There’s something happening in the U.S economy right now and you aren’t the only one who feels the ground shifting beneath your feet. Things seem to have changed since the Great Recession. Some parts of the economy haven’t really recovered from those dismal economic times, and others seem forever changed by some deep-rooted technological, economic, societal and demographic trends that extend far beyond the borders of the electrical market.

The “New Normal” discussed in Times and Trends on page 4 isn’t necessarily a bad thing. The changing business world will offer transformative opportunities to the companies that adapt, but will lock out others that don’t keep up and elect to continue business as usual. While it’s important to think through how these macroeconomic trends will impact your business, don’t get freaked out by them. Just worry about the things you can control. The sidebar on page 20 offers some “Points to Ponder” that you can use to chart your journey through the New Normal. Here are our picks for the trends that will impact your business most in the future.

#1.Web-based control and other aspects of the IoT (the Internet of Things) are transforming the lighting and building automation markets. This trend is exploding in many different areas of society, because you can embed a sensor with a wireless IP address in virtually anything, including not only lighting fixtures and building automation systems, but also in roadways to measure traffic volume or weather patterns; in automobiles to monitor location or countless operating characteristics; and in products on a factory’s assembly line for quality control and production counts.

On the building automation side, it’s helping homeowners who want to remotely control their lighting or HVAC systems and facility managers who want real-time status reports on the energy use of their plants anywhere in the world. This trend impacts the full range of outdoor lighting, too, because it offers building managers or municipalities the power to remotely control and monitor every lighting fixture on every street, pathway and parking lot, and offers additional capabilities to individual lighting fixtures, like security, wireless networking and 24/7 maintenance reporting. GE Lighting is using the street lighting system it installed in San Diego as a beta test site. The street lights there can be programmed to emit a different color to illuminate recommended traffic patterns. And Acuity recently announced a pilot project at a Florida shopping mall where video cameras in the lighting fixtures monitor parking lot volume and help shoppers to areas with open parking spaces.

#2.Changes in go-to-market strategies by the Big Three lamp manufacturers may scramble the traditional product mix that full-line electrical distributors sell. The advent of web-based lighting control systems mentioned above are one of the key reasons the three largest lamp manufacturers on the planet, GE Lighting, Osram Sylvania and Philips Lighting, are rethinking how or if they will compete in the new world of solid-state lighting. The lighting folks have talked for years about how lighting is evolving into a “systems sell.” But the revolution in LED lighting and how quickly it has replaced traditional incandescent, fluorescent, metal-halide and HID (high-intensity discharge) lamps and the ballasts and fixtures that power and house them, is having a truly dramatic impact on lighting products that distributors stock, and is creating alternative channels of distribution — online and with new brick-and-mortar sources of supply — for the new solid-state lighting products.

While the lighting market once pumped gazillions of semi-commodity, shelf-good SKUs through distributors’ warehouses, customer demand is ramping up fast for LED-based lighting systems. It’s a good news/bad news situation for electrical distributors. Companies that retrain their sales forces to sell the latest in lighting solutions can stake their claim to one of the fastest-growing and most exciting new sales opportunities electrical wholesaling industry has ever seen.

These LED-based systems are evolving fast and require a whole different inventory philosophy because today’s state-of-the art LED lighting solutions can become tomorrow’s obsolete inventory. When you consider that lighting easily accounts for 20% or more of a traditional electrical distributor’s sales, that means a big chunk of their business is under assault. It could be a battle distributors don’t win if they choose not to keep up with the changing market and don’t invest in the business.

#3.The natural gas revolution is revolutionizing the U.S. economy. While the drop in oil and gas prices and the warm winter weather in many parts of the United States has prompted a lull in the chatter about natural gas resources being unlocked through fracking, there’s no doubt that having such an inexpensive energy resource so close to electric utilities, building owners and other customers who can uses it to power their business is transforming the U.S. economy. You can see the change in the number of new power plants being built or on the drawing boards that will depend on natural gas-fired turbines, and in the proposals for more than 20 multi-billion dollar LNG (liquefied natural gas) export facilities along the North American coasts and Gulf of Mexico.

Localized production of electric power, whether it’s from natural gas-fired turbines, wind farms or solar fields, is offering corporations, universities and other building owners the chance to create their own power, and is rewriting many of the rules that have governed power delivery in the utility business over the past 100 years. While solar and wind may be somewhat restricted to certain regional pockets of the U.S. with the right climate and local financial incentives, the concept of local power production is here to stay. The feature article on page 14 explores this important trend in much more detail.

