In the past 12 years, lighting reps have seen a transformation of their companies. The advent of LED lighting and subsequent advancement in solid-state lighting has dramatically shaped their value proposition in the industry. With those changes, mid-sized and large lighting reps have changed their organizations to reflect the increase in technical support and customer differentiation.

The adage “bigger is better” appears to be true with lighting reps. In an Egret Consulting survey sent to more than 300 lighting reps about the changes in their businesses from 2006 to 2018, we constructed a detailed assessment of lighting reps. They were asked to define their current structure and contrast that with where they were “pre-LED and/or pre-recession.” Egret specified 2006 as an estimated starting point. Over 20% of the rep firms responded, and in this article many of the survey results are broken out into categories based on the size of the respondents’ firms.

The results show remarkable changes in the organizations, including increased headcount, increased support staff and more complex channel strategies. The results have been sorted into three groups of rep firms – “Small,” “Mid-sized” and “Big.” Small firms include an additional subset of niche reps categorized as firms with only three or four employees, limited lines and narrow approaches to the market.

These firms tend to be residential or specialty lighting or controls-focused firms. The results for the niche reps are being sent to those reps and are not included in this larger discussion of the commercial market’s lighting reps.

The Definitions Used in Egret's Rep Survey

Revenues (Sales): Total gross product sales (i.e. an agency sold $50 million in equipment)

Income: Total gross commissions from those sales. Commissions include all overage dollars; we did not ask to break out those numbers.

Small: Rep firms with revenues between $10 million to $35 million in product sales. Average small rep firm has $19 million in product sales.

Mid-sized: Revenues between $40 million to $80 million in product sales. Average mid-sized rep respondents had $58 million in product sales.

Big: Revenues in excess of $80 million in product sales. The average big rep in this survey had $147 million in product sales.

Survey results showed significant differences as the size of the rep firm grew. The most dramatic finding is that the largest lighting reps doubled the size of their sales staff since 2006 (17.5 salespeople to 34.8 salespeople) and added more than twice the number of support staff over that same time (Fig. 1).

In general, the average sales per salesperson increases as the size of the firm grows. As a comparison to 2006, sales per salesperson increased for the Mid-sized and Big firms. Sales also increased as a ratio of sales/total headcount across all sizes of firms. Big firms had the largest percentage growth over 2006 for both categories. At an average of $4.1 million in sales per salesperson for a mid-sized firm and $5.1 million in sales per salesperson year for a big firm, the numbers are impressive and likely represent the presence the largest reps have in the market that commands higher sales performance.

Similar to revenues, commissions (income) per salesperson and per total headcount have also grown over 2006 and track proportionately with size of the firm. In essence, larger firms generate significantly more commissions per headcount than smaller firms. It is interesting to note that the average commission dollars/salesperson of Big firms ($670,000) is more than twice the number of Small firms ($320,000), and nearly twice the amount for commissions/total headcount for Big vs. Small ($230,000 compared to $157,000).

Size does come with significant complexity, however. Big firms require 1.76 staff members to support each outside salesperson. Mid-sized firms reported 1.44 support staff per salesperson. Small firms have largely retained the old rule of thumb of one inside salesperson for each outside salesperson, with a net ratio of 1.1 support staff per salesperson.

Additionally, big firms take on large numbers of product lines — the average number of lines for a big firm is 121, versus 83 in 2006. Mid-size firms have aggressively increased their number of lines from 76 to 112. Small firms average 64 lines and have not generally added additional lines since 2006.

The complexity in larger firms is apparent by their responses to channel strategies as well. Big firms reported far more diversity of channel markets to focus on, as opposed to mid-sized or small firms. Big firms have dedicated staff to address emerging models: human-centric lighting (HCL), vertical farming, ESCOs and more. Big firms are also more inclined to have alternative for-fee services such as consulting, design, financing and audits. Total income is inclusive of these alternative for-fee strategies.

An interesting trait of the larger firms is that the “old school” approach of assuming the salesperson is the primary generator of revenue has faded. In fact, in the larger firms and many of the mid-sized firms, salespeople are financially paid on a straight salary basis, with a company-wide bonus program. “Orders” in today’s world have far more people touching that order: integration services, quotes, applications, order services, warranty, etc.

