EDITOR’S NOTE

This article is part of Electrical Wholesaling’s EW’s Lunchtime Learning classes, a new educational resource for the electrical market aimed at both newcomers and industry veterans in the electrical market.

In addition to articles in Electrical Wholesaling’s print magazine and on ewweb.com, the classes will also be available in a YouTube video format. Each video is no longer than 10-15 minutes in length. EW’s editors believe breaking the content into bite-sized chunks will enable viewers to watch the videos whenever and however works best in their busy schedules. And because the classes are in a YouTube video format, you can watch it on a mobile device, laptop or desktop computer.

We learned from the success of Electrical Wholesaling’s Today’s Electrical Economy podcasts that EW’s subscribers enjoy the shorter format. And because we broke down the content into bite-sized chunks, you can squeeze a quick class into your lunch hour, or whenever you have a few extra minutes for some online learning.

If you are a manager, you can use the classes for lunch-and-learns for your team. To help you do that, each session includes some “Points to Ponder” — suggested questions about the subject matter to generate a discussion on the content. Each class also offers suggestions for additional resources in case you want to learn more.

EW’s LunchTime Learning series has two tracks — one for newcomers to the electrical market and one for managers and industry veterans. The classes for new employees include an overview of the electrical wholesaling industry and EW’s popular Electrical Market 101 content, which introduces students to the basis of the industry’s three largest market segments, the commercial, industrial and residential markets.

EW’s Lunchtime Learning Series will be a valuable resource for you, whether you have been in the electrical industry for 10 days or 20 years. Electrical Wholesaling’s editors here at Endeavor Business Media are excited about this new learning resource and think it’s a new and exciting format that will help us carry out the same editorial mission we have had for more than 100 years — to help you run your company more profitably and to sell more electrical products.

In “Five Trends that Could Shake the Electrical Market,” Electrical Wholesaling’s editors make their picks for the trends that we believe will have the most impact on the electrical industry in this post-COVID era. These trends are:

1. Inflation-fueled electrical price increases will continue

2. Acquisitions are off to a slow start in 2022, but they are bound to heat up again & follow the long-term trend of consolidation

3. Massive population shifts are reshaping which local markets will grow fastest in the future

4. The talent crunch will continue for distributors & their customers

5. Technology is creating exciting new sales opportunities

#1. Inflation-Fueled Electrical Price Increases Will Continue

It’s tough to forecast exactly how long we will see this historic rise in electrical prices. Inflationary pressures stemming from materials shortages, supply chain snafus, uncertainty over the health of the economy and more recently the war in Ukraine have driven electrical prices to heights not seen in more than a decade.

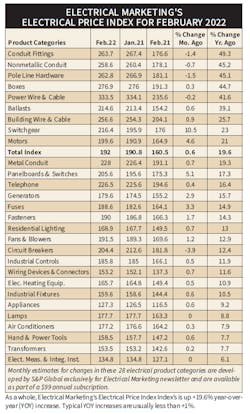

Electrical Marketing newsletter’s monthly Electrical Price Index has been tracking the prices of more than 20 electrical products since 1990, and over the past year the index as a whole has shown double-digit year-over-year increases since March 2021. Its most recent data for Feb. 2022 is up +19.36 over Feb. 2021 That mind-blowing increase pales in comparison to eight other product categories riding even higher over that time period: Conduit Fittings (+49.3%); Nonmetallic Conduit (+45.2%); Pole-Line Hardware (+45.1%); Boxes (+44.7%); Power Wire & Cable (+41.6%); Ballasts (+39.1%); and Building Wire & Cable (+25.7%); and Motors (+21%). If you need monthly estimates for changes in 28 core electrical product categories developed by S&P Global for Electrical Marketing newsletter, they are available as part of a $99 annual subscription.

