Report Finds Distributed Solar System Prices Continue to Fall

The latest edition of Lawrence Berkeley National Laboratory’s (Berkeley Lab’s) annual Tracking the Sun report finds that prices for distributed solar power systems continued to fall in 2018, that industry practices continue to evolve and that systems are getting bigger and more efficient.

The report describes price and technology trends for distributed solar projects nationally, collecting project-level data from approximately 1.6 million systems, representing roughly 80% of all systems installed through the end of 2018. More than 2 million distributed solar projects are currently operating in the United States.

Key findings from this year’s report include:

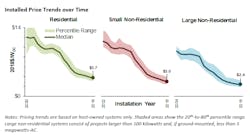

- Installed prices continue to fall through 2018 and 2019. National median-installed prices fell year-over-year (YOY) by 5-7% across the market, continuing trends seen over the past five years. Before any incentives, national median-installed prices in 2018 reached $3.70 per watt for residential, $3.00 for non-residential and $2.40 for large non-residential systems.

- Installed prices vary by state. Prices per watt varied widely for all sectors and regions, ranging from a low of $2.80 in Wisconsin to a high of $4.40 in Rhode Island for residential systems. The range of prices for small non-residential systems was similar, from $2.50 in Washington to $3.70 in Minnesota. State differences stem, in part, from underlying market conditions, such as market size and competition, as well as differences in permitting and interconnection processes, taxes and incentives.

- Other drivers of prices. Other differences in price can stem from system size, module- and inverter-type, mounting-type, location, installer, host customer-type and new construction versus retrofits. This year’s report has a new analysis to isolate the effects of individual pricing drivers, including characteristics of the local photovoltaics market related to market size, competition and installer experience, among other factors.

- Market trends. Third-party ownership of systems has declined in recent years, dropping to 38% of residential, 14% of small non-residential and 34% of large non-residential systems in the 2018 sample. That trend reflects the emergence of residential loan products, among other factors. Tax-exempt customers, such as schools, government, and nonprofit organizations, made up a disproportionately large share (roughly 20%) of all non-residential systems.

- Distributed photovoltaic systems keep getting bigger and more efficient. Median system sizes in 2018 grew to 6.4 kilowatts for residential and roughly 50 kilowatts for non-residential systems, with 20% of the latter larger than 200kW. The larger system sizes partly reflect a steady growth in module efficiencies, which rose a full percentage point to a median of 18.4% among systems installed last year. The report also covers system design trends, including panel orientation, inverter loading ratios, solar-plus-storage, use of module-level power electronics and third-party ownership.

Check out the full report here, along with an accompanying slide deck, summary data tables, and a public version of the underlying dataset.