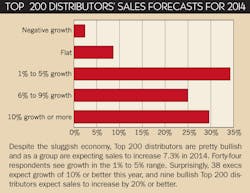

Even though 2014 has so far offered mostly modest growth, many Top 200 distributors are cautiously optimistic about sales, and they are steadily investing in their businesses. Whether it’s installing a new computer system, restaffing after the recession, or opening a new branch, a key trend in the survey responses from over 140 Top 200 respondents is definitely one of reinvestment, rather than retrenching.

Philip deLoache, president and CEO, FirstSource Electrical, Houston, is particularly optimistic and sees his company’s sales growing 12% to 15%. “FirstSource Electrical continues to grow by double digits year-over-year and invest in growth engines such as additional salespeople,” he said in his survey response. “The stellar Houston economy provides us a market where this is possible. We will exceed $30 million in 2014 in our sixth full year of operation.”

The oil and gas business in some regions of the United States and LED lighting, for those companies that invested early and wisely in this technology to support customers, are driving some of the most bullish forecasts by Top 200 electrical distributors this year. But good, old-fashioned commercial construction is driving sales in some of the hottest regional markets, too.

Pockets of double-digit growth. It’s not surprising the oil and gas market is lifting sales for some electrical distributors serving the Texas and North Dakota’s Bakken oil and gas business, and at least four of the companies that provided details on their 2014 growth forecasts attributed some of that growth to the energy markets — Border States Electric, Fargo, N.D. (+10.8%); Elliott Electric Supply, Nacogdoches, Texas (+15%); FirstSource Electrical, Houston (+13.5%); Mid-Coast Electric Supply Inc. (+15%); and Sun Valley/Energy Electrical Distribution, Las Vegas, Nev. (+20%).

LED opportunities. When you dig into the individual product markets with the most action, challenges and future potential, the LED lighting market has clearly captured the attention of not only the lighting design professionals who have seen its potential over the past decade, but also some Top 200 business owners who have figured out how to make a profit selling LEDs.

Several Top 200 distributors say LED lighting has already changed how electrical distributors approach the lighting market. They are learning to manage challenges like dealing with customers who got burned by purchasing inferior LEDs from unknown offshore suppliers in their first experiences; servicing or backing a five- or 10-year warranty in a product where product obsolesce is such a big factor; and selling a product that won’t have to be replaced for a decade, which potentially eliminates much of the lamp replacement business that historically drove sales in the lighting market.

Philip deLoache from First Source Electrical said LED lighting is becoming the preferred lighting technology for many customers because prices have fallen and the economics have improved. “We stock and sell a wide range of LED lighting products, both indoor and outdoor, and expect to see this in incandescent and most HID light sources,” he said. “The challenges have been the lack of standards and the many low-quality products that consumers cannot differentiate from high-quality, name-brand LED products. Until recently, the price points have also been so high LED lighting would put a project out of budget.”

Facility Solutions Group, a hybrid distributor that has both electrical supply and ESCO businesses, was all-in early on LEDs and has had as much or more experience with them than any other electrical distributor. William Graham, CEO of the Austin Texas-based company, believes LED lighting is mirroring the personal computer revolution of the late 1980s and early 1990s, and he expects the technology will continually get better.

“It will be embraced by every segment in the market,” he says. “It will be the hardware of lighting that will also usher in a demand for software (control, management, application) support. It’s here to stay.”

When Electrical Wholesaling asked about the biggest challenges Facility Solutions Group has had with LEDs, Graham listed several concerns in his survey response, “Low cost of entry into the market by too many non-lighting competitors… Internet visibility of options and price points on products sucks value out of the selling process... Rapid generational obsolescence of products... The rapid rate of performance improvement and decline in cost leaves manufacturers and distributors holding dollars of product that is no longer relevant. Overstated performance claims... Inconsistent standards... Complex technology.”

Methodology. To compile this listing, in April of this year Electrical Wholesaling’s editors sent out a survey to several hundred distributors of electrical supplies that have either been on the listing in the past or have at least $10 million in annual sales, according to our data sources. In addition, we get data from publicly held distributors and other companies that make their sales and company data public. This year we got information back from 147 Top 200 distributors, which is our best response ever. It’s quite an accomplishment to get this much sales and company data because the vast majority of companies on this listing are privately held. Many of these companies do ask us to use their sales data confidentially and only for placement on the listing.

