The past three years have been loaded with unique challenges for electrical distributors. They had to adapt to hybrid officing strategies and limited customer access during the COVID-19 era; endure the waiting game with product shortages; wrestle with head-spinning price increases; decide how much sales time and inventory to invest in new products like electric-vehicle charging stations and a new generation of LED lighting products; and for some companies, decide if the time was right to sell the family business in the latest wave of M&As.

Despite it all, Electrical Wholesaling's Top 150 distributors proved once again that they are a resilient bunch. For some companies, 2022 was a banner sales year, and many saw their annual revenues blow past the +4% to +8% annual revenue increase range in the electrical market.

At OmniCable, West Chester, PA, Greg Lampert, president & CEO, said the company’s 2022 sales increase was due to the new products, new markets and investment in inventory to serve customers when supplies are tight. Lampert is optimistic about 2023 and is forecasting a +51% increase in revenues.

For some companies, price increases due to inflation accounted for a major portion of revenue increase. In the utility market, Matt Brandup, CEO, Rural Electrical Supply Cooperative (RESCO), Middleton, WI, says inflation accounted for two-thirds of his company’s 2022 sales growth and that real growth accounted for 33%. Brandup noted that RESCO’s transformer sales increased considerably in 2022. He’s expecting a +30% increase in 2023 revenues.

A prosperous Canadian economy and growth in the greater Toronto market and in the province of Ontario supported a 2022 revenue increase for O’Neil Electric Supply, Woodbridge, ON. Stephen Kleynhans, the company’s president, said in his response that other contributing factors included immigration, an increase in construction spending and the development of enhanced customer service programs. Kleynhans is forecasting a +15% increase in 2023 revenues.

At Jo-Kell Inc., Chesapeake, VA, a tightly defined OEM niche is producing solid growth. “The largest projects we have seen (and see in the immediate future) are in the automatic car wash OEM sector,” said John Kelly, the company’s chief corporate officer. “Our business in that market tripled in the past year, and we expect even more growth over the next year.”

Click here to download a copy of Electrical Wholesaling's 2023 Top 150 Distributors ranking

Acquisition activity

While the national chains (WESCO, Sonepar, Graybar, Rexel and CED) were once again the most active acquirers over two years, some large regional independents including Green Mountain Electric Supply, Colchester, VT; Elliott Electric Supply, Nacogdoches, TX; Schaedler YESCO Distribution, Harrisburg, PA; and Inline Electric Supply, Huntsville, AL, also made significant acquisitions (See chart below). Bruce Summerville, president, Inline Electric Supply said although his company’s acquisition of Williams Electric Supply in the Nashville area last year was a big factor in the company’s growth, Inline Electric Supply’s revenues were up +30% across its existing footprint.

2023’s biggest challenges. Although the majority of Top 150 respondents believe a recession either has already started or will start before year end (see chart), they were still bullish on their business prospects for 2023. Despite their optimism, they also see some challenges ahead. Concerns over longer lead times persist, and 60% of respondents ranked longer lead times as top challenges in 2023 (See chart on page 25). American Electric’s Mike Pratt said his top concern in 2023 is the switchgear industry’s slow recovery to improve lead time and lack of availability for common SKUs.

Lead times were a challenge for K/E Electric Supply, Mount Clemens, MI, said Rock Kuchenmeister, CEO and president. “Vendor improvements in fulfillment during the second half of 2022 allowed K/E Electric to begin the process of shrinking our customer backlog. However, customer expectations quickly recovered (from Covid levels) and the company backlog has actually grown to unprecedented levels.” He is forecasting a +14% increase in K/E Electric’s 2023 sales.

Other major concerns included the impact of remote officing on demand for new office construction and/or office retrofit work; prices increases; the impact of the regional banking instability on the commercial real estate market; and rising interest rates.

Methodology

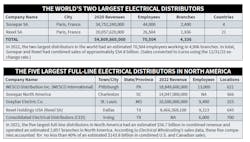

In April of this year, EW’s editors sent out a survey to several hundred distributors. We had a great response this year, and more than 100 electrical distributors provided sales revenue for their companies. We supplemented this data with publicly available revenue and company information for hybrid distributors including Fastenal, MSC Industrial Direct, Motion Industries, Ferguson, Johnson Supply and W.W. Grainger, to present a robust ranking of the industry’s largest distributors. While some readers may question including these companies in the Top 150, they are key channels to the market for many manufacturers and the billions in electrical product sales cannot be ignored.

In those situations where a distributor is large enough to make the listing but did not respond to our surveys, if we have reliable sales or employee data from the past two years, we will place them on the listing using a sales-per-employee average developed each from the respondents who provided both revenue and employee data. For this year’s ranking, the 82 full-line electrical distributors had an average sales-per-employee figure of $941,649. We also placed some distributors that did not provide data on the list with sales or employee data from Mergent Online.

The impact of M&As on EW’s annual ranking of the industry’s largest distributors. EW tracks industry M&A activity closely and has a database of the 600-plus acquisitions. Since 2020, about 30 distributors formerly ranked on the Top 150/Top 200 have been acquired, reducing the “pool” of sizeable companies to include in the list.

The acquisitions of so many distributors is why we only rank 150 distributors instead of 200 companies, as we had done for well over a decade. Despite the smaller list, the 150 distributors in this year’s ranking have tremendous clout in the market. They have an estimated $97.7 billion in 2022 revenues and operate more than 9,871 locations. We estimate that these companies account for 68% of the industry’s total sales.

About the Author

Jim Lucy

Editor-in-Chief

Over the past 40-plus years, hundreds of Jim’s articles have been published in Electrical Wholesaling and Electrical Marketing newsletter on topics such as the impact of amazonsupply.com and other new competitors on the electrical market’s channels of distribution, energy-efficient lighting and renewables, and local market economics. In addition to his published work, Jim regularly gives presentations on these topics to C-suite executives, industry groups and investment analysts.

He recently launched a new subscription-based data product for Electrical Marketing that offers electrical sales potential estimates and related market data for more than 300 metropolitan areas, and in 1999 he published his first book, “The Electrical Marketer’s Survival Guide” for electrical industry executives looking for an overview of key market trends.

While managing Electrical Wholesaling’s editorial operations, Jim and the publication’s staff won several Jesse H. Neal awards for editorial excellence, the highest honor in the business press, and numerous national and regional awards from the American Society of Business Press Editors. He has a master’s degree in Communications and a bachelor’s degree in Journalism from Glassboro State College, Glassboro, N.J. (now Rowan University).