Electrical Wholesaling's 2022 Top 150 Ranking: Updated!

After successfully navigating through most of the 2021’s COVID-induced challenges, Top 150 distributors now must learn to overcome historic product price increases, supply chain snafus and labor shortages in the field and at their own companies.

From what EW’s editors saw in the survey responses for this year’s Top 150 ranking, North America’s largest electrical distributors are confident they can overcome these challenges. Over the past two years, distributors of electrical supplies found that they could not only adapt to COVID-19 restrictions out in the field and hybrid work strategies at their own businesses, but also grow market share by investing in their businesses and focusing on service basics.

Grabbing More Market Share Despite Some Tricky Economic Conditions

Richard Booth, Electrical Division manager for Coburn Supply, Beaumont, TX, sees a +20% increase in his company’s 2022 revenues. Booth said Coburn’s growth over the past year can be attributed to “price increases, increased market share, having inventory when other distributors didn’t and not shutting down during COVID-19, which earned us many new customers in 2020.”

Thomas Nelson, corporate communications director, Border States, Fargo, ND, said inflation had some impact on its 2021 revenue growth, but that Border States also “identified a number of areas of the business where we grew market share and expanded our share of wallet with key customers.” In 2022, he says Border States is experiencing double-digit growth in all key market segments and that supply chain constraints have been the primary reason that any of the segments have lagged.

Julie Kingsley, controller, Electrical Equipment Co., Raleigh, NC, sees plenty of large projects underway or on the drawing board in her company’s market area, including textile plant expansion, utility upgrades and new facilities in the auto tire, aggregate and cement plant niches. She said in her response that Electrical Equipment Co.’s bookings outpaced sales because of supply chain issues and that this trend also holds for 2022. “Calendar year 2021 sales trended approximately +12% higher than 2020 with increases in OEM and MRO spend,” she said. “OEM sales and orders accelerated throughout the year. Industrial capital spend was limited, but it was a mirror of 2020 results. Utility spend and specifically solar grew in 2021.”

Loeb Electric, Columbus, OH, is one of the Ohio distributors looking forward to the groundbreaking of Intel’s multi-billion semiconductor manufacturing facility near Columbus. Brandy Seich, Loeb Electric’s senior director of marketing, said data centers, medical center expansion and other large commercial projects contributed to the company’s 2021 revenues and that Loeb expects a +15% increase in 2022 revenues due in part to “continued positioning as a service leader for our entire customer base.”

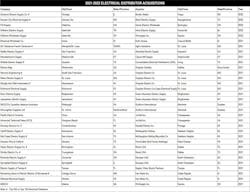

No stranger to double-digit annual revenue growth, Jeff Metzler, CEO of Houston’s Lonestar Electric Supply is expecting +25% growth this year because of inflation and growth and market share. He is also excited about joining the IMARK buying/marketing group. Matt Brnik, executive VP of Schaedler YESCO Distribution Services, Harrisburg, PA, said the company gained more market share in the construction and commercial markets. The company made major investments in its logistical capabilities, adding 40,000 sq ft to an existing central distribution center; purchasing a larger facility in the Allentown, PA; market; and purchasing a warehouse in the Pittsburgh metropolitan area to convert into a CDC. Schaedler YESCO is also seeing increased revenues from the branches in Pittson, PA, and Johnson City, NY, it purchased from Rexel in 2020. See the chart at the bottom of the page for a list of electrical distributor acquisitions over the past two years.

Dean Stier, marketing director, IEWC, New Berlin, WI, was also very bullish on his company’s growth prospects. “We have much to celebrate,” he said in his response. “A record 2021, a strong start to 2022, our expansion into the telecom market via our recent acquisitions of Cablcon and Jupiter Communications, and our continued expansion of our OEM business in the EMEA (Europe, Middle East, and Africa) and APAC (Asia-Pacific) markets.”

Larry Swink, president of Jackson Electric Supply, Jacksonville, FL, says his company has gone from a privately owned, unknown start-up in 2013 to $54 million in 2021 revenues. He estimates that Jackson Electric Supply is now #2 in its local market with a national footprint selling lighting and gear to national retailers and global logistics companies. “Jackson exceeded projections for 2021 and grew from $25 million to $54 million year-over-year,” he wrote in his response. “Key investments in new salespeople and an increase in business with existing customers combined help the Jackson team reach new levels in 2021, and we are positioned for continued growth in 2022.”

