With all the distributor acquisitions making headlines these days, it’s sometimes easy to forget about the impact a purchase can have on the identity and culture of the company being acquired. Rexel’s 2021 purchase of Mayer Electric Supply, Birmingham, AL, was one of the biggest acquisitions in the history of the electrical wholesaling industry. At the time of the deal, Mayer had $1.3 billion in annual revenues and locations across 13 states.

Rexel has made several other larger acquisitions over the years, and all came with their own unique set of challenges. For example, its purchases of Platt Electric Supply, Beaverton, OR (2012); Branch Group, Upper Marlboro, MD (2000); Westburne, St. Laurent, Quebec (2000); GE Supply, Shelton, CT (2006); and Capitol Light & Supply (CLS), Hartford, CT (2006) were all unique in that the companies all had different branch networks, market geographies, warehousing/distribution philosophies and customer mixes.

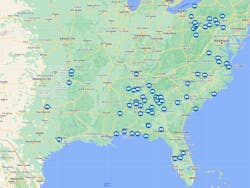

A key challenge with the Mayer Electric Supply acquisition was maintaining the Mayer culture woven throughout its 68 locations and championed by more than 1,200 employees in Alabama, Mississippi, Georgia, Florida, Louisiana, Arkansas, Texas, Tennessee, South Carolina, North Carolina, Virginia, West Virginia and Pennsylvania. A big part of the Mayer culture championed by Charles and Patsy Collat and their family was giving back to the community and industry.

The Collats were well-known for their community generosity, support of the Industrial Distribution Program at the University of Alabama at Birmingham, and volunteer support of the National Association of Electrical Distributors. The university named the business school the Collat School of Business in 2014, to honor Charles and Patsy Collat for their financial support, which included $25 million in gifts and pledges. Mayer Electric Supply also has the rare distinction of having four of its executives serve as NAED chairman – Wes Smith, Glenn Goedecke, Jim Summerlin and Charles Collat. Wes Smith now leads NAED as its CEO and president.

Mike Kidney, who was appointed region president for the Mayer business in late 2022, said throughout the acquisition process Rexel listened to the Mayer management team about the importance of the company’s culture. “They kept communicating with our people,” Kidney said in a telephone interview with Electrical Wholesaling. “As with any acquisition, folks were concerned about change, but keeping key Mayer executives helped them through that.”

Rexel’s approach to integrating Mayer was based on several key principals:

- Mayer retained its own brand, systems and relationships in its operational regions, but now with the backing of an international company.

- Rexel gained more than geographies and customers. It also brough in experience talent from Mayer. Many of Mayer’s leaders and managers hold key positions with Rexel USA, from the executive level to deeper layers in the organization.

- The integration focused on people – employees, customers, partners.

Kidney, who joined Mayer Electric Supply in 2001 after leadership posts with Thomas & Betts and Carlon, said the Mayer and Rexel management teams have been able to blend the strengths of both companies into one cohesive unit. For example, he says at the time of the acquisition Rexel was stronger on web-enabled sales and sales of EV charging systems and solar products, but that because of initiatives that Wes Smith led over the years on customer integration efforts, including that tying the business systems of contractors, industrials and other customers to Mayer’s JD Edwards ERP system, the company had tighter relationships with local customers.

Kidney thinks 2024 will be a good year, in large part because of the shift to electrification and the opportunities that data centers represent. “There are ample opportunities to grow,” he said. “Getting people will be the key.” He added that Rexel has a strong personnel development program which will be critical in adding new talent to Mayer’s management ranks as Baby Boomers retire. He also believes Rexel’s strength in areas like electric vehicles will help attract young people to the business.

Long lead times on switchgear continues to be a challenge, says Kidney, which is frustrating to his management team because there’s business to be had out in the market and projects being delayed because of difficulties in getting switchgear.

A major advantage that Rexel and Mayer will have in growing the business is that fact that so many of Mayer Electric Supply’s branches are in some of the nation’s fastest-growing markets, and including the Atlanta metropolitan area; Charlotte, Greensboro, and Durham, NC; Huntsville, AL; Nashville, TN; and Tampa and Orlando, FL. The company operates in 12 states, including Texas through its Mustang Electric Supply purchase in 2012, and western Pennsylvania through The Hite Co. acquisition in 2018.

Future expansion is very much part of Rexel’s plan for Mayer Electric Supply, and Kidney says Rexel is strongly encouraging growth within Mayer Electric’s footprint and past it, through branch expansion or acquisitions.