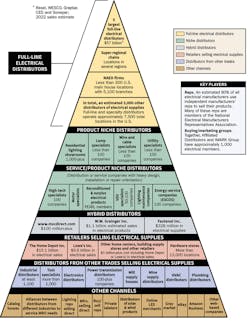

When Electrical Wholesaling’s editors get to work on their annual update of the Electrical Pyramid, it gives us a chance to analyze the competitive landscape in the electrical market and see if any new online or brick-and-mortar competitors are taking an interest in the electrical business.

Despite intense competition from online competitors like Amazon Business, big-box stores like Home Depot and Lowe’s and hybrid distributors like W.W. Grainger and Fastenal that sell millions of dollars in electrical supplies as part of their much broader portfolios of products, full-line electrical wholesalers remain the primary channel of distribution for most electrical products sold to electrical contractors, facility maintenance personnel and other end users and by our estimates will sell at least $140 billion in electrical supplies this year.

Over the past two years, EW’s editors have seen four important trends that will either reshape some key channels in the electrical market or will eventually offer vast sales opportunities to many of the existing channels of distribution or spark the creation of some new channels to the market: a surge in the acquisition of larger regional distributors by one of the national or super-regional chains; the consolidation of the channel for industrial automation products; the emergence of EV charging stations as a major market opportunity; and the expansion and hardening of the U.S. electrical grid. Let’s look at each of them.

MERGERS PICK UP SPEED

Over the past two years, the electrical market has been reshaped by an extraordinary number of acquisitions of large regional distributors that in many cases were leading sources of supply in their local market. According to EW’s count, since Jan. 2022 at least 15 distributors ranked in the magazine’s Top 150 ranking were acquired. The two most recent acquisitions from that list were Graybar’s purchase of Shepherd Electric Supply, #34 in EW’s Top 150 and Baltimore’s largest independently owned electrical supply house, and Rexel’s purchase of Buckles-Smith, Santa Clara, CA.

Mergers and acquisitions can change the dynamics of a local market for competing distributors because the acquiring company may bring in additional resources and invest in inventory, personnel, new branches or facility expansion. On the flip side, when an independent, family-owned business is acquired, sometimes the business loses the personal touch and local market insight that made them a strong contender, or loses key salespeople or other employees that decide to move onto another local company because of the change in ownership.

CHAINS INVEST IN INDUSTRIAL AUTOMATION

With the exception of direct sellers like automationdirect.com, most wholesalers serving this market segment were either automation specialists, independent distributors with a freestanding automation department, or one of the national chains. Many of the automation specialists are members of the Association for High Technology Distribution (AHTD).

The products industrial automation distributors carry have drastically evolved over the years from electromechanical controls, sensors and related equipment to semiconductor-based smart nodes on the factory floor that can be remotely programmed, controlled and updated. Because of the sophistication of these products, distributors in this market invest in automation specialists with engineering degrees and on-site training facilities for product training.

Consolidation has been a major factor in the industrial automation channel, particularly with Rockwell Automation/Allen-Bradley distributors. Most recently, Rexel USA, Dallas, acquired two Rockwell distributors — Horizon Solutions, Rochester, NY, in July 2022, and Winkle Electric, Youngstown, OH, earlier this year. These purchases followed up on Rexel’s 2021 acquisition of Mayer Electric Supply, Birmingham, AL, a full-line distributor with a well-established factory automation business. According to a post about Rexel’s acquisition of Horizon Solutions and commentary on Rockwell Automation’s distribution strategy by David Gordon on www.electricaltrends.com, Rockwell Automation now has 24 distributors, and reportedly would like to eventually pare down its distribution network to 14 companies.

Graybar Electric Co., St. Louis, MO, has also used acquisitions to grow its automation business over the years, most recently with its 2021 acquisitions of Stevens Engineering, South San Francisco, CA, and Shingle & Gibb Automation, Moorestown, NJ. It also acquired Advantage Industrial Automation, Duluth, GA, in 2015 and Commonwealth Controls Corp., Richmond, VA, in 2001.