While few Top 150 respondents have seen federal dollars from the Biden Infrastructure Bill for electrical grid modernization flowing freely, utility specialists are still seeing growth. Steve Gramling, president/CEO of Gresco Utility Supply, Forsyth, GA, said fiber-to-home projects added to the company’s 2021 revenue growth, and Rusty Batch, CEO, Tri-State Utility Products Inc., Marietta, GA, said grid modernization projects are underway in the Southeast.

Several distributors saw growth in 2021 because of concerted efforts to stock up inventories. John Eggleton, Kirby Risk Corp., Lafayette, IN, said in his response that his company saw sales increase in 2021 due to “less COVID-19 restrictions, increased onsite access vs. competition, pent-up demand and strong inventory position.” The company also has a new CRM (customer relationship management) and digital transformation strategy, he said.

Click here for more insight into Electrical Wholesaling's Top 150 Electrical Distributors

New Business Ventures

James DeRosa, general manager for YESCO Electrical Supply Inc., Columbiana, OH, said the company had a good year because of having product on hand from “enhanced purchasing in 2020.” DeRosa is forecasting a +20% increase in revenues for 2022, in part from a new GSA (General Services Administration) contract to supply goods to the federal government via the GSA Advantage program. The contract took more than a year to complete. “We already are seeing orders from the USDA, Navy and other agencies within the federal government,” he said in his survey response.

Warshauer Electric Supply Co., Tinton Falls, NJ, opened a state-of-the-art electrical training facility called “Warshauer Trade” and established a Green Energy Division that focuses on all green technologies and energy saving initiatives. Joe Borkey, president, PEPCO, Eastlake, OH, said the company’s new “Audit and Efficiency” effort reviews all processes, procedures, operations, etc., and has led to “paradigm shifts in pricing and service models.” PEPCO also opened locations in Latrobe and Palmyra, PA.

Methodology

In April of this year, EW’s editors sent out a survey to several hundred distributors. More than 100 electrical distributors provided sales revenue for their companies. We were able to supplement this data with revenue and company information for publicly held companies including Fastenal, W.W. Grainger and Rexel and collected corporate data from some distributors’ websites, so we are able to present a robust ranking of the industry’s largest distributors.

Many of these companies asked us to use their sales data confidentially and only for placement on the listing. We are glad to do that. Over the past three years, we have had more distributors ask us to use their sales data confidentially, so when you see a “NA” (Not Available) for 2021 revenues, that most often means we have the data but are not releasing it publicly.

In those situations where a distributor is large enough to make the listing but did not respond to our surveys, if we have reliable sales or employee data from the past two years, we will place them on the listing using a sales-per-employee average developed each from the respondents who provided both revenue and employee data. For this year’s ranking, the 69 full-line electrical distributors had an average sales-per-employee figure of $799,132. We also placed some distributors that did not provide data on the list with sales or employee data from Mergent Online.

The impact of M&As on EW’s annual ranking of the industry’s largest distributors. Electrical Wholesaling tracks industry M&A activity closely and has a database of the 600-plus acquisitions we have reported on since the 1980s. Over the past two years, no less han 18 distributors formerly ranked on the Top 200 have been acquired, reducing the “pool” of sizeable companies to include in the list, and if you consider the number of distributors with $20 million in sales or more that have been acquired over the past five years, that adds at least 20 more distributors that had been in EW’s annual rankings before their acquisitions.

The acquisitions of so many distributors who had been ranked in our annual listing was a major factor in our decision to only rank 150 distributors this year (as in 2021) instead of 200 companies, as we have done for well over a decade. Despite the smaller list, the 150 distributors in this year’s ranking have tremendous clout in the market. They have an estimated $84 billion in 2021 revenues and operate more than 7,000 locations. Our best estimate is that these companies account for roughly 70% of the electrical wholesaling industry’s total sales.

Click On the Green Button Below to Download Electrical Wholesaling's 2022 Ranking of the 150 Largest Electrical Distributors in North America

WHAT'S NEW WITH THE TOP 150 ELECTRICAL DISTRIBUTORS

Major Anniversary Milestones

Shepherd Electric Supply, Baltimore, MD, took top honors with the oldest anniversary — it turns 130-years-old this year. Central Supply Co., Indianapolis, IN, is 120 years old; Crescent Electric Supply, East Dubuque, IL, celebrated its 103 anniversary; WESCO will be turning 100 years old in June; Turtle & Hughes, Linden, NJ is planning its 100th anniversary celebration; J.H. Larson, Plymouth, MN, turned 90 in 2021; Wholesale Electric Supply, Texarkana, TX, is 75 years old this year; and Border States is celebrating its 70th year and growth from one location in Grand Forks, ND, primarily serving the utility market to today’s 101 locations in 24 states serving customers in the construction, industrial and utility markets.

