Electrical Wholesaling has been ranking the electrical wholesaling’s largest distributors for more than 40 years, but EW’s editors can’t remember a time when distributors’ revenue forecasts, year-over-year (YOY) revenue growth and expectations for health of the overall U.S. economy showed such a wide disparity.

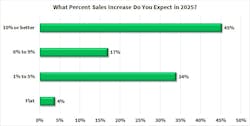

For example, of the 37 distributors that provided a revenue forecast, an impressive 40.5% of respondents expect growth of 10% or better – but the same percentage of distributors see growth in a rather pedestrian range of +1% to +5%. Roughly 14% of distributor respondents are gunning for 2025 revenue growth in the +6% to +9% range, which is fairly close to the electrical wholesaling industry’s historical growth range of +4% to

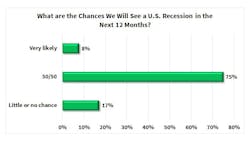

+8%. And when asked about the chances of a U.S. recession in the next 12 months, 69% of the 42 Top 100 distributor execs who answered the question said recession chances are 50/50, and another 11.9% said chances were very likely.

This same disparity surfaced in answers to the Top 100 survey’s question about 2024 sales change from 2023. An impressive 40.5% saw revenues grow +10% or better -- but 48.6% of respondents saw growth either flat or topping out at +5% YOY growth.

Economic expectations all over the place

It’s tough to pinpoint exactly why Top 100 distributors are all over the map with their economic expectations, especially when outside of the uncertainty over tariffs and concern over the size of the national debt, the overall U.S. economy is still growing at a steady if unspectacular rate. Unemployment is currently not growing at a dangerous rate, inflation has not hit the danger zone, and while the expected real GDP growth rate of less than 2% for Q2 2025 will elicit plenty of yawns, it’s still expected to land on the positive side of the ledger for this quarter.

EW’s editors think the most likely reasons for the widespread differences of opinion over 2025’s economic prospects may be linked to two market drivers:

#1. Executives are waiting for the other shoe to drop with tariff-induced price increases in core electrical products

Tariffs and rising product pricing are very much on the minds of Top 100 distributors, and when asked about which economic, technological or demographic factors will have the most impact on their businesses, tariffs and rising product pricing were ranked #1 and #2 as having the most impact, with 25.8% of the 63 respondents expecting tariffs to have the most impact on their businesses and 21.3% worried about product pricing.

Evidence of rising electrical product prices surfaced in the April 2025 data in Electrical Marketing’s monthly Electrical Price Index, the first since tariffs were announced in early April. The April data was up +1.5% over March 2025 and +4% over April 2024. These increases were up significantly over the EPI’s historical averages, of 0.21% monthly increases and +2.6% YOY increases.

#2. Big-time growth in the “right” geographic markets, project types or end-use markets, and sluggish to no growth in other markets

Right place/right time and right products/right service package for the right project. Top 100 distributors are working on an impressive array of large construction projects, with data centers, semiconductor plants, hospitals, airports, and public works projects being the most common in this year’s survey results. But if a company doesn’t have some of these large projects underway or in the pipeline in their geographic market, it may be hard to enjoy a stellar growth year.

For some distributor specialists, their product and service expertise is matching the need of some very large construction projects. For instance, C.N. Robinson Lighting, Baltimore, MD, is expecting double-digit growth this year, based in part on servicing three larger projects Maryland – the expansion of the Fort Meade East Campus Building in Fort Meade, MD; the renovation of the Pimilco Racetrack in Baltimore; and a project at the Johns Hopkins medical center in Baltimore.

Shikha Gupta, marketing manager, Nassau National Cable, Great Neck, NY, says the company is supplying wire and cable products to a diverse array of large construction projects, including power cable for a utility-scale offshore wind farm in Virginia; cabling products for a Meta data center in Wisconsin; and the Greenlink West Transmission Line a large utility project in Nevada with “huge demand “for aluminum and copper building wire.

For other distributors, growth is linked to tremendous opportunities in servicing mega-projects in their own backyard. For example, Jackson Electric Supply Co., Jacksonville, FL, enjoyed +34%YOY growth in 2024 and expects 2025 growth of +15%. While Larry Swink, company president, said some of his company’s 2024 growth could be attributed to gaining additional market share from customers and the easing of lead-time issues with switchgear and some other products, he said the Jacksonville market is also enjoying “unprecedented growth driven by transformative developments across downtown revitalization, healthcare, infrastructure, defense, and public utilities.”