#5.Our increasingly digital world is drastically changing what types of products factories need to produce. The solid-state lighting fixtures discussed earlier don’t often don’t require as much metal as some of old industry standards, like the 2x4 industry troffer. That means there isn’t as much demand for steel, aluminum, ballasts and other products in the older fixtures. Somewhere in the manufacturing world that decrease in demand hurts.

Think about what’s happening to the paper industry and manufacturers of office equipment because more of our information is stored digitally, instead of on paper. That affects the companies related to the manufacture and distribution of paper (pulp mills, ink manufacturers and related products, etc.) and even the companies that make the office equipment and related products that we used to need to store all of that paper, like manufacturers of filing cabinets, hanging file folders, staplers, hole punchers, and the like. And while we are talking about less demand for paper, consider the decrease in demand for paper road maps because of how quickly we all moved to Google maps and digital driving directions.

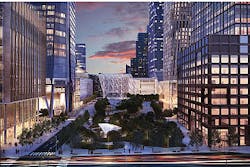

#6.A patchwork economy has developed where some metros continue to attract lots of investment and attention and others are seemingly left behind. Over the past few years, some fortunate metros have seen an insane amount of new construction that completely dwarfs the construction in other cities. Some 2015 construction data recently released by Dodge Data & Analytics showed New York City enjoyed a total of $34.9 billion of commercial and multi-family projects — a 66% from 2014. This total included 43 multi-family projects valued at $100 million that broke ground last year, including several luxury condo towers in the exploding Hudson Yards district on the west side of Manhattan.

That’s a mind-numbing amount of construction and it’s changing the Big Apple’s skyline. But what’s even more amazing is that Miami, the city with the second highest amount of commercial construction activity, finished behind New York with “only” $6.3 billion in commercial construction. The other cities that made Dodge’s Top 10 list had between $3 billion and $6 billion in total commercial construction activity — Dallas-Fort Worth, Chicago, Washington, D.C., Los Angeles, Boston, Seattle, Houston and Denver.

It’s tough to say whether this disparity in construction spending is just part of normal non-residential business cycles or the sign of deep-rooted economic issues that seem to be sorting local metropolitan areas into a new world of “have” and “have not” local economies. You can probably attribute some of the

frustration and anger that’s surfacing in this Presidential election season to this aspect of the evolving U.S. economy. Many angry citizens feel they have been left out of economic growth opportunities because they were laid off during the Great Recession and are still unemployed or under-employed, or because they worked for manufacturers that moved production offshore over the past few years.

#7.In today’s digital economy, electrical customers expect their supply sources to offer the same easy online access to purchasing products in their business lives that they get in their personal lives. EW’s editors have covered this topic thoroughly over the past few years and many articles are available on www.ewweb.com on how electrical distributors can best compete with Amazon. com and other online merchants. There’s little question that an increasingly important factor in how end users will judge electrical distributors as a source of supply will be the online shopping experience they provide.

#8.New workforce demographics will change how you manage employees. (Editor’s note: EW’s editors wrote about this trend in a 2006 article “10 Trends Shaking the Industry.” It’s just as important today as it was then, so we are running it again.) The workplace presents an interesting social mix these days. Although most of the World War II generation has retired or died, it’s not at all unusual in family-owned businesses for the matriarch or patriarch to come in for a few hours a day to open mail or kibitz with long-time employees or customers. Their sons and daughters — Baby Boomers born from 1948 to the early-1960s — are usually running things by now. But demographers say two more generations are working today, each with their own desires, expertise and peculiarities — “generation X,” born 1965 to 1980, and “generation Y” or the “millennial generation,” born 1981 and after.

Some interesting social demographics define these generations. Half come from single-parent homes, and four out of five had working mothers while they were growing up. One-third of them are minorities. Both of these generations are more technologically savvy than their parents or grandparents, and they value any training their employers can provide on new computer software, as well as other skill sets that can help them advance in their careers. Raised in the post-Watergate era, generation Xers tend to be suspicious of authority and cynical by nature.

At least 20 years younger than most baby boomers, members of generation Y can have a difficult time relating to Boomer-supervisors and prefer to socialize with people of their own age group. They generally don’t enjoy after-hours socializing with customers or vendors, and often don’t place the same importance as Baby Boomers on job longevity, retirement benefits and team play. Instead, they’re motivated by a flexible work environment and time off. Social and environmental causes are important to them. Some companies have even developed buy-back plans in which employees can buy additional vacation time.