And you can’t dig too deep into the factory automation business without bumping into McNaughton-McKay, Madison Heights, MI, the largest independent distributor of Rockwell Automation and Allen-Bradley products. Over the past five years, the company acquired two large Texas distributors of automation products, The Reynolds Co., Fort Worth, TX, and Mid-Coast Electric Supply, San Antonio, TX (through Reynolds), as well as Caniff Electric Supply, Hamtramck, MI, a contractor-oriented wholesaler, in 2021.

We also saw a sizeable merger in 2022 when French Gerleman, St. Louis, MO, and IAC Solutions, Memphis, TN, merged to form Agilex Solutions, now ranked as #50 on Electrical Wholesaling’s 2023 Top 150 listing with a $250-million company employing more than 375 people in 13 branches across six states.

It will be interesting to see if M&As continue at the current rate in the channel for industrial automation products, and in particular with Rockwell Automation distributors. Acquisitions always have a ripple effect across local markets that impacts end user and other buying influences, independent reps and vendors of related industrial products. But because of the size of many of the Rockwell Automation distributors making the acquisitions, the impact can loom even larger. If you are in the automation niche, use the strategic planning tools discussed in this article to analyze the impact of any acquisitions of automation distributors in your local market.

ELECTRIC VEHICLES WILL DRIVE NEW SALES

The electrical market’s largest distribution & switchgear companies are making big-time investments in electric vehicle (EV) charging stations, but some other electrical manufacturers also now sell EV charging equipment. If you haven’t yet started stocking electric vehicle charging equipment, check out what manufacturers like ABB, Eaton, Espen Technology, Leviton, LEDVANCE, Schneider Electric and Siemens offer in this market and research the product offerings of EV charger specialists like Charge Point, EV Box and WallBox.

When asked about the market opportunities that looked most promising in the next year or two, 46% of EW Top 150 respondents chose EV charging stations for commercial, retail or municipal applications. They were less optimistic about EV charging stations for residential applications.

EXPANSION & HARDENING OF THE U.S. ELECTRICAL GRID

The utility market has always been an interesting niche in the electrical market because it can be a large and profitable business for some companies, foreign territory for many commercial/industrial distributors, or a primary market focus, which is the case for a relatively small number of utility specialists. Sales of utility products through electrical distributors will grow in the near future because of federal funding from the U.S. infrastructure bill, the growth of utility-scale renewables and increased cybersecurity spending to protect the grids against online attacks.

According to Electrical Marketing newsletter’s 2022 electrical sales potential estimates, utility products account for an estimated 2.9% of all product sales through electrical distributors and in 2022 will total an estimated $3.7 billion. This sales estimate just covers pole-line hardware and related utility products and doesn’t take into account the market potential of electrical products needed for utility-scale solar fields or wind farms, such as switchgear and related distribution equipment, wire and cable, grounding equipment, lugs and termination or products needed for the construction of natural gas-powered utility plants, a fast-growing segment of the utility industry.

Full-line distributors see a fair amount of competition from utility product specialists. Many of these companies (as well as some full-line electrical distributors) are members of the North American Association of Utility Distributors (NAAUD). NAUUD has 13 distributor members that together do $2.6 billion in annual transmission and distribution sales; operate 230 locations; and have a total of $440 million in inventory of utility products. NAUUD members share inventory in storm emergencies, a service that typically accounts for a significant share of their business.

WESCO Distribution, Sonepar’s OneSource Supply Solutions and Irby Utility businesses and Border States Electric Supply are the largest full-line distributors with a major focus on the utility market who are NAUUD members. Other NAUUD members in EW’s Top 150 ranking include Brownstone Electric Supply Co., Brownstone, IN; Electric Supply Inc., Tampa, FL; Power Line Supply Co., Reed City, MI; and Tri-State Utility Products, Marietta, GA. Graybar Electric Co. is also a major player in this market and has been selling utility products for more than 100 years.

To get a sense of the size of the market opportunity in utility-scale renewables, get to know two very large players in this game: NextEra Energy, which says it’s the largest generator of wind and solar energy in the world and a world leader in battery storage, and Quanta Services, a Houston-based electrical contractor with approximately $17 billion in 2022 revenues that specializes in utility grid renovation and construction and renewables.

Quanta Services got 74% of 2022 revenues from utilities and renewable energy developers. The company expects massive investment in both new transmission lines and additional capacity to accommodate the installation of EV charging stations. On www.quantaservices.com, the company refers to a study by Americans for a Clean Energy Grid that says from 2022 to 2042 there will be an investment of $240 billion to replace and upgrade 96,000 circuit miles of transmission lines.

