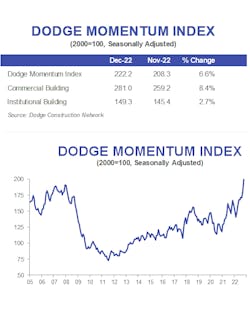

December’s Dodge Momentum Index Still Shows Strong Construction Planning Momentum

“One of the key construction storylines for 2022 was the return of enthusiasm and optimism in prospects for nonresidential growth,” said Richard Branch, chief economist for Dodge Construction Network, in the press release. “While some of that will likely erode in 2023 as economic growth wanes, increased demand for some building types like data centers, labs, and healthcare buildings will provide a solid floor for the construction sector.”

Commercial planning in December was supported by broad-based increases across office, warehouse, retail and hotel planning. Meanwhile, institutional growth focused on recreation and public building, with education and healthcare planning activity remaining flat. On a year-over-year basis, the DMI was +40% higher than in December 2021; the commercial component was up 51%, and institutional planning was +20% higher.

A total of 15 projects with a value of $100 million or more entered planning in December. The leading commercial projects included a $500-million Vantage Data Center in Sterling, VA and a $183-million mixed-use building in Chicago. The leading institutional projects comprised of the $400-million Acute Neuropsychiatric Hospital in Los Angeles and a $185-million life sciences building in Philadelphia.