While updating the EW Electrical Pyramid for 2017, EW’s editors quickly saw two glaring changes in the key channels for distribution of electrical products — first, the constantly evolving “bricks versus clicks” battle between established wholesalers servicing the market more or less traditionally with local branches stocked with inventory and local delivery versus the kaleidoscope of online new competitors, and second, some radically new channels for LEDs and related lighting systems.

A fascination with clicks. On the online front, folks are still fixated on the 800-pound gorilla of the Internet, Amazon Business, and its billion-dollar business in distributing products to business customers that includes but is not limited to electrical contractors and other end users in the electrical market. While there’s no doubt Amazon is chomping away at some market share of traditional full-line electrical distributors, the actual sales dollars in play is anyone’s guess. Right now, in addition to what seems to be a taste for LED replacement lamps, Amazon Business seems to be focusing on higher profit, easy to stock and ship electrical products like test equipment, and not on low-profit commodities like fittings and connectors or tough-to-handle products like conduit and wire and cable. Of course, Amazon could easily afford to buy a distributor or distributors of any size it wants (witness its recent $13.7 billion acquisition of Whole Foods) and change the distribution game completely.

Relearning the lighting channel. As EW’s editors thought about the most dynamic channels depicted in this year’s Electrical Pyramid, we saw the channels to distribute lighting products are changing the fastest. Lighting products are a big deal in the electrical wholesaling industry, and they can easily account for 25% or more of the traditional electrical distributor’s business. Where full-line distributors invest their lighting inventory dollars is changing fast. According to a 2016 survey of the Top 200 distributors, LEDs now account for more than half of the lamps stocked and sold by Top 200 electrical distributors. And if you consider that more than 100 of the Top 200 distributors said LEDs account for 3.3% of all their product sales, the sales of LEDs flowing through full-line distributors channel are more than $3 billion.

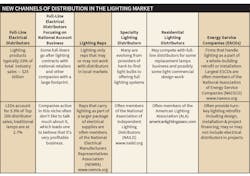

There were always many different channels for lighting products when you consider full-line distributors, lighting reps selling direct, bulb specialists, residential lighting specialists, direct sales, ESCOs (energy service companies) and MRO distributors with a major interest in lighting, like Grainger or Fastenal. The convergence of the Internet of Things (IOT) and app-based control from smartphones and tablets and LEDs have drawn a whole new layer of players from the software, internet and other tech industries into the lighting market, including Apple, Cisco, Google, Amazon, Intel, Johnson Controls, Microsoft,Qualcomm and Verizon. The chart on pages 14-15 shows the options lighting manufacturers now have to sell lighting equipment. The move by the tech giants into lighting is only one megatrend revolutionizing the lighting channel.

If you look at the EW Electrical Pyramid from the perspective of LED vendors formulating channel strategies for the future, there are no guarantees that traditional electrical distributors will be their channel of choice. The lighting market is converting over to LEDs niche-by-niche, and the traditional equation of having electrical distributors stock and sell lamps, ballasts, lighting fixtures and lighting controls in local markets doesn’t always add up in the new world of lighting because of several key factors:

- The LED, fixture, power source and even the control components are now often shipped in one unit, blowing apart many of the lamp-fixture-ballast-control relationships of the past.

- Unless electrical distributors truly dedicate themselves to keeping pace with rapidly maturing LED technology, they won’t be able to perform their role as a reliable source of technical information on lighting products.

- LEDs have a nasty habit of becoming obsolete rather quickly, and this changes inventory management and investment dynamics for distributors.

- New LED vendors quite often attempt to crack the lighting market by going direct, experimenting with online vendors or new combinations of distribution channels.

BUILDING YOUR OWN ELECTRICAL PYRAMID

EW’s Electrical Pyramid is a snapshot of the electrical market as a whole. It can be an even more valuable tool when you “localize” it to analyze the channels of distribution in your geographic market of choice. So get out your paper tablecloths, magic markers and whiteboards and start drawing your own electrical pyramids (See www.ewweb.com’s “10 more Ideas for How to Use Your Own Electrical Pyramid.”) EW’s editors think this article does a pretty good job of summarizing the biggest channels to market in the electrical industry. If you find other bricks that belong in the pyramid, draw them in and send them to us at [email protected]. We will include them in our next edition of Electrical Wholesaling’s Electrical Pyramid.

