If you are searching for economic trend information to factor into your 2009 sales forecast, then you have come to the right place.

In this article, Electrical Wholesaling has collected economic data for the segments of the construction and industrial markets that have the most impact on the electrical business. This data should prove more valuable than the general economic forecasts you find in the business pages of most newspapers, because they focus more on retail sales, consumer spending and macroeconomic information rather than on data that directly affects the electrical market.

The overall economic picture is downright grim. But when you break it down into smaller pieces, it may look a little brighter. For example, the housing market is currently one of the black holes of the U.S. economy, but it only accounts for approximately 25 percent of all sales through electrical distributors, and many companies don't do much residential business at all. Electrical distributors, electrical manufacturers and independent manufacturers' reps should consider themselves lucky that the commercial/industrial market, which provides more than 50 percent of industry sales, is in much better shape than the residential market. The wild card in the all-important commercial/industrial segment is definitely the credit crunch, as a huge percentage of all new project work is fueled by credit. With credit markets still virtually frozen, many contractors will be out in the cold until the financing picture clears up.

Ready yet for some good news? Construction of K-12 schools is booming in many markets, and colleges across the country are still seeing a healthy flow of new construction and retrofit work. Real-world, right-now opportunities exist for energy-efficient retrofits of basic lighting systems. Farther down the road, more distributors, reps and manufacturers will cash in on wind and solar projects, and the utility infrastructure needed to bring this green power to market will require massive amounts of construction.

First published in 2002, the Economic Factbook is intended to be a companion piece to Electrical Wholesaling's annual Market Planning Guide published each November. The Market Planning Guide provides sales data and key employment statistics readers can use to estimate the size of their local markets. This article takes a broader view to provide electrical distributors, independent manufacturers' reps and electrical manufacturers with national data on trends in construction, industrial spending and demographics.

- Copper Prices

- National Office Vacancy Rates

- Electric Utilities

- Purchasing Managers Index

- Institutional Construction

- AIA Work-on-the-Boards survey

- Electrical Contractor Employment

- Commercial Buildings

- Housing Inventory

- Total Construction

- Housing Starts

- Residential Improvements

- Machine-Tool Orders

- Capacity Utilization

- K-12 Enrollment

- Higher Education Enrollment

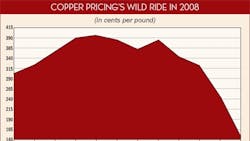

Copper Prices

In describing the copper market's free-fall during October, when the spot price for a pound of copper dropped 36 percent in 30 days to $1.84, noted copper expert John Gross pretty much says it all in his November 2008 issue of The Copper Journal: “There is no description of the copper market during October 2008 that can properly portray the carnage that unfolded.” That's saying a lot, when you figure that copper also broke the $4/pound mark earlier in 2008 and historically ranges from 80 cents to $1.20 a pound.

- Copper Prices

- National Office Vacancy Rates

- Electric Utilities

- Purchasing Managers Index

- Institutional Construction

- AIA Work-on-the-Boards survey

- Electrical Contractor Employment

- Commercial Buildings

- Housing Inventory

- Total Construction

- Housing Starts

- Residential Improvements

- Machine-Tool Orders

- Capacity Utilization

- K-12 Enrollment

- Higher Education Enrollment

National Office Vacancy Rates

Grubb & Ellis expects national office vacancy rates to surge to an uncomfortable 17 percent by the fourth quarter of 2009, but doesn't expect things to get much worse. An office vacancy rate below 10 percent indicates an extraordinarily healthy market, while any market with 20 percent of its office space empty has lots of uninhabited “see-through buildings.” In third-quarter 2008, Boston, New York, Washington, D.C., and San Francisco were the four largest cities with sub-10 percent downtown vacancy rates, while Atlanta and Detroit had vacancy rates over 20 percent.

