The decline in the industrial market segment over the past two quarters seems to have a cast a shadow over any optimism for the overall 2016 electrical market. And that’s a shame, because the construction market should more than pull its weight in 2016 with some steady if unspectacular growth forecast for the commercial building segment and big-time growth expected in the single-family construction market. The construction outlook for 2016 definitely has a “Tale of Two Cities” flavor to it, with a select handful of local markets like Boston, New York, Miami, Austin the San Francisco Bay Area/San Jose and Seattle, enjoying the best of times, and many other markets slugging it out in a slow growth/no growth scenario.

All eyes seem nervously focused on the industrial market right now, which between the MRO (maintenance and repair operations); OEM (original equipment manufacturers) and factory automation segments combine to power roughly 19% in total industry sales, according to Electrical Wholesaling’s Market Planning Guide data. With the exception of some new auto plants and other manufacturers feeding Motown’s auto industry, the industrial market started to slide in the latter half of 2015.

One of the more important leading economic indicators for the industrial market, the Purchasing Managers Index published monthly by the Institute for Supply Management, Tempe, Ariz., has lost steam over the past year, and in November it slid into contraction territory for the first time since Nov. 2012. The crash in the oil market is well-known, and the Baker Hughes Rig Count, a handy leading economic indicator measuring this wildly cyclical market segment, continued to decline through November. Year-over-year, there are more than 1,100 fewer oil rigs operating in the United States (on land and offshore). While some of the industrial market news is pretty grim, it’s sending out some positive signals, too. National manufacturing employment through Oct. 2015 isn’t showing any significant decline and capacity utilization in industrial facilities has grown over the past year.

At his presentation during the recent NEMA annual meeting, Don Leavens, vice president and chief economist for the National Electrical Manufacturers Association (NEMA), Washington, D.C., told members he is concerned about the possibility of a continued industrial slowdown because of a hesitancy by companies to invest in brick-and-mortar, hurting capital expenditures; heavy global debt loads; and the comparatively low number of people in the U.S. workforce.

Electrical Wholesaling’s editors think growth for next year in the overall electrical market will settle in somewhere in the low single digits, well above some of the more dire predictions for the industrial market, but substantially below the sizzling growth forecasts for the residential business.

Total U.S. Construction Starts

Dodge Data & Analytics

Architecture Billing Index (ABI)

American Institute of Architects (AIA)

Electrical Contractor Employment

Bureau of Labor Statistics

Manufacturing Employment

Bureau of Labor Statistics (BLS)

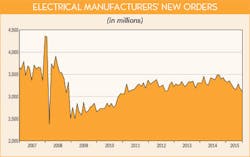

Electrical Manufacturers’ Shipments

U.S. Department of Commerce

Purchasing Managers Index (PMI)

Institute for Supply Management

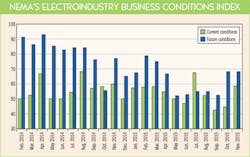

Electroindustry Business Conditions Index (EBCI)

National Electrical Manufacturers Association (NEMA)

Housing Starts 2011-2017 Forecast

National Association of Home Builders (NAHB)

Copper Prices

Global Insight and www.kitco.com

About the Author

Jim Lucy

Editor-in-Chief of Electrical Wholesaling and Electrical Marketing

Jim Lucy has been wandering through the electrical market for more than 40 years, most of the time as an editor for Electrical Wholesaling and Electrical Marketing newsletter, and as a contributing writer for EC&M magazine During that time he and the editorial team for the publications have won numerous national awards for their coverage of the electrical business. He showed an early interest in electricity, when as a youth he had an idea for a hot dog cooker. Unfortunately, the first crude prototype malfunctioned and the arc nearly blew him out of his parents' basement.

Before becoming an editor for Electrical Wholesaling and Electrical Marketing, he earned a BA degree in journalism and a MA in communications from Glassboro State College, Glassboro, NJ., which is formerly best known as the site of the 1967 summit meeting between President Lyndon Johnson and Russian Premier Aleksei Nikolayevich Kosygin, and now best known as the New Jersey state college that changed its name in 1992 to Rowan University because of a generous $100 million donation by N.J. zillionaire industrialist Henry Rowan. Jim is a Brooklyn-born Jersey Guy happily transplanted with his wife and three sons in the fertile plains of Kansas for the past 30 years.