One other key thought to remember before you dig into the valuable exercise of building your own electrical pyramid: Remember that there really isn’t any right or wrong combination of channels of distribution. EW’s Electrical Pyramid is in some ways more like a kaleidoscope than a snapshot of the electrical channel, in that the bricks in it shift on a product-by-product or market-by-market basis.

For instance, a manufacturer that wants to grow in the New York-New Jersey metropolitan area may have entirely different Electrical Pyramids for the five boroughs of New York and suburban Westchester County or Long Island in New York and Bergen, Hudson and Passaic Counties in New Jersey because the channels of distribution and local buying influences can be very different. And the bricks in the pyramid that a local electrical distributor will build to analyze his competition for a slice of that same market will look different from that manufacturer’s pyramid.

The Electrical Pyramid is going to be much more valuable if you build your own and customize it to your own unique market needs. But like lots of things, the devil is in the details. It’s a fun exercise, so don’t be afraid. Here’s how to get started.

Schedule at least a half-day. Invite your management team and best strategic thinkers to this session. If you can do it off-site in a conference room, all the better, but if time or budget don’t allow it, find a quiet room in your building where you can spread things out a bit.

Bring the right equipment. If you are leading the discussion and are a white-board type of guy or gal, you will have fun with this assignment. Bring ample erasable markers — you will be building an Electrical Pyramid brick-by-brick and will be thinking on the fly. Or, if you aren’t into white boards, get hold of a large roll of newsprint from an art supply or craft store and bring along a handful of markers. Other resources you should have on-hand include laptops (internet access is a big plus in this meeting); copies of this article; and sticky notes. If a PDF of this article would be helpful for the session, contact EW at [email protected]. The analysis in this article will provide a high-altitude overview of the various channels (bricks) in each tier of the pyramid. Your job in this exercise is to bring this analysis down to ground level for the market area under discussion, and identify all of the key players in it.

If you want to get really creative and make it a fun hands-on exercise, you may even want to try bringing along some large wooden building blocks, and Legos or Duplo bricks. Assign the person in the room with the most artistic talent with the job of inscribing each brick with the channel of distribution under discussion.

Assign one person to be the “scribe.” If you are going with the building block idea, you have your man or woman. But make sure you have someone who is copying down all of the ideas sure to be flying around the room.

Build your pyramid level-by-level, starting with full-line distributors. Here’s where you will need a copy of EW’s Electrical Pyramid illustration shown on page 13. You may find it easiest to start at the top with full-line electrical distributors and work your way down through the seven tiers shown in the illustration. The rest of this article will walk you through each tier:

- Full-line electrical distributors

- Product niche distributors

- Service/product niche distributors

- Hybrid distributors

- Retailers selling electrical supplies

- Distributors from other trades selling electrical supplies

- Other channels

- Web-based companies

If you are a distributor, go around the room and start listing all competitors. Group them by national chain, regional chain or local independent. If you are an electrical manufacturer or independent manufacturers’ rep, do the same thing, but you may want to group them by the amount of business you do, don’t do or want to do with them. Depending on the type of analysis you are doing you may also want to pencil in which buying/marketing groups the distributors are in, if any.

And don’t forget to factor in the huge role independent reps play in any local market. Depending on your position in the market (distributor, rep, manufacturer, consultant, etc.) you may or may not want to list and profile all of the independent manufacturers’ reps in the market, and possibly the factory-employed field salespeople who cover the market as well.

You may find that creating an Electrical Pyramid leads to the creation a “customer pyramid,” where you analyze your market’s key accounts by size, type of company, market focus, the level of service required and how they buy product. And remember psychologist Abraham Maslow’s “hierarchy of needs” pyramid from that Psychology 101 class, which illustrated our basic need for food, water, shelter, companionship, respect, etc.? You could draw up a customer’s “hierarchy of needs,” where you illustrate the importance of price, delivery, education, return policy, etc. And don’t forget to check out the Customer Pyramid at www.ewweb.com.

