Mega-Projects Lead Huge Gains for Total Construction in July

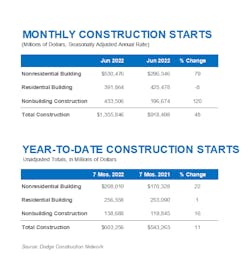

Total construction starts rose a whopping +48% in July to a seasonally adjusted annual rate of $1.36 trillion, according to Dodge Construction Network. This gain results from the start of three large manufacturing plants and two LNG export facilities. However, even without these projects, total construction starts would still have increased +7%. Nonresidential building starts rose +79% in July, and nonbuilding starts jumped +120%. Conversely, residential starts decreased -8%.

Year-to-date, total construction was +11% higher in the first seven months of 2022 compared to the same period of 2021. Nonresidential building starts rose +22% over the year, residential starts were +1% higher, and nonbuilding starts were up +16%. For the 12 months ending July 2022, total construction starts were +10% above the 12 months ending July 2021. Nonresidential starts were +21% higher, residential starts gained+ 4%, and nonbuilding starts were up +10%.

“Mega-projects aside, construction continues to improve despite the pressure created by higher interest rates and labor scarcity,” said Richard Branch, chief economist for Dodge Construction Network, in the press release. “Combined with the strong labor market, this is another indicator that the U.S. is not currently in a recession. However, the Federal Reserve will continue to aggressively raise interest rates until they feel that inflation is under control. This will create mounting pressure on building activity and potentially lead to a slowdown in construction starts by year-end.”

$16.4 BILLION IN NON-BUILDING CONSTRUCTION FROM LNG PLANTS IN LOUISIANA & TEXAS

Nonbuilding construction starts rose +120% in July to a seasonally adjusted annual rate of $433.5 billion. The main driver of growth during the month was the utility/gas sector, as two multi-billion-dollar LNG export plants broke ground. If not for those two projects, nonbuilding starts would have still risen a healthy +29% in July because of gains in miscellaneous nonbuilding starts (+85%), environmental public works (+60%) and highway and bridge starts (+33%). Through the first seven months of the year, total nonbuilding starts were +16% higher than in 2021. Utility/gas plant starts gained +63% through seven months, highway and bridge starts were +16% higher, and environmental public works were +2% higher. Miscellaneous nonbuilding starts, by contrast, were down -20% through seven months.

For the 12 months ending July 2022, total nonbuilding starts were +10% higher than in the 12 months ending July 2021. Utility/gas plant starts were +44% higher, highway and bridge starts rose +7%, and environmental public works increased by +4%. Miscellaneous nonbuilding starts decreased -18%.

The largest nonbuilding projects to break ground in July were the $9.4-billion first phase of the Driftwood LNG export terminal in Calcasieu Parish, LA; the $7-billion third stage of the Cheniere Corpus Christi LNG in Gregory, TX; and the $2-billion Intermountain Power Project in Delta, UT.

NONRESIDENTIAL MARKET POSTS BIG GAINS

Nonresidential building starts rose an astonishing +79% in July to a seasonally adjusted annual rate of $530.5 billion. Manufacturing was the main driver of growth due to four projects breaking ground that together total $17.9 billion. Without these projects, nonresidential building starts would still have risen by +16%. Institutional starts rose +28% during the month due to a solid gain for healthcare starts, while commercial starts lost 11%. Through the first seven months of 2022, nonresidential building starts were +22% higher than during the first seven months of 2021. Commercial starts advanced +13% and institutional starts rose +2%, while manufacturing starts were +185% higher on a year-to-date basis.

For the 12 months ending July 2022, nonresidential building starts were +21% higher than in the 12 months ending July 2021. Commercial starts grew +13%, institutional starts rose +6%, and manufacturing starts swelled +170% on a 12-month rolling sum basis.

The largest nonresidential building projects to break ground in July were the $10-billion Intel Semiconductor plant in Jersey Township, OH; the $2.9-billion BlueOval SK Battery Park Ford plant in Glendale, KY; and the $2.8-billion BlueOval City manufacturing campus in Stanton, TN.

RESIDENTIAL CONSTRUCTION

Residential building starts fell -8% in July to a seasonally adjusted annual rate of $391.9 billion. Single family starts lost -9%, and multi-family starts were -5% lower. Through the first seven months of 2022, residential starts were +1% higher than that of the same timeframe in 2021. Multi-family starts were up +24%, while single-family housing slipped -7%. For the 12 months ending July 2022, residential starts improved +4% from the same period ending July 2021. Single family starts were -4% lower, and multi-family starts were +26% stronger on a 12-month rolling sum basis.

The largest multi-family structures to break ground in July were the $680-million first phase of the OneJournal Square building in Jersey City, NY; the $380-million 90Ninety mixed-use building in Jamaica, NY; and the $325-million Domino Sugar Factory redevelopment in Brooklyn, NY.