The Local Touch

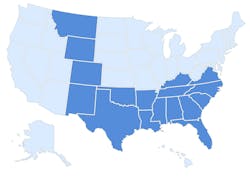

Many reps have unique and interesting narratives on how they grew their companies. But few if any have a growth story quite like JD Martin, a 71-year-old rep firm based in Houston, TX, that now has more than 250 employees and covers 17 states. Some folks might see a map of JD Martin’s geographic coverage or hear about its six acquisitions since 2018 and think geographic expansion is the main driver for CEO Greg Baker and his team, but a “land grab” growth strategy could not be further from the truth.

Baker says JD Martin’s growth can be attributed to a team of talented employees with the freedom and resources to spend as much time as possible working with customers in the field. He says for most of JD Martin’s history, the company was a pretty typical electrical rep that focused on selling shelf-good electrical products. But in more recent years, he and his management team have expanded the company’s portfolio of lines into the industrial OEM area with several acquisitions that brought on product area experts, and hiring new employees with deep product expertise, solid networks of vendor or customer contacts, and some hard-to-duplicate skills in software development and artificial intelligence

The company now focuses on the oil & gas, mining, steel, wastewater treatment, wind power generation and commercial construction niches, landing an impressive array of industrial projects with its expertise in medium-voltage switchgear, temporary power, pre-assembled systems, customized panels, control systems and other products and services and needed for data centers. They do it all with a devotion to bringing business through electrical distributors.

THE ROAD TO GROWTH IN THE INDUSTRIAL MARKET

Building its presence in the industrial OEM and shelf-goods markets throughout 17 states in the Sunbelt and Intermountain states has taken hard work, grit and salesmanship; key acquisitions; building relationships with customers, distributors and other buying influences in local markets; partnering with electrical manufacturers; and learning from other reps through the National Electrical Manufacturers Representatives Association (NEMRA).

Greg Baker joined JD Martin in 2003 after spending several years with Thomas & Betts in sales and national accounts. He bought into the company along with Jim Carr (son-in-law of the founder Jimmy D. Martin, Sr.) when Jim Martin, Jr., son of the founder, retired. Becoming active with NEMRA and serving on the NEMRA board from 2014-2016 gave Baker the opportunity to learn from other reps and work with Ken Hooper, then NEMRA’s president and now executive advisor with JD Martin, and Tim Klinger with I-Pro, which JD Martin acquired in 2022. “It did afford me the opportunity to travel the country and see how other reps operated,” Baker says. “At that time, JD Martin was like a lot of other reps. You were either pretty much a commodity, shelf-goods rep or you were a boutique industrial rep.”

A major driver for JD Martin’s growth in the industrial OEM market was ABB’s 2013 acquisition of Thomas & Betts, which the company represented. At about the same time, Baker convinced Jeff Anderson, now JD Martin’s executive VP of industrial sales, to join the agency. Anderson had spent his career working with large electrical manufacturers including ABB, Siemens and Rockwell, and his network of contacts in the industrial world helped shape JD Martin’s path into that market.

“It really changed the whole dynamic of our business because we literally became a commodity shelf-goods agency that was also heavily involved in the industrial OEM/MRO business,” says Baker.

During that transition, the company picked up some key product lines for that market, including Hammond, Hoffman and Dialight. Another big move at that time was hiring several talented technical salespeople who had worked at ABB’s Wichita Falls, TX, plant to get into more sophisticated industrial controls and switchgear products.

The broadening of the company’s line card into industrial products set the stage for several key acquisitions. Each of the company’s acquisitions was a distinct market opportunity, and not part of a master plan to fill in the map with new territories, says Baker. In its first acquisition, the 2018 merger with the Schell Co., Mandeville, LA (now Schell Martin Co.), JD Martin got access to the Hammond, ABB and Mersen lines along the Gulf Coast and took on a team of seasoned industrial sales pros, including Craig Schell, president of that agency. Baker says the move was a great fit because many of the distributors and engineering firms it worked with in Texas and Oklahoma also did business in Louisiana and Mississippi, including Crawford Electric Supply, Graybar, Lonestar Electric, Elliott Electric Supply and Wholesale Electric Supply of Houston.

