This month’s article focuses on one of the most important of all markets for electrical products — the commercial construction market. The products used in this market cut across virtually all product categories, including lighting; wire and cable; fittings; connectors and terminals; conduit, cable tray and wiring systems; wiring devices; motors and motor controls; distribution equipment; circuit breakers and fuses; switchgear; voice-data-video (VDV) products; power conditioning equipment; signaling equipment; building management systems; and electricians’ supplies.

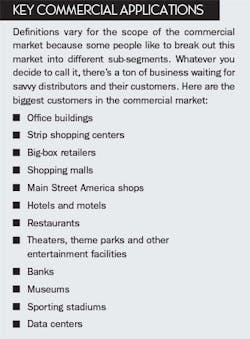

With this selection of products, it’s easy to see why few markets are nearer and dearer to an electrical distributor’s heart than new construction and retrofit work in the commercial market. It’s a huge market that sweeps across big cities, small towns and rural areas — from Main Street America to malls and strip shopping centers. The biggest applications include office buildings, stores and shopping centers, hotels, banks, theaters, museums, sporting facilities, data centers and other public buildings.

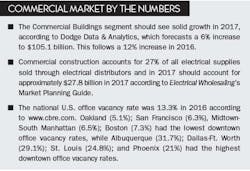

Commercial construction probably accounts for a bigger selection of products from a distributor’s warehouse shelves than any other market. Depending on how you define this market, it accounts for approximately 27% of a typical electrical distributor’s business, according to Electrical Wholesaling magazine’s most recent reader surveys. Following are the key market trends that shape the commercial market.

The more profitable jobs often get obscured by the “trophy” jobs. Everyone likes to drive by the biggest construction project in town and say to anyone who will listen, “We worked on that project.” But for every office tower, stadium or other landmark job, there are probably dozens of smaller — but more profitable — jobs that get done quietly, don’t go out to bid and never quite hit the radar screen in the market. Don’t overlook the small projects or retrofit work that may still be available even in the slowest of economic times.

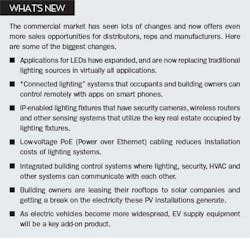

Retrofit work is equally important as new construction. It’s tough to get hard numbers on exactly how big the commercial retrofit market can be for electrical distributors and their customers. But no one will dispute that it’s sizeable and that it can often be more profitable than new construction work because it usually doesn’t go out to bid. According to Electrical Wholesaling reader surveys, commercial/office maintenance supplies and commercial/office retrofit business account for approximately 8% of the average distributor’s sales, while new office construction is 12% of sales. One of the biggest sources of commercial retrofit work is energy-efficient lighting systems. The inherent cost savings of the more efficient LED lighting systems blended with utility rebates and federal, state or local tax incentives can often push the return on investment (ROI) for energy-efficient lighting systems to three years or less.

Although solar installations on commercial facilities are becoming more popular in the geographic market areas that offer a lucrative blend of utility rebates and local incentives, along with the 30% federal tax incentive, currently most photovoltaic (PV) systems for in the commercial market have a ROI of at least five years or more.

CBRE also said in its 2017 Real Estate Market Outlook (a must-read if you track trends in the commercial real estate market) that it expects more than 50 million sq ft of office space completion in 2017, the most since 2009 and that, “Growth in the tech sector will be critical for continued office-using job growth and demand. The high-tech industry accounts for nearly one-fifth of the major office leasing activity since 2014.”

When you need to get forecasts on the health of the construction market, check out Electrical Wholesaling’s monthly “Electrostats” department, which compiles the Department of Commerce’s Value of New Construction data for offices, lodging and other market segments. More detailed data by project type is available on a monthly basis at www.census.gov by clicking on the “Construction” tab and then selecting “Value Put in Place.” Other sources of economic data include Dodge Data & Analytics’ www.construction.com, and Construction Market Data’s www.cmdgroup.com; the American Institute of Architects’ Architectural Billings Index, available monthly at www.aia.org; and CBRE’s www.cbre.com. CBRE offers quarterly reports on office vacancy trends for the entire United States and broken down for major U.S. metropolitan markets. Office vacancy rates are an important regional economic indicator because developers and building owners generally won’t build many new buildings when office vacancy rates are much above 10%. The www.cbre.com website is a treasure trove of local office market data and offers plenty of free content on local economic trends along with its core real estate advisory services.

Voice/data applications still offer good growth in the commercial market. While so much of the focus these days is on lighting retrofits in commercial applications, you don’t have to look far in any modern office building to see that more applications than ever exist for voice/data cabling in commercial applications such as offices, stores and warehouses. People are producing more data than ever on computers, and because they need to send, manage, print and otherwise manipulate this data, it creates an enormous amount of opportunity, even in the recent recession. More and more of this is done wirelessly, and wireless networks have quickly become as common as hard-wired networks in commercial buildings. A related opportunity is in data centers, which continue to grow in many metropolitan markets.

The maturation of the “Go Green” movement. Even if the LEED certification offered by the U.S. Green Building Council has lost some momentum because of the cost of the cumbersome registration requirements, the “Go Green” mentality is still a huge design factor in commercial buildings. Energy-efficient lighting systems have almost become a given in this market. The lighting system in a commercial building can easily account for up to 25% of the building’s electrical bill. It has gotten easier to sell energy-efficiency to building owners on lighting retrofits, now that the payback is often three years or less, thanks to the growing acceptance of LED lamps and energy efficient lighting fixtures, dimming systems and daylighting designs. You can help electrical contractors get the word across to their customers by working with your electrical manufacturers and taking advantage of the sales tools they offer, such as case studies and energy audits.