These construction projects include a $1.4-billion renovation of the NFL’s Jacksonville Jaguars’ EverBank Stadium that will include a translucent roof, expanded concourses and upgraded amenities. The project will also include a development by team owner Shad Khan’s Iguana Investments featuring a Four Seasons Hotel & Residences; condominiums; and a new six-story Jaguars HQ adjacent to the stadium. Other big projects in the Jacksonville market include more than $600 million in renovations to the U.S. Navy’s Kings Bay Naval Submarine Base; two wastewater reclamation projects topping $100 million; a $190-million expansion of the Baptist Medical Center; and several large interstate construction projects.

“Jackson Electric Supply is actively involved in many of these high-impact initiatives, and their scale and momentum are already shaping our future,” Swink wrote in his Top 100 response. “These projects are expected to significantly accelerate our progress toward surpassing key revenue milestones within our five-year plan, potentially reaching those goals two-to-three years ahead of schedule.”

Acquisitions reshape the Top 100

Over the past 18 months, at least 14 distributors that were previously ranked on EW’s annual listing of the largest distributors were acquired (see acquisition chart below). Sonepar North America, Charleston, SC, was once again the most active acquirer, with seven large acquisitions in the United States or Canada, but the other national distributors (WESCO, Graybar, Rexel and Consolidated Electrical Distributors) were active as well and all acquired major distributors previously ranked in EW’s listings.

Investing in change

While it wasn’t uncommon for 2025 Top 100 distributors to invest in new branches or regional distribution centers, manage an executive succession plan, refine the ERP system or make acquisitions, Border States, Fargo, ND, has been involved with all of these initiatives in 2024 and 2025.

In addition to acquiring Dominion Electric Supply, Arlington, VA, and adding more than 300 employee-owners in 10 locations to service government, commercial, residential and data centers in Virginia, Maryland and the Washington, D.C. , the company embarked on several major initiatives, including the appointment of Jason Seger as president and CEO, following the retirement of David White in March 2024. The company is building several new distribution centers and is working on a new corporate operating model, Thomas Nelson, the company’s communications director, said in his survey response,

“Border States introduced new operating model which places greater emphasis on providing a customer-centric, streamlined experience at branches across the country, and aligns with the company’s commitment to supporting their customers’ unstoppable businesses,” he wrote. “The new model focuses on two key areas of Border States’ business – growing and fulfilling customer relationships. With this shift, leadership at Border States also realigned to best support the needs of customers, vendors and employee-owners.

“A key strategy to support the new operating model is the implementation of distribution centers to enhance Border States’ network of 131 locations. Branches and distribution centers will work together to scale for optimization, while still allowing for customization and delivering cost effective and unique experiences for customers.”

Nelson said the new Upper Midwest distribution center expected to be completed in Fall 2026, and will require several dozen hires. “We hired a director of Warehouse Optimization in Aug. 2024 and anticipate more than 60 full-time warehouse and leadership roles will be hired to support the facility. We will use a dedicated 3PL partnership for the operation. Leadership invested significant time to learn from other companies (in and outside of our industry) that have gone through this journey and to make sound business decisions in the design of the physical building and overall supply chain design strategy. Design decisions include the type of automation equipment used in the facility, services strategy in the distribution center, employee-owner wellness considerations and business continuity requirements.”

Over the past year, Border States also partnered with GAINS to leverage its new Halo360° Decision Engineering and Orchestration Platform to deliver a machine learning solution to improve lead-time accuracy and supply chain performance. GAINS Lead Time Prediction (LTP) enables Border States to determine lead times with greater accuracy, resulting in enhanced customer service, aligned inventory and procurement functions and improvement in working capital.

Border States also enhanced its SAP ERP platform with a move to SAP’s S/4HANA ERP platform, which allows the company to use solutions, like Fiori, to provide a much-improved user experience with easier and faster access to information. The company also celebrated the 40th anniversary of its ESOP program and completed a transition to Border States’ new vendor-managed inventory (VMI) application.

By the Numbers

The 2025 Top 100 distributors do a combined total of $108.5 billion in revenues – 73% of estimated 2024 industry sales of $148 billion. The 10 largest distributors on this year’s list do an estimated $77.6 billion in sales for a 52% share of total industry sales. At least 19 distributors on this list do at least $1 billion in annual revenues, and in total companies on this year’s list employ at least 151,887 workers (counting Grainger and Fastenal), or at least 102,180 employees if you just count full-line distributors and electrical product specialists.

