business), many distributors realized it was time to harness e-commerce to confront these challenges.

Interestingly, competition from Grainger, Fastenal, MSC, McMaster-Carr and other companies regarded as having good websites with state-of the-art online ordering capabilities does not appear to be the main reason most distributor respondents increased their investments in e-commerce. This may be attributed to the fact that, overall, online purchasing through distributor websites still represents a nominal percent of their overall business.

One of the most important findings of the study is that a broad definition of e-commerce has evolved to encompass any electronic method for conducting commerce. Some of this expanded definition may be attributed to Amazon. As companies felt they were competing with Amazon, they sought to redefine their offering. For example, Grainger touted a goal of 60% of their business emanating from e-commerce, but 40% of their business was transmitted via EDI. More recently they began including vending machine sales, whose orders are transmitted electronically, in their reported percentage of online sales.

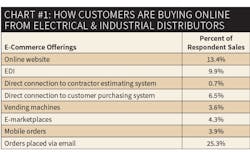

When asked how they defined their e-commerce efforts, the majority of survey respondents used a broad definition for the concept that went far beyond just servicing orders through online storefronts. In fact, across all the industries surveyed, respondents said orders taken through websites accounted for 13.4% of sales, while orders placed via e-mail were the highest at 25.3%. In addition to the e-commerce offerings listed in Chart 1, respondents also were taking digital orders through customer portals; through e-mailed PDFs digitally entered into their ERP systems; by converting PDFs directly from a customer’s computer system to their own ERP system; FTP; VMI (vendor managed inventory); Ariba; Hubwoo; and cXML direct file transmission.

One respondent from the electrical market said it’s important for distributors to have a multi-pronged approach that offers different purchasing operations blended with their service offerings and market expertise. “Over the last three years, awareness of the need for electrical distributors to be able to offer a solution to our customers centered around an easy online ordering platform has increased substantially. It’s mainstream in most senior execs’ lexicon.”

“The actual impact to those who do not participate has yet to be determined. The sky was falling when Home Depot and Lowe’s came to everyone’s back yard, but our industry changed and continued to grow. I am not suggesting it’s not important for all electrical distributors to have an e-commerce platform available as a separate buying channel for established customers. Like other changes to our industry, there is no singular magic bullet that will displace all others. Successful business growth is always about building a multi-prong approach to the market place that includes channel options for customers in conjunction with services, product and market expertise that will add real value to the customer. Calculating ROI within this channel depends on definitions, at a high-level. No, we are nowhere near receiving any ROI. Might it come in the future? Yes, I do believe it will.”

COMPETITORS IN E-COMMERCE

Amazon Business certainly grabs the lion’s share of attention in the online arena, and 61% of respondents said they had customers who shopped at Amazon. It’s no surprise that respondents saw ease of purchase and price as the overwhelming reasons that these customers shop there. But Amazon isn’t the only online game in town. Along with Amazon Business, non-traditional entities such as Automation Direct, SupplyHub, online vertical players such as 1000bulbs.com and others represent a new type of distributor as they have the potential to siphon business from traditional distributors.

When Home Depot, Lowe’s, Home Quarters, Hechinger’s and other “big boxes” entered the building materials industry to focus on DIY buyers and small residential contractors they took a small percentage of industry sales. This may happen again with these online-only competitors siphoning off some percentage of industry sales. This new “channel” represents a different threat for distributors. It can be:

- Alternative order entry system for some customers and their distributors

- Stand-alone business — for a new industry entrant or an existing business

- Direct channel for manufacturers under their brand or another name

- A means to do business in broader geographic areas for an existing organization

- A way to offer different products via a marketplace arrangement

- Information resource

As you can see in Chart #2, while respondents are aware of the threats that Amazon and other competitors with significant online operations represent, they still see independent distributors and national chains as even bigger threats online.

WHERE’S THE ROI?

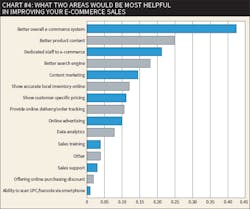

Distributors have heard all about the six-figure investments in e-commerce systems necessary to support the omnichannel e-commerce strategy described earlier. But you hear just as much about the investment in personnel necessary to support the system. The Channel Marketing Group survey offered some insight into where distributors are staffing their e-commerce operations (see Chart #3) and the areas of their online operations that they would like to improve (Chart #4). The key takeaway is that to be successful e-commerce initiatives should be appropriately staffed to communicate commitment and ensure organizational focus. E-commerce requires early staffing to execute upon the strategy and gain adoption.

Several respondents said that while they had not yet seen a return on their overall e-commerce investment, it’s an investment they could not afford to not make. Said one distributor, “We have made a major investment in a new website and e-commerce application in the last two years. No ROI at this time as there is very little incremental sales. However, we expect high-level of growth to exceed growth of traditional sales. We also assume that customers will expect a supplier to support e-commerce as a component of the ‘omni-channel’ sales experience.”

Added another wholesaler, “In general, e-commerce is a factor in wholesale distribution for all the obvious reasons. Amazon is a factor, as are any outlets that offer an e-commerce solution. Business integration is key to make sure the e-commerce functionality works with the customer’s business systems. We all must allocate more resources to keep up with what our customers demand. ROI comes from awareness and access to content, not nearly as much from actual e-commerce revenue.”

KEY OBSERVATIONS

Distributors view e-commerce as an emerging request from customers. While there has been much visibility on the topic over the past few years, to date there has been nominal customer adoption according to respondents, especially for solely ordering via an e-commerce-enabled website. That being said, many distributors recognize that Amazon Business either is, or could be, a competitor, and they believe the company could represent 12% of their industry’s sales in three years. That would easily be more than $8 billion–$10 billion in the electrical industry alone.

Distributors have, and are, investing quite a bit in software, systems, product and people in the e-commerce arena, and are evaluating warehouse management systems to facilitate smaller order management to enable them to adapt to a changing customer dynamic. Few can define a specific ROI on their initiative. However, they believe it’s an essential offering that will be required by customers, perhaps similar to what happened when fax orders became a standard ordering method more than 25 years ago. Eventually, an e-commerce offering will be ubiquitous in the distribution business and the lack of a commerce-enabled site could disqualify a distributor from doing business with a customer.

About the Author

David Gordon

David Gordon is a 30+ year business-to-business marketing veteran. He spent the first 11 years of his career in the performance marketing industry helping clients achieve goals such as increasing sales and market share, acquiring new customers, improving customer retention, enhancing employee loyalty and building and enhancing brand awareness.

In 2001, Gordon founded Channel Marketing Group, a marketing consulting firm for electrical distributors and electrical manufacturers. He has worked with distributors in the development and implementation of their strategic plans and marketing strategies, and with manufacturers on market research, market segmentation strategies, customer specific approaches, branding initiatives and distributor portfolio strategies. He is also publisher of U.S. Lighting Trends.

He was previously V.P. of marketing and e-commerce strategies for the IMARK buying/marketing group, he developed strategies to increase manufacturer sales and market share through the group’s members and in helping members enhance their marketing efforts.

Gordon is a frequent contributor to Electrical Wholesaling and has written for Modern Distribution Management, SupplyHouse Times, TED magazine and Progressive Distributor. He has presented at NAED’s Marketing Conference, Wit's Marketing Conference, speaks at distributor and manufacturer meetings and advisory councils and has co-authored a chapter in NAW's Outlook 2009 on Private Labeling.

Check out his Electrical Trends blog by clicking here.