Okay, now the hard work starts. Compiling a list of distributors (or reps) in your market may unearth a few surprises and provide some valuable information. But to make this information really work for you, sketch out a profile for each of these companies and drill down to their strengths and weaknesses. The basic company profile should include key management personnel; estimated sales volume; market share; and primary market focus. You also need to get answers from your assembled team to questions such as:

- “What value-added services does this company provide that we currently don’t offer?”

- On the flip side, “Which services do we offer where we have a clear advantage?”

- Who are their biggest accounts?

- With which customers are they most vulnerable?

The Five Largest Full-Line Distributors Accounting for 33% of the Market. The electrical wholesaling industry continues to consolidate, and as mentioned earlier over the last few years the five largest national distributors have increased their market share to a third of a $100 billion-plus market, and the Top 200 largest distributors (see EW’s June issue) account for 63% of total sales.

Product Specialists. Now move down to the next tier of the Electrical Pyramid. Go around the room and get people to brainstorm about all of the niche distributors in your market area that focus on a specific product category. The biggest product specialists typically include residential lighting, lamps, wire and cable and utility products. Others include fuses, voice-data-video (VDV) products and utility supplies. You may be surprised by how many product specialists in your market area compete with you on a few product lines. Depending on how in-depth you want to go with your analysis, you may or may not want to develop company profiles for each of these product specialists.

Service/Product Niche Distributors. Find out what ESCOs and lighting maintenance companies are doing in your market. Service/product niche distributors have a heavy emphasis on design, installation or repair. Although they sell electrical supplies, product sales may not be their primary function. These companies focus on providing a complete service solution to their customers.

Pay special attention to ESCOs, which provide the most sophisticated package of design, financing, technical assistance, audit and, in some cases, installation services in the energy market. The sale of electrical products is a relatively small piece of the overall package of products and services that ESCOs provide. Many ESCOs are looking for distributors to provide local warehousing support and logistics for their lighting retrofit projects. The National Association of Energy Service Companies (NAESCO), Washington, DC, offers some good insight into the world of ESCOs at www.naesco.org.

You should also pencil in lighting-maintenance companies into this tier of your pyramid. These companies, which typically have contracts for the maintenance and retrofit of lighting systems in stores, parking lots and other retail or commercial facilities, are emerging as skilled players in the energy game.

If you want to get a sense of how far these companies have evolved, check out the training resources at www.nalmco.org, the web-site for the interNational Association of Lighting Maintenance Companies (NALMCO), Ankeny, Iowa. NALMCO’s training resources help school its members in the latest in energy-efficient lighting systems. Some full-line electrical distributors are members of NALMCO, including Border States Industries, Fargo, ND; Facility Solutions Group, Austin, TX; and Graybar Electric Co., St. Louis.

Hybrid Distributors. Don’t overlook Grainger and Fastenal. Grainger and Fastenal are tough to categorize because they don’t carry a full line of electrical products. But they are definitely competitors to full-line distributors because of their intense focus on the industrial MRO and facility maintenance markets, rock-solid balance sheets and progressive internal operations. Electrical products account for more than 15% of Grainger’s total sales. But because of its sheer size, willingness to invest in its e-business capabilities, distribution network and branch infrastructure, the company is a formidable competitor for full-line distributors. If you have a Grainger branch in your neighborhood, add a brick to your pyramid for them.

By some measures, Fastenal may be a peripheral player in the electrical market. But with almost 4.7% of its $3.96 billion in sales (an estimated $190 million) in electrical products; more than 12,000 electrical stock-keeping units (SKUs) listed on www.fastenal.com and 2,503 branches, you need to keep an eye on them. And if you want to learn about something really interesting, do some research on the company’s FAST Solutions vending program, where it has more than 62,000 vending machines already installed in customer locations. Add another brick to your pyramid for them.

You may also want to include Anixter International Inc., Glenview, Ill., on this tier of your pyramid if they have any locations nearby. They could also be called a product specialist because of their primary emphasis on wire and cable, but they also sell other electrical products and provide some unique customized supply chain services for customers. EW’s editors put them in this tier. With their acquisition of HD Supply they are definitely a hybrid distributor — part wire and cable specialist, part utility distributor and part full-line distributor.