The company’s next acquisition, Centauri Sales, Albuquerque, NM, came about through a truly unique set of circumstances. JD Martin had a side operation in the enclosure business with Vynckier Enclosures through an arrangement Jim Carr had developed in the 1990s with GE, which then owned the operation. Carr got the exclusive distribution agreement for the line from GE, and when GE wanted to get out of the enclosure business, he bought the presses for the enclosures to manufacture them in Houston. Carr sold the enclosure business to nVent in 2021 and in 2022 retired after 53 years working in the electrical market. Centauri Sales was a Vynckier rep, and its owner worked out a merger with JD Martin, bringing along several key product lines.

Local market and industry contacts also led to the 2022 I-Pro merger and expansion in Colorado, Wyoming and Montana; the2023 acquisition of Broomfield Lamb Holman and a move into the Georgia and Alabama markets; the 2023 purchase of Integrated Component Sales (ICS), which gave it a presence in Alabama, Georgia, Florida, the Carolinas, Virginia and Tennessee; and the 2024 merger with Rhodes Electrical Sales to cover west Tennessee, north Mississippi and Arkansas. In addition to these acquisitions, the company made a key hire to manage growth in Florida when David Dean,a T&B veteran and now JD Martin’s regional VP-Florida, joined the company in 2021. Baker says Dean has done a “miraculous job” building the company’s business in the Sunshine State.

Along with these mergers came opportunities to expand further into the industrial market and particularly into ABB medium-voltage gear and Hammond transformers. “Through all of this, Jeff Anderson has been very successful establishing JD Martin more on the ABB and medium-voltage side,” said Baker. “He has taken the Hammond transformer business to a completely different level across most of our footprint. With that, he got us involved with what used to be ABB medium-voltage transformer business that they sold off to Hitachi. He has taken that to most of our territory.”

Anderson says getting the ABB medium-voltage gear piece was a synergistic move that allowed JD Martin to provide customers in north Texas and Oklahoma with shelf-goods products and high-end switchgear. “It had been handled there by a rep that did about $5 million per year. Our first year we did $19.8 million,” he says. “The reason I bring this up is that it’s part of the story of having the shelf- goods commodity piece, where you are covering the entire market and then the industrial OEM piece is a natural piece there if you do it right.”

SERVICING CUSTOMERS’ NEEDS WITH SYSTEM SOLUTIONS

While the merger of I-Pro expanded JD Martin’s reach into Colorado, Wyoming and Montana, it also provided company with some new capabilities that you don’t find often if ever with independent reps. Tim Klinger, president & CEO; Derek Schouten, VP of Sales-Industrial; Jeremey Waanders, VP of Sales-Commercial; and their team provide packages of switchgear, transformers, temporary power and control products to contractors, fabricators, panel builders and other OEMs in the electrical, electronic, utility and datacom markets in the Rocky Mountain region. A major tool they use in servicing customers is the company’s proprietary Taakboard project management software, which was developed by Derk Schouten and is a project management tool JD Martin’s Services and Solutions team uses to track projects (gantt charts, calendars, repository for drawings, etc.).

Says Schouten, “We have project managers on staff, because as you can imagine,it’s a lot of intricate detail, milestones and analysis to make sure it runs smoothly. We have proprietary software (Taakboard) that we developed specifically for this to manage the project along the way, with the project managers, salespeople and OEMs all having visibility.

“Some of these OEM companies really welcome our support from our project managers and having the software to make sure distributors get payments in on time, invoices get taken care of, submittals get taken care of. It seems to be a win-win for us and them.”

Says Ken Hooper, “The software allows our local companies to focus on selling, demand generation and customer relationships so they are not worried about payables and HR -- all the things that can detract from rep principals time spent on the business. That is the key differentiating point.”

Adds Matt Garavaglia, executive VP, “It allows us to perform better for manufacturers. A lot of distributors’ outside salespeople are focused on major equipment and high-dollar items. (Unfortunately,) the lugs and duct and are sometimes afterthoughts for them. It allows us to provide more value to our distributor and manufacturer partners.

"Since the software has been self-programed and developed, when we see pieces that apply to a different piece of business, we can change that in-house. For instance, when we wanted to drive more contractor face-time and we needed a method of recording it, we modified one part of that platform so that we can measure our effectiveness and impact with how many calls we are making at contractors. We can tweak it how we need it.”