This demographic stew means managers must learn to motivate “cross-generationally,” as they may now have several generations working at their companies, in contrast to the recent past, when the majority of employees were either Baby Boomers or pre-Boomers.

#9.Social media offers companies of all sizes a level playing field in how they communicate to the market about their companies. There’s a business case for building a social media strategy and it goes far beyond just trying to appear “hip” and show how Web-wise your company has become. Social media is a 24/7 unfiltered communications tool that can help you touch new and existing customers and suppliers, potential employees and other buying influences in your company’s business sphere. Posting regularly on LinkedIn, Twitter and Facebook isn’t hard to learn, but to use it as a marketing tool for your company you have to understand its limitations. It takes some time to build a social media following, and you will never reach every customer with it. Consider it part of your communications toolbox, and just another option to communicate, along with face-to-face sales calls, telephone sales, direct mail, counter sales, and trade shows.

#10.The slow-but-sure consolidation of the electrical market will continue. The electrical wholesaling industry has been consolidating for the last 40 years, and there’s no sign that it will stop anytime soon. It’s interesting to note that despite at least four decades of mergers and acquisitions, the five largest electrical distributors — Sonepar North America, Philadelphia; Rexel Holdings USA, Dallas; WESCO Distribution Inc., Pittsburgh; Graybar Electric Co., St. Louis; and Consolidated Electrical Distributors Inc (CED), Irving, Texas — account for approximately 30% of the $100 billion electrical industry. That’s impressive market share, but it doesn’t come anywhere near some other distribution-based industries like pharmaceuticals and electronics, where the largest four or five distributors account for at least three-quarters of their industries’ sales.

POINTS TO PONDER ABOUT THE NEW NORMAL

If any of the trends discussed in this article touch a nerve, get your management team together and use the following questions to spark discussions on how they are currently impacting or will impact your company in the years to come.

The IoT (Internet of Things)

Which of my electrical manufacturers are already offering electrical products with embedded sensors that allow them to be controlled remotely?

Which product areas will IoT sensors affect the most?

Where are my customers on IoT technologies and what can my company do to help bridge any gaps in product knowledge?

The New World of Lighting

Where does my company currently rank in my local market as a provider of LED-based lighting systems?

Where are my lighting vendors at with web-based lighting control?

How soon will web-based lighting control become a “must-have” feature for my customers?

What investments will my company need to make to become the first-call source for LED-based lighting systems and web-based lighting control in my local market?

The Move Toward Local Power Production

Is my market currently seeing any changes because of the growth of the natural-gas industry?

Is there any talk by utilities about building new power plants with natural gas-powered turbines in my local market?

Even if my company is not currently involved in the utility market or in renewables like solar and wind, what is the future impact of these new sources of power for my company and customers?

Our More Digital World

What type of online information do customers need or expect to get about my company, now and in the future?

Is my company willing to invest in the mobile-ordering technology that more of my customers now want?

How fast is my company willing to move toward a true online shopping experience modeled after what customers experience in their personal lives?

New Work-Force Demographics

What types of brand loyalty will the younger generation have, and how will it affect my business?

Could I offer more training to younger employees on computer systems, products, or other job skills?

Can my company be more active in “green” community charities or benefits?

Am I willing to create a flexible work environment to attract younger workers?

About the Author

Jim Lucy

Editor-in-Chief of Electrical Wholesaling and Electrical Marketing

Jim Lucy has been wandering through the electrical market for more than 40 years, most of the time as an editor for Electrical Wholesaling and Electrical Marketing newsletter, and as a contributing writer for EC&M magazine During that time he and the editorial team for the publications have won numerous national awards for their coverage of the electrical business. He showed an early interest in electricity, when as a youth he had an idea for a hot dog cooker. Unfortunately, the first crude prototype malfunctioned and the arc nearly blew him out of his parents' basement.

Before becoming an editor for Electrical Wholesaling and Electrical Marketing, he earned a BA degree in journalism and a MA in communications from Glassboro State College, Glassboro, NJ., which is formerly best known as the site of the 1967 summit meeting between President Lyndon Johnson and Russian Premier Aleksei Nikolayevich Kosygin, and now best known as the New Jersey state college that changed its name in 1992 to Rowan University because of a generous $100 million donation by N.J. zillionaire industrialist Henry Rowan. Jim is a Brooklyn-born Jersey Guy happily transplanted with his wife and three sons in the fertile plains of Kansas for the past 30 years.