Many of the new services that reps offer are a direct result of the major manufacturers abdicating those services to the rep firms. Manufacturers of old had large application teams, field warranty personnel and customer service teams that could directly work with the end-users, contractors or designers. Those services have been eliminated or downsized and outsourced to the field rep organizations. Average annual compensation (salary) for sales staff was: Big firms = $129,000/year, Mid = $115,000, Small = $93,000. Nearly every firm, regardless of size offers a full benefits program, 401K, plus expenses and car allowances. A fully loaded compensation program for a salesperson would realistically be about 40% of their W-2 total. A big firm would average around $180,000 as a cost of each salesperson; a mid-sized firm would average $160,000; and small firm would average $130,000 (Fig. 2).

But in return for those services, average commissions have also risen. The largest reps report an average commission of 13.3% today, versus 12.7% in 2006. Mid-sized firms (Fig. 3) report 11.4% versus 10.2% and small firms (Fig. 5) have averages of 12.7% versus 11.1% in 2006. Note: While Egret asked for commissions, we specifically asked for gross commissions, including overage. We did not ask to break that out, so the concept of the manufacturers’ increasing commissions may be maligned by how much and where overage is reported. As overage is fungible (i.e. transferable across most product lines) many reps run overage through smaller manufacturers, as the smaller manufacturer split tends to be more favorable to the rep firm.

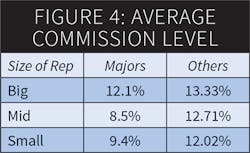

The average reported commission level for the major manufacturers, and other manufacturers is noted on the next page in Fig. 4.

The major manufacturers tend to offer multi-year contracts to their Big and Mid-sized firms more often than the small firms. The median long-term contract is about three years for both big and mid-sized firms. About 30% of the Small firms had multi-year contracts, with the median contract term of three years.

Here are several other interesting findings in the Egret Consulting study:

• About 25% of all reps do some importing of products for resale.

• About 24% of reps will take on a new line to keep it away from a competitor.

• 85% of all reps review their line cards annually; and 87% of firms resign non-performing lines voluntarily.

• Many reps provide for-fee services (directly billing for specific services). These services included (as measured by the percent of reps reporting they provide these services): financing jobs (11%); warehousing or staging jobs (1 rep); design services (35%); field application services (44%); audits (33%); lighting or control applications design (38%); lighting as a service (1 rep).

The Egret study also found that lighting reps have long-tenured staff, with most of the rep firms reporting greater than 10 years of average tenure. Nearly all the rep principals said that while they are making more money now than in 2006, the business is infinitely more complicated. Over 80% of the lighting reps reported that their business focus is project business. Stock business has declined in over 75% of the reps and they’ve simply moved their focus to project business (new construction).

Insights for the Future

This survey is the first effort to explore the business model of an independent lighting rep. While NEMRA (National Electrical Manufacturers’ Representatives Association, Portsmouth, NH) provides insights into the operations of their rep members in the mainstream electrical market, there is no similar outlet for lighting reps to benchmark their performance or to air their grievances to the lighting manufacturing community as a group. The combined product sales volume across all reps that responded to this survey represent over $2.1 billion in product sales in the U.S. market. Here are several recurring issues the lighting industry needs to address:

Fair compensation. I believe the rep market is currently profitable. The mid-sized reps and big firms are generating $184,000/head and $230,000/head, respectively, in income. Subtracting the fully loaded direct cost of sales; as reported from those numbers, you are left with a sizable amount of income to amortize over rent, travel, support staff and general administration and overhead. From this analysis, I believe the commission structure is fair compensation. However, the issues of overage and equitable commissions need to be explored in greater detail.

Current market conditions and challenges. The reps and manufacturers have largely gorged on a robust construction cycle that began in 2009. In that same timeline, they have moved away from the stock-and-flow business model of the past. There are several reasons for that:

1. The advent of LED introduced a significant amount of confusion into the marketplace, including price elasticity, technology adoption and training, and the lack of demand for LED from distributors’ customers. All of this contributed to sidelining the distributors’ role in the sale of over-the-counter lighting products. Distributors tend to be the last mile of adoption of new technologies, and manufacturers, reps and the spec community were trying to hasten their absorption of those changes.

2. The project business was growing, and the ability to package new technology and new pricing into a market with very few standards at the time was lucrative and appealing.

3. The major manufacturers abandoned their support for stock business, and competitors moved in. These companies include RAB, Maxlite and Halco, as well as literally hundreds of Asian suppliers that used cheap prices and quick delivery to pick up distributor business. These manufacturers typically offered simple products and simple pricing. Stock program commissions were lower than available lucrative project business.