The consolidation of the industrial automation market, sales opportunities in EV charging equipment and growth in the electric utility market are three of the biggest changes and opportunities in the market channels covered by Electrical Wholesaling’s Electrical Pyramid. While EW’s 2023 Electrical Pyramid is a snapshot of the electrical market as a whole, it can also be used as a tool to analyze the channels of distribution in your geographic market of choice. You can also use it to look at other channels, such as online merchants, product specialists other distributors from other industries that also sell electrical products. So, get out your magic markers and whiteboards and start drawing your own electrical pyramids.

One other key thought to remember before you dig into the valuable exercise of building your own electrical pyramid: Remember that there really isn’t any right or wrong combination of channels of distribution. EW’s Electrical Pyramid is in some ways more like a kaleidoscope than a snapshot of the electrical channel, in that the bricks in it shift on a product-by-product or market-by-market basis.

For instance, a manufacturer that wants to grow in the New York-New Jersey metro area may have entirely different Electrical Pyramids for New York City, New Jersey and Long Island because the channels of distribution and local buying influences can be very different. And the bricks in the pyramid that a local electrical distributor will build to analyze his competition for a slice of that same market will look different from that manufacturer’s pyramid.

The Electrical Pyramid is going to be much more valuable if you build your own and customize it to your own unique market needs. But like lots of things, the devil is in the details. It’s a fun exercise, so don’t be afraid. Here’s how to get started.

Schedule at least a half-day

Invite your management team and best strategic thinkers to this session. If you can do it off-site in a conference room, all the better, but if time or budget don’t allow it, find a quiet room in your building where you can spread things out a bit.

Bring the right equipment

If you are leading the discussion and are a white-board type of guy or gal, you will have fun with this assignment. Bring ample erasable markers — you will be building an Electrical Pyramid brick-by-brick and will be thinking on the fly. Or, if you aren’t into white boards, get hold of a large roll of newsprint from an art supply or craft store and bring along a handful of markers. Other resources include laptops, fast internet access, copies of this article; and sticky notes. The analysis in this article will provide a high-altitude overview of the various channels (bricks) in each tier of the pyramid.

Your job in this exercise is to bring this analysis down to ground level for the market area under discussion, and identify all the key players in it.

If you want to get creative and make it a fun hands-on exercise, you may even want to try bringing along some large wooden building blocks, and Legos or Duplo bricks. Assign the person in the room with the most artistic talent with the job of inscribing each brick with the channel of distribution under discussion.

Assign one person to be the “scribe”

If you are going with the building block idea, you have your man or woman. But make sure you have someone who is copying down all the ideas sure to be flying around the room.

Build your pyramid level-by-level, starting with full-line distributors Here’s where you will need a copy of Electrical Wholesaling’s Electrical Pyramid illustration. You may find it easiest to start at the top with full-line electrical distributors and work your way down through the seven tiers shown in the illustration. The rest of this article will walk you through each tier:

- Full-line electrical distributors

- Product niche distributors

- Service/product niche distributors

- Hybrid distributors

- Big box stores

- Retailers selling electrical supplies

- Distributors from other trades selling electrical supplies

- Other channels

- Web-based companies

If you are a distributor, go around the room and start listing all competitors. Group them by national chain, regional chain or local independent. If you are an electrical manufacturer or independent manufacturers’ rep, do the same thing, but you may want to group them by the amount of business you do, don’t do or want to do with them. Depending on the type of analysis you are doing, you may also want to pencil in which buying/marketing groups the distributors are in, if any.

And don’t forget to factor in the huge role independent reps play in any local market. Depending on your position in the market (distributor, rep, manufacturer, consultant, etc.) you may or may not want to list and profile all of the independent manufacturers’ reps in the market, and possibly the factory-employed field salespeople who cover the market as well.

You may find that creating an Electrical Pyramid leads to the creation of a “customer pyramid,” where you analyze your market’s key accounts by size, type of company, market focus, the level of service required and how they buy product.