IEWC, New Berlin, WI, hit 60 years as a specialty wire & cable distributor; American Electric Supply, Corona, CA, has operated as a single-location distributor in Southern California for 38 years; Independent Electric Supply, Somerville, MA, joined the 30-year club; and the Utility Supply business of TEC Utility Supply & Service, Georgetown, TX, celebrated its 30th anniversary.

Also, a special anniversary congratulations to Ron Kohlenberg, who recently marked 50 years with Hein Electric Supply, West Allis, WI.

Branch Expansion and Acquisitions

Alameda Electrical Distributors, Hayward, CA, added three branches in the San Francisco market with its asset acquisition of Malty Electrical Supply’s locations in San Francisco, Petaluma and San Rafael, CA, and Echo Group, Council Bluffs, IA, expanded in three states with new locations in Mitchell, SD; Spencer, IA; and Kearney, NE. Elliott Electric Supply, Nacogdoches, TX, opened four locations and made a key acquisition over the past year. The company’s new branches are in Gilbert, AZ; Salina, KS; Avondale, AZ and Gonzales, LA. It also acquired Kansas City Electrical Supply and its branches in Kansas City, MO, and Lenexa, KS. Wholesale Electric Supply, Texarkana, TX, opened branches in Weatherford, TX; Union City, TN; Memphis, TN; Forney, TX; Joplin, MO; and Mansfield, TX.

New Facilities and Capital Expenditures

Candela Corp., Huntington Beach, CA, had a busy year. The company moved its headquarters to Huntington Beach, CA, from Irvine, CA, and converted its ERP system to Epicor Prelude from Salesforce. Atlantic Coast Electric Supply, moved out of a 17,000-sq-ft location in North Charleston, SC, to a brand new 40,000-sq-ft location in Summerville, SC; and Independent Electric Supply, Somerville, MA, will be moving into a new CDC in Aug. 2022 that has triple the pallet space of its current facility, according to Bob Trolander, VP. On the fleet front, ParamontEO, Woodridge, IL, added five new delivery trucks because of increased demand.

ERP Investments

Mars Electric, Mayfield Village, OH, has a new website and e-commerce platform, and in the Philadelphia metro, Scott Pressler, CFO, Billows Electric Supply, NJ, said the company upgraded its computer system and moved to the cloud. Billows now runs an Infor SX.e ERP system. Border States, Fargo, ND, completed its move to S/4HANA, the newest version of SAP, in Feb. 2022. The company also announced its new brand and evolution of its new identity during its Fusion Leadership Conference in May: “Border States. For the Unstoppable.” “The new brand is a promise to treat your business as our own,” the company told its management team at the conference.

Executive Changes

At Coburn Supply, Beaumont, TX, Patrick Maloney became president and Michael Maloney was promoted to VP in 2021, as the next generation of this family-owned business has taken on more senior management responsibilities. Three company veterans at Facility Solutions Group (FSG), Austin, TX, Bernie Erickson, Dave Attardi, Leon Mowadia Jr., took on enhanced responsibilities earlier this year. Erickson is now FSG’s chief marketing officer; Attardi took on FSG’s new chief sales officer role; and Mowadia is COO of Distribution. The company is also building a new regional office in New Jersey.

At Graybar Electric Co., St. Louis, MO, Randall Harwood senior VP and chief strategy officer retired in June 2021 and senior VP and CFO Scott Clifford retired June 1, 2022. On April 1, 2022, David Meyer assumed the position of senior VP and was elected to Graybar’s board of directors. In other company news, in 2021, Graybar extended the company’s five-year $750 million revolving credit facility. The new facility matures in Aug. 2026 and will support Graybar’s general working capital needs as well as its growth initiatives.

On a sad note, Patrick G. Jones, president and CEO of E. Sam Jones, Atlanta, passed in Aug. 2021 from cancer. His oldest son. Griffin L. Jones, 39 years old, who has been working at the company since graduating from college has taken over leadership as president/CEO and majority owner of this well-known specialty lighting distributor.