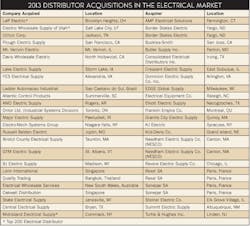

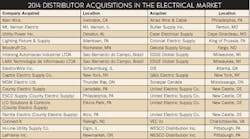

You will also notice that we rank companies that have been acquired in either 2013 or 2014. Our general rule of thumb here is that when a company has been acquired, we include their sales (or a sales estimate) for that calendar year, but take them off the Top 200 listing the next year, when they are fully integrated into the acquirer.

In those situations where a distributor is large enough to make the listing but did not respond to our surveys, if we have reliable sales or employee data from the past few years, we will place them on the listing, using a sales-per-employee average, or the average sales increase based on responses from Top 200 respondents or other Electrical Wholesaling sales data. However, if we haven’t heard from you for a while and your company is on this year’s listing, there’s no guarantee it will be ranked again next year. We make every effort to make this listing as accurate as possible, and can’t rely on sales estimates or other company data that’s more than a few years old.

Strictly by the numbers. With an estimated $62 billion in North American sales, EW estimates the Top 200 distributors controlled approximately 65% of sales through electrical distributors in North America. According to EW estimates, these 200 companies have 88,900 employees and run at least 5,965 North American branches. From the 140 companies that provided both sales and employee data, Electrical Wholesaling’s editors estimated that Top 200 full-line distributors averaged $668,515 in sales per employee.

What's New Among the Top 200?

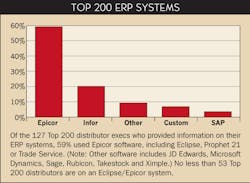

Atlanta Light Bulbs, Tucker, Ga., is moving onto a new ERP this year, and Doug Root, CEO, says the company is making a “heavy investment” into online branding, a new website, blog platform, and email marketing capabilities.

In Colorado Springs, Colo., Steve Blazer, president, said Blazer Electric Supply recently started up the Blazer ProFab division to provide customers with custom pipe bending and threading and labor-saving pre-assembled boxes, switches and plug drops.

Steve Bellwoar, president, Colonial Electric Supply, King of Prussia, Pa., said his company recently launched “web-based Jobtrack software that provides customers remarkable access to all aspects of the project and is driving demand for our project services.”

Julie Kingsley, controller, Electric Equipment Co., Greensboro, N.C., said a major reinvestment in the company’s IT department is one of the company’s big moves, which also include a major recruiting effort for its field service teams that provide diagnostic testing and related services, and an acquisition last year of Atlantic Control Products, Summerville, S.C., to bolster its business in industrial automation and motors. “We are making much greater investment in digital platforms and IT,” she said. “Flexibility, access and the ability to manage complex data is more important than ever. We are investing more into digital marketing, beginning with a new website and expanding into an expansive organic content program. Customers are demanding more self-service options and greater access, and we are implementing a multi-phase ecommerce program in response.”

Elliott Electric Supply, Nacogdoches, Texas, opened locations in Oklahoma City, Okla.; and Pearsall, Pecos, Snyder, and West Fort Worth, Texas. The company also acquired AMO Electric Supply, with locations in Fayetteville, Rodgers and Siloam Springs, Ark., and upgraded its legacy computer software with new features for outside sales, customer inventory management, order tracking and mobile devices for customers and employees.

In addition to opening a New York, N.Y., branch, Stephen Byrne, general manager, Facility Solutions Group, Austin, Texas, said FSG is in the midst of transformation that will “carry the company forward for the next 30 years.” “We have made significant investments in people, technology and infrastructure and have reorganized our organization to increase our focus on improved sales management and operational execution,” he said. “We are betting big on the future.”

The F.D. Lawrence Electric Co., Cincinnati, celebrates its 110th anniversary in 2014 and was recognized last year as a Platinum Level member of the IMARK buying/marketing group. The company also was a finalist in the University of Cincinnati’s 2013 Private Business Award issued by the Goering Center for Family & Private Business. Scott Lepsky, marketing manager, says the company also is adding additional resources to support its growing Energy Efficiency division and hired systems support personnel to help maximize efficiencies with its ERP system.

Barney Sloat, V.P.-general manager, Forest Hills Electrical Supply Inc., Randolph, Mass., says the company will be upgrading its operating system in 3Q 2014 and has added field salespeople in its energy and lighting businesses. The company also recently hired several new employees in inside sales and project management.

Cara Backman, marketing manager, Franklin Empire, Montreal, one of Canada’s largest electrical distributors, reports that the 72-year-old company will be installing a new computer system this year.

Lawrence Heimrath, chairman, G&G Electric, New York, says the company recently opened a new branch in Harlem and will be buying a large warehouse in the Bronx. He expects to be in the facility in 3Q 2014.