And remember psychologist Abraham Maslow’s “hierarchy of needs” pyramid from that Psychology 101 class, which illustrated our basic need for food, water, shelter, companionship, respect, etc.? You could draw up a customer’s “hierarchy of needs,” where you illustrate the importance of price, delivery, education, return policy, etc. And don’t forget to check out Electrical Wholesaling’s Customer Pyramid at www.ewweb.com.

Okay, now the hard work starts. Compiling a list of distributors (or reps) in your market may unearth a few surprises and provide some valuable information. But to make this information really work for you, sketch out a profile for each of these companies and drill down to their strengths and weaknesses.

The basic company profile should include key management personnel; estimated sales volume; market share; and primary market focus. You also need to get answers from your assembled team to questions such as:

- “What value-added services does this company provide that we currently don’t offer?”

- On the flip side, “Which services do we offer where we have a clear advantage?”

- Who are their biggest accounts?

- With which customers are they most vulnerable?

- How has this company’s sales strategy changed because of the COVID-19 coronavirus?

- Have they developed any virtual sales or digital market strategies that we can borrow?

THE FIVE LARGEST FULL-LINE ELECTRICAL DISTRIBUTORS

WESCO, Sonepar, Graybar, CED and Rexel account for at least 40% of the market, and the Top 150 largest distributors account for an estimated 70% of total industry sales.

PRODUCT SPECIALISTS

Now move down to the next tier of the Electrical Pyramid. Go around the room and get people to brainstorm about all of the niche distributors in your market area that focus on a specific product category. The biggest product specialists typically include residential lighting, lamps, wire and cable and utility products. Others include fuses, voice-data-video (VDV) products and utility supplies. You may be surprised by how many product specialists in your market area compete with you on a few product lines. Depending on how in-depth you want to go with your analysis, you may or may not want to develop company profiles for each of these product specialists.

SERVICE OR SPECIALTY PRODUCT NICHE DISTRIBUTORS

Find out what ESCOs and lighting maintenance companies are doing in your market. Service/product niche distributors have a heavy emphasis on design, installation or repair. Although they sell electrical supplies, product sales may not be their primary function. These companies focus on providing a complete service solution to their customers.

Pay special attention to ESCOs, which provide the most sophisticated package of design, financing, technical assistance, audit and, in some cases, installation services in the energy market. The sale of electrical products is a relatively small piece of the overall package of products and services that ESCOs provide. ESCOs occasionally need for distributors to provide local warehousing support and logistics for their lighting retrofit projects.

The National Association of Energy Service Companies (NAESCO), Washington, DC, offers some good insight into the world of ESCOs at www.naesco.org.

You should also pencil in lighting-maintenance companies into this tier of your pyramid. These companies, which typically have contracts for the maintenance and retrofit of lighting systems in stores, parking lots and other retail or commercial facilities and are often NALMCO members, are emerging as skilled players in the energy game, as discussed earlier.

HYBRID DISTRIBUTORS

Don’t overlook Grainger and Fastenal. Grainger and Fastenal are tough to categorize because they don’t carry a full line of electrical products. But they are competitors to full-line distributors because of their intense focus on the industrial MRO and facility maintenance markets, rock-solid balance sheets and progressive internal operations. Electrical products, lighting and motors account for 8% of Grainger’s $15.3 billion in U.S. sales. But there’s plenty of other products for the factory floor or construction site that you can find on www.grainger.com or in its branches, and in total Grainger sells more than $1 billion in electrical supplies and related products of interest to electrical. Add in Grainger’s sheer size, willingness to invest in its e-business capabilities, distribution network and branch infrastructure and you can see why the company is a formidable competitor. If you have a Grainger branch in your neighborhood, add a brick to your pyramid for them.

By some measures, Fastenal may be a peripheral player in the electrical market. But with almost 4.7% of its $6.9 billion in sales ($328.1 million) in electrical products and 1,509 branches in the United States, you need to keep an eye on them. Add another brick to your pyramid for them.

Another hybrid distributor to watch for is MSC Industrial Supply, Melville, NY, with $3.7 billion in MRO supply sales through 50 locations in the United States. The company has 1.9 million SKUs in its e-commerce channels and if you estimate that MSC has the same percentage in electrical products as Grainger and Fastenal, its electrical sales are about $150 million.

