Looking at the economics around us is important to our success. Geographic trading areas with a series of businesses in related segments are called economic clusters. An example of an economic cluster can be found in the Michigan automotive market. Not only are there the automotive manufacturers themselves, but also a series of related businesses such as metal fabrication, robotic and automation suppliers, transportation, paint dealers and parts suppliers from electronics to seat belts.

A terrific tool to identify clusters of manufacturing is available from www.clustermapping.us, an online resource developed and maintained by the Institute for Strategy and Competitiveness at Harvard Business School. It gives a snapshot of clustering and how to consider related businesses. The website also provides a drillable view of related clusters that you can click through.

Why is this important? You should look at clustering and industry-related businesses and sectors because these clusters bring together technology, information and skills that are already engaged to a large extent with some facet of the cluster. We can use existing relationships, skills, products and market knowledge to set the path for developing additional meaningful and profitable relationships specific to an industry.

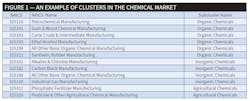

As we know, it’s not easy to develop new customers. However, understanding how to leverage existing relationships to build new customer bridges creates a straightforward roadmap to success. Let’s look at the chemical market broken out by the North American Industry Classification System (NAICS) in Figure 1. If I have a couple of great customers manufacturing petrochemicals buying explosion-resistant boxes, motors and controllers, specialty lighting and safety equipment, it makes sense that identifying other companies in this same cluster may offer similar opportunities for products and services.

How do I identify a cluster? It all starts with some thought. Let’s say I have a customer who builds utility trailers. I stock automotive wire, connectors and lights for their OEM application. They also buy some shop supplies, tools and test equipment. My sales representative knows the customer well and speaks their industry language. Thinking through a cluster of similar companies and related industries leads to boat trailers, motorcycle trailers, semi-trailers, livestock trailers, motor homes, campers and specialty trailers. Looking up the NAICS codes is a quick Google search away. The NAICS code is the key to unlocking the names, addresses and phone numbers of these cluster opportunities. Once the NAICS code is identified, lead lists can be purchased from other sources such as Dun & Bradstreet, providing salespeople a path to success with businesses interested in related products and services.

Economic clusters can be either local or traded. Traded clusters are those concentrated in a geographic area that provide products across the nation or globe. Local clusters are related businesses in regional areas that support their communities. Both services and manufacturing can fit into local or traded clusters.

Much work has been done on economic clusters and cluster mapping and definitions. Harvard Business School has done some great work, as has the National Bureau of Economic Research. These are valuable tools that can be used free of charge by you or your marketing team. In their work “Defining Clusters of Related Industries,” Delgado et al. say, “Clusters are geographic concentrations of industries related by knowledge, skills, inputs, demand and/or other linkages. A growing body of empirical literature has shown the positive impact of clusters on regional and industry performance, including job creation, patenting and new business formation. There is an increasing need for cluster-based data to support research, facilitate comparisons of clusters across regions, and support policy makers and practitioners in defining regional strategies” (www.nber.org/papers/w20375).

As an industry, we are part of the lighting and electrical equipment cluster (See Figure 2). This table was developed by Delgado and other researchers at www.clustermapping.us and the Institute for Strategy and Competitiveness at Harvard Business School. It’s a pretty complete look at the electrical manufacturing industry at a high level.

As you plan for 2022, think about clustered industries and how you can leverage them for growth opportunities in your business. Coming off a stellar 2021, the expectations for 2022 are a high bar. We need to use all the tools at our disposal to create and realize opportunity.

Christian Sokoll is president of DISC Corp., Houston, the electrical market’s leading provider of sales forecasts and related market data. He can be reached at [email protected]

About the Author

Christian Sokoll

Meet Chris Sokoll

Chris began his career in the electrical industry 30 years ago in Spokane, WA, in the way so many in the electrical wholesaling space have – working the counter and the phones. He relocated to Phoenix, Arizona, and continued his career progression in an inside sales role with King Wire covering the Southwest. His next stop was Atlanta, where he continued to learn the business and worked the Southeast region. Little did Chris know that a move back to Washington state would start a career with Houston Wire & Cable that would span nearly three decades.

Chris was named “New Salesperson of the Year” in 1991 for his outstanding results and won additional awards for sales growth by supporting oil and gas exploration in the North Slope and managing a joint contract with Boeing. He progressed in his career taking an outside sales position in Lexington, KY, working with electrical distribution business development on major corporate accounts such as Mead Paper, DOW / Dupont, and the Savannah River Project. Chris was promoted to Regional Manager over the Southeast and again proved himself by significantly growing both sales and profitability.

Chris was asked to take on a turnaround project for Houston Wire & Cable’s Midwest Region, headquartered in the Chicago metro area, where he nearly tripled the region’s sales – from $24 million to $74 million. During his tenure in Chicago, Chris won numerous management and vendor awards for new product rollouts, sales growth, and national account management. His team won more “President’s Circle” sales awards than any of the other 11 Houston Wire & Cable locations. This high level of performance resulted in Chris earning a position as Regional Vice President.

Chris’s next stop was as Division President for Southern Wire, a heavy lift equipment wholesale subsidiary of Houston Wire & Cable based near Memphis, TN. He took this position post-acquisition and integrated the division, managed a transition of computer systems, and developed a segmented market plan while retaining all employees. Chris was able to buy out a competitor’s inventory, resulting in their exit from the market, and then hired their VP of Sales to step in as President of Southern Wire. This facilitated Chris’s next role as Corporate VP of National Business Development based in Houston, where his first responsibilities included continued oversight of Southern Wire, managing the Cable Management Services Project Group, and directing the National Service Center, a training and development group for new sales professionals entering the industry.

During this time overseeing so many critical divisions, Chris became more immersed in business intelligence and market data analysis – leading to innovative internal changes at Houston Wire & Cable. Chris learned to use and blend data from multiple sources such as DISCCORP, Industrial Information Resources (“IIR”), and ERP and CRM data to aid the company in embracing data and visualization tools in a completely new and unprecedented fashion. Chris deployed industry-leading corporate analytics and business intelligence tools such as Tableau, Power BI, Alteryx, Access, and Excel to inform and improve decisions and track KPIs. Likewise, he provided reporting for the board of directors and senior management team both in spreadsheets and in various advanced visual presentation formats. Chris also designed, tracked and approved compensation programs for sales reps and agents, and was also instrumental in the design and tracking of customer rebate programs.

In 2019, after working closely with DISC Corp. as a customer for five years and thus seeing the ongoing need for quality market intelligence data for the industry, Chris left Houston Wire & Cable to purchase DISC Corp. from its founder, Herm Isenstein. Along with being the leading economist in the electrical market for more than 30 years through his work at DISC, Herm was also a prolific author for Electrical Wholesaling magazine.

Herm passed away in Sept. 2019, but Chris continues to grow DISC’s vision while maintaining its leadership position as a trusted data source. By diligently working alongside DISC Corp.'s economists, programmers, and marketers, Chris embraces his passion to ensure that DISC continues delivering high-quality business intelligence and forecasting to further the future of the electrical wholesaling industry.

Chris holds a bachelor’s degree in organizational leadership from Roosevelt University in Chicago and a graduate certificate in finance from the University of Chicago. Chris has completed various Microsoft training programs in Excel and Access in addition to data science theory, and he has written college-level course material on Microsoft Power BI and Excel.