Graybar Electric Co., St. Louis., Mo., reported new branches in Montgomery, Ala.; Decatur, Ga.; Champaign and Rockford, Ill.; Dickinson and Minot, N.D.; Binghamton, N.Y.; Williamsport, Pa.; Columbia, Mo.; Boston (downtown), Mass.; and Carrizo Springs, Deer Park and Odessa, Texas.

Mission Controls & Supply, San Antonio, Texas, is one of the many electrical distributors celebrating an anniversary this year (25 years). David Gardner, president, says the company will be moving into a new 50,000-square-foot facility this summer and will be hiring this year. “Outlook is strong,” he says.

Standard Electric Supply Co., Milwaukee, plans to expand its Milwaukee headquarters, and Larry Stern, president, says the company is looking at opening additional locations this year to expand its territory. This year marks the company’s 95th year in business.

Rusty Batch, CEO, Tristate Utility Products, Marietta, Ga., is proud of the longevity of many of the company’s vendor relationships and says 2014 marks the 40th anniversary of the company’s relationship with Howard Industries and 20 years with Nordic Fiberglass. In 2013, the company also celebrated the 25th anniversary of its Florida business unit with an open house and product expo.

Top 200 Distributors Sound Off on AmazonSupply

Electrical Wholesaling asked Top 200 survey respondents about the chances of AmazonSupply taking significant market share away from electrical distributors and their responses were mixed. While some executives said AmazonSupply is or will be a big threat to their business, generally speaking, most of the respondents who commented said that while AmazonSupply will take some market share, customers will still go first to distributors of electrical supplies for their purchases.

Rick Kerman, CEO, Steiner Electric Co., Elk Grove Village, Ill., is not taking AmazonSupply lightly. “They are a significant concern,” he says. “We are hopeful the top suppliers realize Amazon does not spec product, (and) only sells it when requested. Distributors provide all the product knowledge, local inventory, technical support and after-hour services and delivery that is more costly and much more valuable to the supplier/distributor relationship. We hope the supplier continues to hold this in high regard.”

Other Top 200 electrical distributors think AmazonSupply may be a tough competitor for commodity items or for distributors that don’t offer a full package of value-added services that their customers want, but that they won’t be much of a factor in switchgear, lighting packages, wire and cable or highly engineered project business. Said Fromm Electric Supply’s Michael Fromm, “Amazon’s fulfillment and pricing models will be a challenge for distributors in all industry segments. In electrical, they may capture commodity business, but complex automation or lighting and control systems design will be difficult.”

Rock Kuchenmeister, president, K/E Electric Supply, Mt. Clemens, Mich., said some of his company’s facilities management and MRO customers are price shopping at AmazonSupply, but they still come back to his company and other electrical distributors to order. “Essentially, the customer searches the internet for products and pricing, instead of seeking information from sales reps,” he said. “Some of these customers are comfortable ordering from the internet sites, others just want the distributor to match the price.”

About the Author

Jim Lucy

Editor-in-Chief of Electrical Wholesaling and Electrical Marketing

Jim Lucy has been wandering through the electrical market for more than 40 years, most of the time as an editor for Electrical Wholesaling and Electrical Marketing newsletter, and as a contributing writer for EC&M magazine During that time he and the editorial team for the publications have won numerous national awards for their coverage of the electrical business. He showed an early interest in electricity, when as a youth he had an idea for a hot dog cooker. Unfortunately, the first crude prototype malfunctioned and the arc nearly blew him out of his parents' basement.

Before becoming an editor for Electrical Wholesaling and Electrical Marketing, he earned a BA degree in journalism and a MA in communications from Glassboro State College, Glassboro, NJ., which is formerly best known as the site of the 1967 summit meeting between President Lyndon Johnson and Russian Premier Aleksei Nikolayevich Kosygin, and now best known as the New Jersey state college that changed its name in 1992 to Rowan University because of a generous $100 million donation by N.J. zillionaire industrialist Henry Rowan. Jim is a Brooklyn-born Jersey Guy happily transplanted with his wife and three sons in the fertile plains of Kansas for the past 30 years.

Doug Chandler

Senior Staff Writer

Doug has been reporting and writing on the electrical industry for Electrical Wholesaling and Electrical Marketing since 1992 and still finds the industry’s evolution and the characters who inhabit its companies endlessly fascinating. That was true even before e-commerce, LED lighting and distributed generation began to disrupt so many of the electrical industry’s traditional practices.

Doug earned a BA in English Literature from the University of Kansas after spending a few years in KU’s William Allen White School of Journalism, then deciding he absolutely did not want to be a journalist. In the company of his wife, two kids, two dogs and two cats, he spends a lot of time in the garden and the kitchen – growing food, cooking, brewing beer – and helping to run the family coffee shop.