#2. Acquisitions are Off to a Slow Start in 2022, but They are Bound to Heat Up Again & Follow the Long-Term Trend of Consolidation

Last year was one of the busiest acquisition years ever for distributor M&A activity. Last year, Electrical Marketing had reported on 26 deals. Eleven of them involved the sale of electrical supply houses on Electrical Wholesaling’s 2021 Top 150 Distributors list (see chart).But it wasn’t the number of acquisitions that stands out; it’s the amount of sales dollars changing hands. EW estimates that no less than $2.5 billion in industry sales is now under new ownership. Rexel’s acquisition of Mayer Electric Supply, Birmingham, AL, accounted for approximately $1.1 billion of that amount, but there were at least six other deals that involved distributorships with $100 million-plus in sales. The Mayer acquisition was one of the largest acquisitions in the industry over the past decade, and it dramatically increases Rexel’s presence across the Southeast, Texas and western Pennsylvania. Rexel also recently purchased Winkle Electric Co. in Youngstown, OH.

According to EW’s database of distributor acquisitions, Rexel has acquired at least 30 wholesalers in the United States and Canada since the 1980s, including well-known players like Platt Electric Supply, Beaverton, OR (2012); Branch Group, Upper Marlboro, MD (2000); Westburne, St. Laurent, Quebec (2000); GE Supply, Shelton, CT (2006); and Capitol Light & Supply (CLS), Hartford, CT (2006).

Graybar Electric Co., St. Louis, also made headlines with its acquisition of three Top 150 distributors: Metro Electric Supply, St. Louis; Shingle & Gibb Automation, Moorestown, NJ; and Stevens Engineering, South San Francisco, CA. Together, the three companies add an estimated $180 million in revenues to Graybar, which logged approximately $7.2 billion in 2020 sales.

Sonepar USA, North Charleston, SC, also made waves, with its acquisitions of two well-known Midwestern distributors — Springfield Electric Supply, Springfield, IL, and Richard Electric Supply, Cincinnati.

OmniCable, West Chester, PA, surprised the wire and cable world with its purchase of Houston Wire & Cable, Houston, and Consolidated Electrical Distributors, Irving, TX, adding to an already strong position in the Sunbelt with its acquisition of Wildcat Electric Supply, Houston. Another Pennsylvania distributor was in the news this year, with the sale of Rumsey Electric Co., Conshohocken, PA, to Kendall Electric Inc., Portage, MI.

Another acquisition of note was the deal where Supply Chain Equity Partners (SCEP), Tampa, FL, bought the largest independent distributor headquarter in Florida — Electric Supply of Tampa. The company is one of the 100 largest distributors in the United States. This deal was also unique because of SCEP’s background. According to Jim Miller, one of the company’s partners, SCEP is the only 100% distribution-centric private equity fund in the U.S. SCEP’s investors include more than 40 distribution veterans, including eight former owners of Top 200 electrical wholesalers. ESI is SCEP’s 44th distribution investment since 2007.

Prior to founding SCEP, Miller and the principals of the fund worked in an advisory capacity for some of the biggest electrical wholesalers in the U.S. and abroad, including Warren Electric, Stuart C. Irby, Edson Electric, Leff Electric, Platt Electric, Melexa, Heritage/OneSource, Calvert Wire & Cable, Houston Wire & Cable, Roden Electric and Western Extralite.

#3. Many of the Fastest-Growing Local Electrical Economies are Located in the Sunbelt and Intermountain States.

Population growth (or decline) has a direct impact on the electrical construction industry because new residents need places to live, shop, go to school, worship, work and play. When folks move into or leave a local market area it immediately affects the potential demand for the construction and renovation of homes and apartments, schools and colleges, churches, synagogues and other houses of worship, hospitals and medical offices, Main St. shops and strip malls, government offices, sporting facilities and other retail, commercial and institutional construction.

With the U.S. Census Bureau’s population data (released annually), you can quickly identify where the most residents are moving into or leaving a geographic area. The map above uses this data to show you which counties have added or lost population over the past 10 years and clearly illustrates the massive population shift the United States is experiencing, with tens of thousands of people moving from areas in the Midwest and Northeast to Sunbelt locations in the Carolinas, Georgia, Florida, Texas and Arizona, as well as Intermountain states like Colorado, Idaho and Utah.

