For 2009, the economic numbers don't lie. They paint the electrical wholesaling industry in subdued tones of grey and black, as many segments of the market are near record lows and will take most if not all of next year to recover. In some market segments and in some regions of the United States the recovery will take even longer.

That's the bad news. The good news is that some economists are adding some brighter colors to their palettes and are forecasting some improvement for the U.S. economy in 2010. The color swatch that may best define 2010's economic fortunes may be beige, as in nothing too exceedingly cheerful, but nothing as horribly bad as the last 12 months, either.

That being said, some great growth opportunities exist for those companies willing to stretch their market interests. As mentioned in this issue's cover story, federal stimulus dollars have sparked an explosion in construction and retrofit projects with federal buildings, dams and military bases. Some of this work will be in lighting retrofits, which is an enormous opportunity that goes far beyond the recent flurry of activity in government work. Construction and retrofit work in the educational and health-care market are worth a look, too. Don't expect too much from commercial buildings next year, because in most regional markets the demand just isn't there. A matter of concern on the commercial scene is a potential credit crisis in commercial loans that's scaring the heck out of some construction economists.

In this article, Electrical Wholesaling has collected economic data for the segments of the construction and industrial markets that will have the most impact on the electrical business in 2010. These data should prove more valuable than the general economic forecasts you find in the business pages of most newspapers, because those sources focus more on retail sales, consumer spending and macroeconomic information rather than on data that directly affect the electrical market.

First published in 2002, the National Factbook is intended to be a companion piece to Electrical Wholesaling's annual Market Planning Guide published each November. The Market Planning Guide provides sales data and key employment statistics readers can use to estimate the size of their local markets. This article takes a broader view to provide electrical distributors, independent manufacturers' reps and electrical manufacturers with national data on trends in construction, industrial spending and demographics.

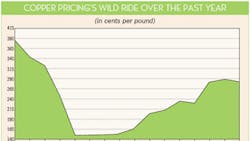

Source: U.S. Geological Survey, Metals Week and www.metalprices.com

Compared to 2008 when copper broke the $4/pound barrier but then plunged 36 percent in just 30 days in the fall, this year's copper market didn't see really wild swings. That doesn't mean pricing isn't confounding metals experts who say pricing is out of synch with basic demand. Global Insight's John Mothersole expects copper pricing to “moderate” to approximately $2.50/pound in 2010. That's still high when you think that before this “new normal” copper's historical price band was between 80 cents and $1.20 a pound.

Source: Grubb & Ellis

At 17.1 percent during the third quarter, office vacancies are lingering at a high level not seen since the early 1990s. That hurts when you consider an office vacancy rate below 10 percent indicates a very healthy market, while any market with 20 percent of its office space empty has lots of uninhabited “see-through buildings.” New York (8.6%), Washington, D.C. (12.1%) and Boston (10.4%) are the three largest cities with vacancy rates near 10 percent, while Detroit (29.4%), Kansas City (23.2%) and Dallas (22.4%) are the largest of the cities with vacancy rates over 20 percent.

Source: McGraw-Hill's 2010 Construction Outlook

The always-volatile market segment for construction of power plants was a real downer in 2009, declining 45 percent to $16.5 billion after a 70-percent increase in 2008 to $30.2 billion. McGraw-Hill's economists expect it to decline another three percent in 2010. Miles of red tape snag the approval process, but when utility projects get the green light, they pump big dollars into the construction market. As more utility-scale wind and solar projects come online and smart-grid funding becomes a reality, this market will explode.

Source: Institute for Supply Management

The Purchasing Managers Index (PMI) is one of the most widely watched indicators of the health of the industrial market. That's why when this monthly survey of purchasing managers dropped in October to 38.9 points and — its lowest reading since 1982 — and then lingered around the 40-point mark through March it made economists very uneasy. But this number hit growth territory in August when it topped the all-important 50-point measure that indicates the manufacturing arena is expanding. Below 50 points indicates the industrial market is generally contracting.

Source: McGraw-Hill's 2010 Construction Outlook

If you want to see the best regions for institutional construction, follow the population growth. As the population continues its long-term shifts to the Sunbelt markets, these will be the areas building the most schools, universities, hospitals and medical buildings and other types of institutional buildings. Nationally, McGraw-Hill expects this market to increase one percent in 2010 to $111.1 billion. Some market segments and regions will do better. Some Sunbelt schools will continue to see crazy-number enrollment increases.

Source: American Institute of Architects (AIA)

This survey is one of the construction market's leading indicators because it tracks inquiries for new construction projects received by architects and billing trends at those design offices. The good news with this statistic is that through September, the Work-on-the-Boards report was picking up an increase in inquiries. However, the all-important number for billings is still mired below the 50-point mark that indicates healthy billings activity.

Source: Bureau of Labor Statistics

Electrical contractors had 118,000 fewer employees on the payrolls in September compared to a year ago, a massive decrease. Any drop in this statistic has a direct impact on the electrical wholesaling industry, because according to the 2010 Electrical Wholesaling Market Planning Guide data, on an annual basis an electrical contractor typically buys $34,605 in electrical products per employee. That's a $4 billion drop in sales potential. Ouch!