Methodology. In putting together the 2025 Top 100, company data was gathered during April 2025 -early June 2025 through a SurveyMonkey survey of electrical distributors, public documents and information on individual distributors' websites.

Many of these companies asked us to use their sales data confidentially and only for placement on the listing. We are glad to do that. Over the past four years, we have had more distributors ask us to use their sales data confidentially, so when you see a “NA” (Not Available) for 2023 revenues, that most often means we have the data but are not releasing it publicly.

Where Electrical Wholesaling editors had an employee count for a company but not a sales figure, we used the survey sales-per-employee average from 62 full-line distributor respondents of $1,059,519 per employee to estimates sales for placement on the listing. That sales-per-employees figure is up +9% from the 2024 number of $971,254.

We were able to supplement this data with revenue and company information for publicly held companies including Fastenal and W.W. Grainger, and collected corporate data from some distributors’ websites, so we are able to present a robust ranking of the industry’s largest distributors.

We received survey data from more than 80 distributors, and were able to build the list from that base with sales estimates for companies that had provided data in the last year or two, and from public sources for publicly held companies.

You may notice that quite a few familiar names are not included in this year’s ranking. At least 10 Top 100 electrical distributors were acquired in 2024 and are no longer listed separately. These companies include Blazer Electric Supply, Colorado Springs, CO; Desert Electric Supply, Palm Springs, CA; Dominion Electric Supply, Arlington, VA; Electric Supply Center (ESC), Burlington, MA; Electrical Supplies Inc., Miami, FL; Kovalsky-Carr Electric Co., Rochester, NY; Madison Electric Co., Warren, MI; Parrish-Hare Electrical Supply, Irving, TX; Standard Electric Co., Saginaw, MI; and Summit Electric Supply, Albuquerque, NM. So far in 2025, two Top 100 electrical distributors have been acquired – Schwing Electrical Supply Corp., Farmingdale, NY, and Swift Electric Supply, Teterboro, NJ.

Despite the smaller number of distributors that Electrical Wholesaling can rank compared to past years due to all the acquisitions of independently owned companies, our 2025 Top 100 ranking remains a valuable resource because it identifies the fastest-growing electrical distributors in the industry; current business conditions in the electrical market; the size of product specialists and distributors from outside the mainstream electrical market that sell millions of dollars of electrical supplies; and the key challenges and business opportunities for distributors of all sizes.

Electrical Wholesaling’s editors hope you enjoy this reading year’s ranking as much as we enjoyed putting it together.

Big Projects Top 100 Distributors are Working On

Data center projects topped the list of major construction projects for Top 100 distributors, but some large hospital and public works or highway projects also garnered many mentions. Some companies also mentioned EV plants. Here’s a partial list of projects Top 100 distributors are working on or see potential in.

- Indiana University Hospital, Indianapolis, IN

- Fort Meade East Campus Building, Fort Meade, MD

- Pimilco Racetrack, Baltimore, MD

- Johns Hopkins medical center, Baltimore, MD

- Dana-Farber Cancer Institute, Boston, MA

- Northeastern University multi-use building, Boston, MA

- Boston University housing, Boston, MA

- JFK Airport, Queens, NY

- $15-billion Micron facility expansion in Boise, ID

- Paul, Weiss, Rifkind office tower renovation in New York, NY

- Offshore wind facility off the coast of Virginia

About the Author

Jim Lucy

Editor-in-Chief

Over the past 40-plus years, hundreds of Jim’s articles have been published in Electrical Wholesaling and Electrical Marketing newsletter on topics such as the impact of new competitors on the electrical market’s channels of distribution, energy-efficient lighting and renewables, and local market economics. In addition to his published work, Jim regularly gives presentations on these topics to C-suite executives, industry groups and investment analysts.

He recently launched a new subscription-based data product for Electrical Marketing that offers electrical sales potential estimates and related market data for more than 300 metropolitan areas, and in 1999 he published his first book, “The Electrical Marketer’s Survival Guide” for electrical industry executives looking for an overview of key market trends.

While managing Electrical Wholesaling’s editorial operations, Jim and the publication’s staff won several Jesse H. Neal awards for editorial excellence, the highest honor in the business press, and numerous national and regional awards from the American Society of Business Press Editors. He has a master’s degree in Communications and a bachelor’s degree in Journalism from Glassboro State College, Glassboro, N.J. (now Rowan University).