The population growth in the fastest-growing counties in these states is staggering. For instance, from 2010 to 2020, the Phoenix metropolitan area in Maricopa County, Ariz., added 761,964 new residents (+20%), and Texas had five of the Top 10 counties that added the most new residents from 2010 to 2020: Harris County (Houston) added 645,794 residents; Tarrant County (Dallas) was up 314,313 residents; Bexar County increased its population by 312,050 residents; Collin County was up 289,728 residents; and Travis County (Austin) added 276,237 residents.

#4. The Talent Crunch Will Continue for Distributors’ Electrical Contractor Customers

Electrical contractors are feeling the current labor shortage. According to EW estimates developed from the monthly job opening data collected by the U.S. Bureau of Labor Statistics, at least 49,000 job openings exist at electrical contractors. Many of these job openings are posted on LinkedIn. EW’s editors track the LinkedIn job postings by the 10 largest electrical contractors on EC&M’s Top 50 Contractors listing and found that at press-time more than 2,000 jobs were posted by these companies, including M.C. Dean (741 jobs posted); Quanta Services (439 jobs); Berge Electric (148 jobs); Faith Technologies (136 jobs); and MYR Group (132 jobs).

Some electrical distributors are helping their contractor customers with their talent crunch by stocking preassembled electrical products and systems so they don’t have to spend valuable labor and time wiring or assembling products on the job-site. For example, in Graybar Electric Co.’s “Install This-Not That” initiative, the company suggests time-savings preassembled products such as pre-wired receptacles, prefab box assemblies, conduit trapeze supports and metal boxes that snap on to metal stubs instead of having to be fastened with screws.

#5. Despite the Current Economic Uncertainties, New Technologies Will Create Exciting Sales Opportunities in the Near Future

Many electrical distributors are already taking advantage of all the new business now available in lighting retrofits because of the technological developments in LED lighting. The sale of electric vehicle charging stations will be big business for the electrical contractors trained to install them, and distributors are in the perfect position to stock and sell EV chargers because many of their existing suppliers are already selling them, including Schneider Electric, Siemens, Leviton and Eaton.

Out in the field, you may find new sales opportunities with customers involved in new types of construction. Two of the more interesting trends EW’s editors have seen is the conversion of vacant or underutilized or office space in urban areas into apartments and the modular construction industry. Modular construction companies like Factory OS (www.factoryos.com), MiTek Modular (www.mitekmodular.com) and even Marriott Hotels now prefabricate individual apartment units, hotel rooms, hospital patient rooms and other types of buildings that have units with the same footprint at a central construction facility and ship them to the building site, where they are picked up by cranes and stacked up like Lego bricks.

Did we miss any big trends out in the market? We would love to chat with you about them. Contact Jim Lucy, Editor-in-Chief at [email protected]"> [email protected].

About the Author

Jim Lucy

Editor-in-Chief of Electrical Wholesaling and Electrical Marketing

Jim Lucy has been wandering through the electrical market for more than 40 years, most of the time as an editor for Electrical Wholesaling and Electrical Marketing newsletter, and as a contributing writer for EC&M magazine During that time he and the editorial team for the publications have won numerous national awards for their coverage of the electrical business. He showed an early interest in electricity, when as a youth he had an idea for a hot dog cooker. Unfortunately, the first crude prototype malfunctioned and the arc nearly blew him out of his parents' basement.

Before becoming an editor for Electrical Wholesaling and Electrical Marketing, he earned a BA degree in journalism and a MA in communications from Glassboro State College, Glassboro, NJ., which is formerly best known as the site of the 1967 summit meeting between President Lyndon Johnson and Russian Premier Aleksei Nikolayevich Kosygin, and now best known as the New Jersey state college that changed its name in 1992 to Rowan University because of a generous $100 million donation by N.J. zillionaire industrialist Henry Rowan. Jim is a Brooklyn-born Jersey Guy happily transplanted with his wife and three sons in the fertile plains of Kansas for the past 30 years.