4. Future market: Project business will dry up; likely within a short period of time. The reps have staffed up to support field level services and expanded markets, and those costs are now built into their business model. When the project business turns down, lighting reps will be vulnerable to a quick collapse of profits. Channel strategy or specialization may sustain them, but the majority of their revenue is currently tied to projects.

Leadership. Most rep firms are largely controlled by Baby Boomers. Boomers are retiring and the need for succession planning is urgent. Most major manufacturers have some level of discussion with their rep principals on succession planning; some actively implant future principals into their rep firms. But the need for leadership skills has changed. The days of running a rep firm with a key principal or two are largely gone or disappearing for every mid-sized and large firm. Succession planning is simply hard. It’s emotional. It’s financially challenging. And it’s urgent for many rep firms.

Talent. The availability of talent to rep firms is sparse at best. The time it takes to attract, train and realize a profit for a new salesperson or inside technical person is daunting. As important as leadership succession is, so is the fueling of new talent into the rep functional roles.

Complexity. The business has changed forever. The range of added services is extensive, and managing that business is far more challenging than ever before. With 100-plus lines and seven or eight well-defined alternative markets, a rep’s leadership team must have a well-planned and structured organization to continue to grow. The sheer concept of actively “promoting” 100-plus different brands is impossible. There will be a reckoning with an emphasis on efficiency of the operation. As the next recession arrives, efficiency will be requisite to survival.

Contracts. I found it interesting to see the vast disparity in contract lengths, from 30-day industry “standard” contracts to over five years. There will be a need to develop a more cohesive relationship between major manufacturer and the rep firms well beyond annual planning meetings. The market complexity and demands of time on salespeople will require a more structured approach to meeting company goals and preserving their businesses. The small firms are far more critical of their relationships with manufacturers than are the big firms.

Commissions. The reported commission percentages for their major lines is unsettling. The Big firms average over 12% with their major partners, while the Small reps and Mid-sized companies average around 9%. While I appreciate the focus on bigger markets and supporting them, I feel commissions should be equitable to the size of product revenue generated. Smaller markets still need as much income relative to their market size to succeed.

Overage. We purposely avoided digging into this controversial practice in this survey, as it could have skewed the results and hampered the insights into the rep world. Let’s be honest: Overage exists because of the imbalance in income between manufacturers and reps. Manufacturers see reps as the lowest cost of sales solution to selling their products in the market. Reps see manufacturers as sources of overage to offset that low cost of sales concept. Overage is fungible. The manufacturer who lowers their “package” price funds the overage. It’s clear from the survey that “average” commissions of around 11% to 12% would equitably provide a lucrative business for both manufacturer and rep. And I know it’s not that simple, but overage is a scourge to many people and engenders distrust across many participants in the industry.

Alliances. The major firms are complicit in assisting their big rep partners to expand geography at the expense of smaller firms. Reps operate as independents and effectively shield manufacturer access to the marketplace. Pricing is an art and is based on an uneasy alliance between manufacturer and rep. Overage is a slippery slope.

What is missing is a true partnership between manufacturers and reps that’s open, honest and financially supportive with equitably defined roles in these key areas:

Warranty. There should be no expectation of reps fixing a manufacturing defect, other than a site visit to define the issue.

Customer service. Order entry for reps is complex for a project quote with 60 or 70 manufacturers. It requires extensive and well-compensated labor to decipher a project order into multiple manufacturers’ purchase orders, with pricing strategy for overage, plus the follow up of order status, ship dates, submittal dates, etc. Technology has to fix this.

Financial. Commission statements can be confusing, and payments can be lagged for months. Cash flow is key for everyone and reps need to be compensated in a timely and accurate manner.

About the Author

Ted Konnerth, Egret Consulting Group’s founder and CEO, recruits on a retained basis, helping leaders in the electrical and lighting industry identify their next C and V-level hire. Ted also manages Egret’s Consulting Services division, assisting clients with organizational strategy, channel strategy, succession planning and M&A consulting. Contact Ted to learn how he can help your company at [email protected].

About the Author

Ted Konnerth

President / CEO

Ted Konnerth is president/CEO of Egret Consulting Group, Mundelein, Ill., a retained search firm with specialties in the electrical market, consulting services (architectural and engineering), and mergers and acquisitions consulting. Prior to founding Egret Consulting in 1999, Konnerth was Cooper Lighting’s vice president of sales. Contact info: (847) 307-7125; or e-mail: [email protected]; website: www.egretconsulting.com.