Source: McGraw-Hill's 2010 Construction Outlook

McGraw-Hill expects the all-important commercial construction market segment to decline an additional four percent to $46.1 billion on top of the 43 percent it declined in 2009. That's less than half the $100.8 billion in 2007 construction activity, when the market topped out. But the really scary noises in this market segment are not the silence of vacant office buildings or construction sites, but the sounds of commercial credit loans imploding, not unlike what happened to the residential market in 2008.

Source: U.S. Census Bureau and the National Association of Realtors

As a measure of the number of vacant new homes and existing houses for-sale-by-owner on the market, this statistic is just as important as building permits and housing starts. Housing inventory is one of the brightest spots in this market, because home sales are increasing and soaking up excess inventory. Through September, inventory had decreased 700,000 units, from 4.3 million in Sept. 2008 to 3.7 million units this year. At this rate, the for-sale housing stock would take 7.8 months to clear out, down from 9.9 months a year earlier.

Source: McGraw-Hill's 2010 Construction Outlook

While expecting total construction spending to increase 11 percent in 2010 to $466.2 billion, McGraw-Hill's forecast says that's 32 percent below the market's peak in 2006 of $689.6 billion. Much of that decline came in 2009, which is expected to come in 25 percent lower than 2008. It expects the commercial building, manufacturing and utility segments to remain in negative territory for 2010, but is forecasting increases for single-family and multi-family housing, institutional buildings and public works.

Source: National Association of Home Builders (NAHB)

The housing market may have finally found a bottom, but that bottom is way below anything seen in years. Forecasts for 2009 and 2010 are less than half the activity this market saw during its go-go years from 2003-2006, when starts were never less than 1.8 million and topped 2 million in 2005. NAHB expects 568,000 total housing starts in 2009, 716,000 starts in 2010 and 1.059 million housing starts in 2011. If you need some good news, look toward the decrease in housing inventory and the expansion of the tax credit for homebuyers.

Source: Department of Commerce

To no one's surprise, electrical manufacturers' new orders are down this year. The amount of the decline is depressing, as the Department of Commerce says new orders were off 28.2 percent year-to-year in September to $3.29 billion. That's down roughly 44 percent from the peak numbers of the current business cycle in early 2008, when new orders topped $4 billion per month. New orders seem to be on a bit of a plateau right now after bottoming out in January 2009 at approximately $2.17 billion dollars.

Source: American Machine tool Distributors Association (AMTDA)

Machine-tool orders offer a quick read on the health of the industrial market because they reflect the sales of the equipment on the factory floor that manufacturers use to shape, mold and form metal for use in their products. September's numbers were up 17.8 percent from August but down 69.3 percent from the total of $500.57 million reported for September 2008. With a year-to-date total of $1,199.93 million, 2009 is down 67.8 percent compared with 2008.

Source: Federal Reserve Board

Another indicator of the slowdown in Industrial America is capacity utilization, which is basically a measure of the current output versus potential output of U.S. factories. After topping the 80 percent utilization rate generally considered to be the point where factories begin expanding their facilities or retrofitting existing manufacturing lines in 2006 and 2007, this figure dipped below 70 percent at times in 2009 — an extraordinarily low level not seen since the 1982-1983 recession.

Source: National Center for Education Statistics

The children of Baby Boomers will continue to fill classrooms in near-record numbers for the next decade. While the local areas' construction climates vary due to the credit crunch and local demographic trends, over the long haul K-12 schools will remain one of the strongest segments of the construction market. The Sunbelt is seeing the biggest increases in enrollment, with Texas, Florida, Georgia and California leading the pack. Some suburban school districts in Virginia, Nevada and North Carolina also are seeing some huge increases.

Source: National Center for Education Statistics

The song remains the same for colleges and universities, as the children of Baby Boomers graduate from high school and move on campus. As with K-12 school districts, growth is most apparent in the Sunbelt, and in particular California, Florida and Texas. New classrooms, housing, eating and athletic facilities in these states will be loaded with the latest in energy-efficient lighting, voice/data/video systems and security networks, creating a bonanza of electrical sales opportunities.

About the Author

Jim Lucy

Editor-in-Chief of Electrical Wholesaling and Electrical Marketing

Jim Lucy has been wandering through the electrical market for more than 40 years, most of the time as an editor for Electrical Wholesaling and Electrical Marketing newsletter, and as a contributing writer for EC&M magazine During that time he and the editorial team for the publications have won numerous national awards for their coverage of the electrical business. He showed an early interest in electricity, when as a youth he had an idea for a hot dog cooker. Unfortunately, the first crude prototype malfunctioned and the arc nearly blew him out of his parents' basement.

Before becoming an editor for Electrical Wholesaling and Electrical Marketing, he earned a BA degree in journalism and a MA in communications from Glassboro State College, Glassboro, NJ., which is formerly best known as the site of the 1967 summit meeting between President Lyndon Johnson and Russian Premier Aleksei Nikolayevich Kosygin, and now best known as the New Jersey state college that changed its name in 1992 to Rowan University because of a generous $100 million donation by N.J. zillionaire industrialist Henry Rowan. Jim is a Brooklyn-born Jersey Guy happily transplanted with his wife and three sons in the fertile plains of Kansas for the past 30 years.