There’s lots to be concerned about for 2019, let alone the next three years. First, some perspective on why we are where we are. No question, the overall economy has thrived over the last year or so, with unemployment in the 3% to 4% range.

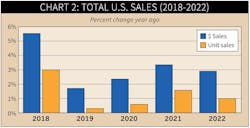

DISC Corp. forecasts that the +5.8% sales gain in 2018 will be the highest we will see through 2022. We are projecting industry sales to advance just +1.7% this year and average about +2.5% over the next three years.

Why the low growth?

- Inflation in this industry will average less than +2% annually. That puts a damper on increasing sales (price x quantity = revenue).

- Residential construction will be negative this year, and up less than +2% annually through 2022.

- DISC forecasts that nonresidential construction will average +2.5% to +3% through 2022.

- Business investment in equipment will average about +3% annually through 2022.

These percentages reflect quantity, and there is no inflation in the above calculations. What does it all mean for the electrical industry? It’s not a pretty picture. I am not into gloom and doom, but DISC Corp.’s projections for the economic environment driving the electrical industry indicate weakness for 2019 and the next three years.

The economic scenario we are forecasting directly affects your potential profitability. How do you make money in the electrical industry when it’s growing revenues at just +2% on an average annual basis?

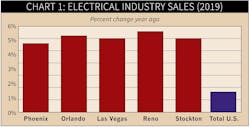

There will be some winners in individual regional areas or business segments that do not track the overall electrical industry. They will provide profitable opportunities over the next few years (see Chart 1). But for many other areas, it won’t be easy to make money growing at less than a +2% annual rate (see Chart 2).

A focus on unit sales. Unit sales correspond to your business resources, mostly head count. If volume out the door is increasing at just +0.6% next year, do you really want to add more people? The true value of a forecast is not the dollar sales, but the unit sales because they give you important insight into better managing your important resources.

The author is president of DISC Corp., the industry’s leading provider of electrical sales forecasts. If you have any questions about subscribing to DISC’s subscription-based data services, contact Isenstein at 203-799-3673 / [email protected].

About the Author

Herm Isenstein

Herm passed away in Sept. 2019 at the age of 86 from brain cancer. He was a good friend to the editors on the staff of Electrical Wholesaling and a prolific writer for the magazine for 15 years.

During his 30-plus years in the electrical industry, Herm Isenstein was the premier economist in the electrical wholesaling industry If you have any questions about DISC's subscription-based data services, contact Chris Sokoll, DISC's president at at 346-339-7528.