The move to connected lighting systems. On top of all of the market turmoil in the lighting market that has come with the transition to LEDs, another freight train is approaching that has the potential to eventually revolutionize the control of lighting systems — connected lighting. Connected lighting is part of the Internet of Things (IoT), and it’s starting to take root in new commercial construction projects. More lighting systems can now be controlled remotely over the web because they have sensors with IP (Internet Protocol) addresses embedded in them to link to building management systems and mobile apps. All of the major lighting players are integrating connected lighting into their product lines, and you need to start familiarizing yourself with it if you want to continue to be a player in lighting.

While a full discussion of connected lighting is beyond the scope of this article, check out “Smart Lighting’s Future Footprint,” EW’s January 2017 feature on a panel discussion on connected lighting at Penton Media’s IoT Emerge event in November 2016.

PoE cabling systems may revolutionize the installation of lighting systems. PoE (Power-over-Ethernet) cabling is quickly changing how lighting systems are wired in many new buildings and retrofits. It’s not too often that a new product technology comes into the electrical market with the proven potential to reduce the total installed cost of a system by up to 20%.

Customers look for faster turnaround of custom-built products. When it comes to switchgear, large load centers and other products that require a high degree of customization, customers expect manufacturers and distributors involved in the transaction to get the product on the jobsite as quickly as possible. With CAD/CAM design systems, speed-of-light communication systems and the move to more modular components, manufacturers have to make their manufacturing processes as responsive as possible. When possible, manufacturers design these systems with modular components so they can tailor a product to a customer’s specific request. This enables manufacturers to cut down on the number of different products they have to design, build, stock and track.

“Design/build” construction continues to gain ground on traditional “design-bid-build” construction. In a design/build project, the same company does the design and construction work, as opposed to the traditional bid project, where a design firm handles its part of the project for the building owner, who then puts the project out for open bidding.

Electrical contractors with design/build capabilities see less competition and more profit margin in the design-build market than in the traditional design-bid-build market. They also can take control of an entire project, get involved earlier in the process and eliminate the disputes that exist between the contractor and the designer. From a building owner’s perspective, proponents of design-build projects say their biggest advantages are the single point of responsibility for construction and design; potential to fast-track a project (beginning construction or procurement prior to the design being completed); shorter overall delivery time of the project; and the reduction or elimination of change orders.

The latest in design and communication technologies are becoming a bigger part of the commercial market. You don’t find many electrical contractors wandering into a distributor’s counter area with a materials list for a commercial job scrawled on a piece of 2x4, as in the old days. Electrical distributors’ customers are slowly adopting project management software, CAD/CAM, remote ordering and other productivity tools. As the industry moves slowly but inevitably toward greater computerization, electrical distributors can expect their customers to order products online using applications on tablet computers and smart phones right from the job-site.

Distributors will also see increasing numbers of contractors monitor their performance with project management software. Project management software tools offered by companies such as e-Builder and AutoDesk allow electrical contractors and subcontractors in other building trades to track deliveries, order products and monitor construction project deadlines via the web.

One e-business tool that can help your customers save time in the bidding process is offered by Trade Service Corp./Trimble, San Diego, Calif. Submittal Manager includes software and 250,000-plus catalog pages covering more than one million electrical items accessible with the click of a mouse.

Get familiar with BIM (building information modeling). One buzzword you are sure to run across in the commercial market is BIM. Wikipedia defines BIM as, “Building information modeling covers geometry, spatial relationships, light analysis, geographic information, quantities and properties of building components (for example manufacturers’ details)… The concept of Building Information Modeling is to build a building virtually prior to building it physically, in order to work out problems, and simulate and analyze potential impacts.”

One of the biggest reasons BIM is important to electrical manufacturers, distributors and independent manufacturers’ reps, is that in a full-blown BIM design, each electrical product used in the design may have a digital record “attached” to it that includes not only its technical specifications and capabilities, but pertinent logistical and pricing information such as suppliers, change orders, and where it fits in the project timeline. If you are looking for information on BIM, a great place to start is www.buildingsmartalliance.com. The Building Smart Alliance is run by National Institute of Building Sciences, Washington, DC, to promote BIM and educate construction professionals on its use in the building trades. Associated General Contractors, Arlington, Va., and Engineering News-Record magazine (www.enr.com) are two other great resources for the latest information on BIM. Although BIM’s adoption rate appears to be slow and depends on the size of the contractor (with bigger companies most prevalent among the early adopters), it’s a trend worth watching.

Next month: Industrial Market 101

About the Author

Jim Lucy

Editor-in-Chief of Electrical Wholesaling and Electrical Marketing

Jim Lucy has been wandering through the electrical market for more than 40 years, most of the time as an editor for Electrical Wholesaling and Electrical Marketing newsletter, and as a contributing writer for EC&M magazine During that time he and the editorial team for the publications have won numerous national awards for their coverage of the electrical business. He showed an early interest in electricity, when as a youth he had an idea for a hot dog cooker. Unfortunately, the first crude prototype malfunctioned and the arc nearly blew him out of his parents' basement.

Before becoming an editor for Electrical Wholesaling and Electrical Marketing, he earned a BA degree in journalism and a MA in communications from Glassboro State College, Glassboro, NJ., which is formerly best known as the site of the 1967 summit meeting between President Lyndon Johnson and Russian Premier Aleksei Nikolayevich Kosygin, and now best known as the New Jersey state college that changed its name in 1992 to Rowan University because of a generous $100 million donation by N.J. zillionaire industrialist Henry Rowan. Jim is a Brooklyn-born Jersey Guy happily transplanted with his wife and three sons in the fertile plains of Kansas for the past 30 years.