BIG BOX STORES

Roughly 50% of Home Depot’s $151.2 billion in 2022 revenues come from professional contractors. The company offers its Pro Xtra app to professionals so they can track in-store and online purchase and savings through the Perks program.

The company is also intent on growing in the MRO marketplace and in 2020 acquired HD Supply, a national distributor of MRO products to multi-family, hospitality, healthcare and government housing facilities, among others. The company’s MRO business sells products primarily through a professional sales force, its e-commerce platforms and print catalogs.

Lowe’s has historically had a bigger focus on do-it-yourselfers than contractor, and it gets 20% to 25% of its $96.3 billion in annual revenues from contractors. However, over the two years, Lowe’s has invested in its Pro operation to go after the contractor segments. Last year, the company rolled out several new features in its stores for professional customers, including dedicated checkout stations for pros, and the Pro Zone for grab-and-go convenience. In April the company added to its MVPS Business Tools and now offers online quoting, a volume savings program, quick re-ordering for frequently purchased items and order tracking.

HARDWARE STORES & CO-OPS

There are more than 13,000 hardware stores in the United States, according to a research report at www.ibisworld.com. Many of these independently owned and operated stores are members of one of the hardware industry’s three largest buying cooperatives — Ace Hardware, True Value and Do It Best. If you take the total combined sales data of each of these co-ops and use that 8% electrical/lighting multiplier from home centers, members sell an estimated $2.1 billion in electrical supplies. Ace Hardware, with 5,600-plus stores and $1.6 billion in estimated electrical sales is the largest, followed by Do It Best, which specializes in hardware, lumber and building supplies. Do It Best tallied $.5.5 billion in 2022 sales and an estimated $440 million in electrical supplies. True Value, with 5,600 locally owned hardware stores in all 50 states and 70 countries and an estimated $120 million-plus in electrical sales is also a major player.

DISTRIBUTORS FROM OTHER TRADES SELLING ELECTRICAL SUPPLIES

That distributor down the street may be a competitor. When you have at least 1,000 industrial distributors, 1,000 tool specialist distributors, perhaps 100 specialists in power transmission products in the United States, you know some electrical sales are flowing through these often-overlooked channels. If you have any of these types of distributors in your market, as well as distributors of electronics components, HVAC equipment, plumbing supplies or other specialty distributors, they may be worth further study to see what kinds of electrical products they might be stocking.

It makes sense to get to know the distributors from other trades in your local market area. In a sense, you are in the same business but are just shipping different stuff in the boxes. Find some non-competing distributors from other trades and compare best practices in sales, warehousing, delivery, e-business and operations. You may also want to consider joining the National Association of Wholesaler-Distributors (NAW), Washington, DC (www.naw.org), which provides some terrific venues for networking with distributors from other trades and an insider’s perspective on legislative issues of interest to distribution firms.

OTHER CHANNELS

Always changing but always growing. Any single brick in this level of the EW Electrical Pyramid may or may not account for a ton of electrical sales in your market. This level of the Pyramid may be toughest to track because it’s where the new and potentially competing channels of distribution first start out.

Do you have any reps in the spec-grade lighting niche selling direct? Pencil them in. And if solar is growing in your market area, find out who is selling the photovoltaic (PV) equipment. It might be a small PV contractor who is also a dealer for a limited number of lines.

Another hotly debated sales channel is the manufacturers selling direct. Outside of providing large quantities of wire and cable for massive projects in the utility market; gigantic turnkey switchgear or automation projects; spec-grade lighting packages; and now LED lighting solutions, this historically hasn’t been a widespread issue in the mainstream electrical wholesaling industry.

ONLINE MERCHANTS

Depending on your market position, these bricks in the pyramid may be changing the fastest. The most obvious bricks here include www.amazonbusiness.com, www.ebay.com and online LED merchants. While Amazon Business doesn’t break out sales by individual product category, a post at www.digitalcommerce360.com said its sales were $35 billion in 2022. Colin Sebastian, an investment analyst with R.W. Baird, expects revenues for Amazon Business to grow to $80 billion by 2025.

SUMMARY

After you build your own Electrical Pyramid, check out www.ewweb.com for more information that EW’s editors have posted on some of the fastest-growing alternative channels of distribution over the years. Just type “electrical pyramid” into the search engine.