IHS Markit Pinpoints States Likely to Get Hit Hardest from COVID-19

This report by Karl Kuykendall, associate director, Regional Economics, IHS Markit, says the impact of the COVID-19 will vary by geography, but that all states will be affected. This report and other IHS Markit data on the electrical industry, including the monthly Electrical Price Index, are normally only available to our readers as part of a $99 annual subscription to Electrical Marketing newsletter. We are occasionally releasing some market reports from IHS Markit to our entire audience during the COVID-19 crisis to provide access to key market data they need to management their businesses at this time.

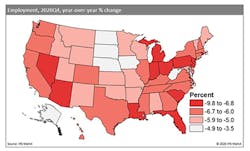

No state will be immune from employment and GDP declines this year given the sudden and deep economic shocks associated with the necessary containment efforts around COVID-19, but the impacts by region could vary widely in terms of degree and duration.

Tourism-reliant states. There will be a wide variation in state-level performance this year with tourism-dependent states seeing the largest immediate declines. This will hit Nevada and Florida the hardest, with employment falling 9.8% and 7.9%, respectively, by the end of this year. Temporary shutdowns among resorts and casinos will lead to a dramatic decline in the second quarter in these states with total employment plunging more than 30% (annualized) in Nevada and 20% in Florida.

Manufacturing-reliant states. Manufacturing-intensive areas in the Midwest and the generally slower growing and densely populated Northeast will also be among the states with the deepest employment declines this year. Most sectors of manufacturing (with the exception of food and other consumer staples) will be affected by plant shutdowns due to reduced demand along with virus concerns.

Energy-reliant states. Texas, North Dakota, New Mexico, Oklahoma and Alaska stand to endure significant economic losses as mining output shrinks over 2020 and 2021. In the second quarter of 2020, the negative impacts resulting from virus mitigation efforts will dominate the economic picture even in the major oil-producing states. The impact from lower mining activity will become more noticeable later in 2020 and into 2021. As broader economic conditions start to improve in 2021, oil-producing states will see a slower rebound as they continue to grapple with weakness in the oil patch. Economic losses related to oil will be much more pronounced in gross state product (GSP) than employment given the high output nature of the industry. In Texas, for example, the natural resources and mining sector accounts for 15% of real GSP but only 2% of jobs.

Impact on rural states. On the other end of the spectrum, South Dakota, Nebraska, andIowa will be the most resilient given their smaller share of sectors most exposed to COVID-19 disruption and rural landscape, which naturally helps with social distancing.

Metro-area impact. There will not be a direct link between the regional distribution of COVID-19 caseloads and the economic damage associated with the virus. The specific economic structure of the state or metro, along with state and local policies around containment, will generally be most impactful. However, there will be situations where caseloads affect our outlook, with New York serving as a prime example. It’s grappling with an outsized number of cases stemming from New York City and will endure greater economic disruption as a result. Densely populated urban areas are naturally at most risk for caseload escalation.

Outlook. We should not overlook that fact that the economic disruption from COVID-19 will eventually pass, with our current forecast calling for employment and output to rise over 2021. We are not expecting a “V” shaped recovery, in which economic activity snaps right back soon after the outbreak is under control and people can return to work. It will take time for travel activity to rebound and consumer confidence and spending to return to full health. The recovery will also depend upon the extent of financial damage caused by layoffs and shutdowns, which could lead to longer-term losses in demand. Nevertheless, the states and metros hit hardest will generally be among the fastest growing over the ensuing recovery as activity that fell most sharply during the downturn has the greatest room for growth as conditions normalize.

--Karl Kuykendall, associate director, Regional Economics, IHS Markit