The I-Pro team also used VISIE software to manage a wide range of tasks, including financial data, sales commission reporting, logistics planning, pricing, marketing campaigns and vendor portals to share product, pricing and marketing data. The company’s dedicated marketing director, Brooke Baker Schell, works closely with electrical manufacturers on these portals.

Says Schouten, “Necessity is the mother of invention as they say, so years and years ago we needed to provide a more robust software solutions to better manage the rep business model and how we go to market and how we track progress and success.

“VISIE is the Dutch word for ‘vision.’ It gives us visibility and vision into our business not only financial data with sales commission reporting but also CRM data, follow-ups, action items, logistics planning with regional manufacturers' visits and calendar invites.

He says the program uses artificial intelligence to build catalog references and cross-references. “AI is going to revolutionize every aspect of the electrical business, including our own. You will see a lot more automated systems and agentic AI and process management. I am trying to get our manufacturers to realize the fundamental shift in society, let alone business. People don’t realize what’s at our fingertips. There’s a lot more coming on VISIE with AI.”

Tim Klinger says VISIE has been particularly helpful in managing manufacturers’ marketing initiatives and territory visits. If, for example, each of the 20 or so companies JD Martin represents had five marketing initiatives they wanted to work on with JD Martin, that’s 100 initiatives to manage. Klinger says tracking manufacturers’ visits can also get unwieldly if they aren’t tracked properly, and JD Martin built a customized trip planner function on VISIE they share with the manufacturer.

Baker says JD Martin has picked up best practices from all of its operating companies acquired through acquisitions that can be used throughout the agency, such as the proprietary software developed at IPro. “All of the manufacturers want us on some kind of sales (software) but none of them talk to each other,” he says. “Ours is second to nobody.”

Baker and his team have also had success with the EOS (Entrepreneurial Operating System) software for performance management and say it provides some commonality across the company, because while they encourage managers to have their own leadership styles, they wanted to have a common system to evaluate employees. EOS (Entrepreneurial Operator System) is derived from a book from Gino Wickman called Traction. Many of JD Martin’s manufacturers and contractors are utilizing the same system to run their organizations.

Says Tim Klinger, “When Greg and I got together we talked about how we have all these successful leaders, all nuanced in different ways in how they did business. We wanted some commonality. It’s allowed us to improve our employee experience from Day One.”

The focus on employee development extends to a solid package of company benefits, including health care, a 401K program, industry training, career advancement and a commitment to helping local communities. Garavaglia said JD Martin stepped up in a big way to help communities affected by the recent flooding in Texas. “ You have to practice what you preach on being local. It was more than an employee match in donations. In partnership with Southwire’s Project Gift. Greg pledged $50,000 directly and up to an additional matching $50,000 to employees’ donations. In addition, Greg encouraged employees to do hands-on help with two paid days of time off. It reiterates our family-first feel of our culture."

Garavaglia also said a big differentiator for the company is that because of its scale, it can offer employees career advancement opportunities that just aren’t available as often in smaller agencies. Adds Baker, “If you have a hotshot sales guy who wants to be sales manager or the principal of a smaller agency, they may have to wait for someone to die before they have the opportunity to do anything above outside sales.”

MARKETING JD MARTIN

Ken Hooper says that as the JD Martin executive team built out the company into all of these areas, they decided it was a story they wanted to get out in the market to differentiate the agency from competing reps. They hired Mower, a well-known and respected marketing agency in electrical industry circles, to rebrand the company. This effort involved much more than creating a new logo. Mower helped the company analyze its strengths and weaknesses by talking with key distributors and manufacturers and employees. The 63 pages of feedback for these interviews helped the JD Martin executive team craft a narrative that highlighted its 70-plus years in the business and the investments it made in local relationships and develop a video that introduces the company to new customers, vendors and industry professionals. One method it now uses to tell its story is a new company video.

Down the road, Greg Baker won’t rule out making more acquisitions, but he says the main objective for the company is growing the business in its key end user niches and existing geographic markets. He says JD Martin might consider expanding into the utility or mechanical markets if customers or vendors have a need for their unique package of services.

Baker and his team are proud of how JD Martin has grown and of the investments thy made in services like VISIE, Taakboard and the Mower marketing campaign. They believe they are true differentiators between how they and their competitors do business. "We've taken the "Rep of the Future" study best practices to the next level," says Baker. “By continually investing in our people, our systems, and our go-to-customer sales process, we can accelerate our growth on behalf of our manufacturers and customers."