Retailers Selling Electrical Supplies. Keep an eye on what Home Depot and Lowe’s are doing. When you figure that Home Depot or Lowe’s does an estimated 10% of their total sales in electrical products, you realize why you still have to watch what these big boxes are doing in their electrical aisles. It’s true that a huge chunk of their electrical business is in residential fixtures, which may or may not be a concern. And although all of the talk about home centers going after the contractor market in a big way seems to have died down a bit, both still provide home installation services and Lowe’s appears to have a fairly large residential solar installation play in its Sungevity service.

And here’s an interesting side note that shows just how big electrical sales are at Big Orange. Home Depot’s 2016 10K filing says its electrical aisles account for 6.4% ($6.09 billion) and its lighting aisles account for 3.1% ($2.89 billion) of total 2016 sales of $94.6 billion.

Distributors from Other Trades Selling Electrical Supplies. That distributor down the street may be a competitor. When you have at least 1,000 industrial distributors, 1,000 tool specialist distributors, and more than 200 specialists in power transmission products in the United States, you know some electrical sales are flowing through these often-overlooked channels. If you have any of these types of distributors in your market, as well as distributors of electronics components, HVAC equipment, plumbing supplies or other specialty distributors, they may be worth further study to see what kinds of electrical products they might be stocking.

It makes a lot of sense to get to know the distributors from other trades in your local market area. In a sense, you are in the same business but are just shipping different stuff in the boxes. Find some non-competing distributors from other trades and compare best practices in sales, warehousing, delivery, e-business and operations. You may also want to consider joining the National Association of Wholesaler-Distributors (NAW), Washington, DC (www.naw.org), which provides some terrific venues for networking with distributors from other trades and an insider’s perspective on legislative issues of interest to distribution firms.

Other Channels. Always changing but always growing. Any single brick in this level of the EW Electrial Pyramid probably may or may not account for a ton of electrical sales in your market. This level of the Pyramid may be toughest to track because it’s where the new and potentially competing channels of distribution first start out.

Do you have any reps in the spec-grade lighting niche selling direct? Pencil them in. And if solar is growing in your market area, find out who is selling the photovoltaic (PV) equipment. It might be a small PV contractor who is also a dealer for a limited number of lines.

Another hotly debated sales channel is the manufacturers selling direct. Outside of providing large quantities of wire and cable for massive projects in the utility market; gigantic turnkey switchgear or automation projects; spec-grade lighting packages; and now LED lighting solutions, this historically hasn’t been a widespread issue in the mainstream electrical wholesaling industry. However, we expect more lighting manufacturers to sell their customized LED lighting solutions direct to end users.

Online Merchants. Depending on your market position, these bricks in the pyramid may be changing the fastest. The most obvious bricks here include www.amazon.com, www.ebay.com and the online LED merchants mentioned earlier.

Summary. After you build your own Electrical Pyramid, check out www.ewweb.com for some more information that EW’s editors have posted on some of the fastest growing alternative channels of distribution. Just type “2017 Electrical Pyramid” into the search engine.

About the Author

Jim Lucy

Editor-in-Chief of Electrical Wholesaling and Electrical Marketing

Jim Lucy has been wandering through the electrical market for more than 40 years, most of the time as an editor for Electrical Wholesaling and Electrical Marketing newsletter, and as a contributing writer for EC&M magazine During that time he and the editorial team for the publications have won numerous national awards for their coverage of the electrical business. He showed an early interest in electricity, when as a youth he had an idea for a hot dog cooker. Unfortunately, the first crude prototype malfunctioned and the arc nearly blew him out of his parents' basement.

Before becoming an editor for Electrical Wholesaling and Electrical Marketing, he earned a BA degree in journalism and a MA in communications from Glassboro State College, Glassboro, NJ., which is formerly best known as the site of the 1967 summit meeting between President Lyndon Johnson and Russian Premier Aleksei Nikolayevich Kosygin, and now best known as the New Jersey state college that changed its name in 1992 to Rowan University because of a generous $100 million donation by N.J. zillionaire industrialist Henry Rowan. Jim is a Brooklyn-born Jersey Guy happily transplanted with his wife and three sons in the fertile plains of Kansas for the past 30 years.