- Copper Prices

- National Office Vacancy Rates

- Electric Utilities

- Purchasing Managers Index

- Institutional Construction

- AIA Work-on-the-Boards survey

- Electrical Contractor Employment

- Commercial Buildings

- Housing Inventory

- Total Construction

- Housing Starts

- Residential Improvements

- Machine-Tool Orders

- Capacity Utilization

- K-12 Enrollment

- Higher Education Enrollment

Electric Utilities

This always volatile market segment is in for another wild ride in 2009, and McGraw-Hill expects a 30 percent decline in utility construction to $16.8 billion. That's coming off a 55 percent increase in 2008. Miles of red tape snag the approval process for utility construction, but when these projects get the green light, they pump big dollars into the construction market. As more utility-scale wind and solar projects come online, watch for growth in the construction of the long-distance transmission lines needed to bring this green power to the market.

- Copper Prices

- National Office Vacancy Rates

- Electric Utilities

- Purchasing Managers Index

- Institutional Construction

- AIA Work-on-the-Boards survey

- Electrical Contractor Employment

- Commercial Buildings

- Housing Inventory

- Total Construction

- Housing Starts

- Residential Improvements

- Machine-Tool Orders

- Capacity Utilization

- K-12 Enrollment

- Higher Education Enrollment

Purchasing Managers Index

As one of the most widely watched indicators of the health of the industrial market, the Purchasing Managers Index (PMI), carries a lot of weight. That's why when this monthly survey of purchasing managers dropped like a ton of bricks in October to 38.9 points — its lowest reading since 1982 — it sent shock waves through corporate office suites and the national media. A reading above 50 points indicates the manufacturing arena is expanding; below 50 points indicates it's generally contracting.

- Copper Prices

- National Office Vacancy Rates

- Electric Utilities

- Purchasing Managers Index

- Institutional Construction

- AIA Work-on-the-Boards survey

- Electrical Contractor Employment

- Commercial Buildings

- Housing Inventory

- Total Construction

- Housing Starts

- Residential Improvements

- Machine-Tool Orders

- Capacity Utilization

- K-12 Enrollment

- Higher Education Enrollment

Institutional Construction

While McGraw-Hill expects this market to experience a 3 percent decline in 2009 to $121 billion, some market segments and regions will do better. Educational construction in the Sunbelt is expected to remain quite strong, but because the Northeast and Rustbelt are slowly but surely losing population to sunnier climates, these areas of the country won't have as many students filling classrooms. McGraw-Hill expects construction of healthcare facilities to drop 6 percent in 2009 to 98 million square feet.

- Copper Prices

- National Office Vacancy Rates

- Electric Utilities

- Purchasing Managers Index

- Institutional Construction

- AIA Work-on-the-Boards survey

- Electrical Contractor Employment

- Commercial Buildings

- Housing Inventory

- Total Construction

- Housing Starts

- Residential Improvements

- Machine-Tool Orders

- Capacity Utilization

- K-12 Enrollment

- Higher Education Enrollment

AIA Work-on-the-Boards survey

This survey is one of the construction market's leading indicators because it tracks inquiries for new construction projects received by architects and billing trends at those design offices. Through September, the Work-on-the-Boards report was picking up a gradual decline in activity. However, AIA saw a significant drop in October, when billings and inquiries for new projects posted their sharpest monthly declines in the association's 13-year history of tracking architecture business trends.

- Copper Prices

- National Office Vacancy Rates

- Electric Utilities

- Purchasing Managers Index

- Institutional Construction

- AIA Work-on-the-Boards survey

- Electrical Contractor Employment

- Commercial Buildings

- Housing Inventory

- Total Construction

- Housing Starts

- Residential Improvements

- Machine-Tool Orders

- Capacity Utilization

- K-12 Enrollment

- Higher Education Enrollment

Electrical Contractor Employment

The most recent data on electrical contractor employment still shows more than 900,000 employees working at electrical contracting firms, so this important indicator for the health of the electrical construction market would seem to show a solid market. Any drop in this statistic has a direct impact on the electrical wholesaling industry, because according to 2007 Electrical Wholesaling data on an annual basis an electrical contractor typically buys $43,743 in electrical products per employee.

- Copper Prices

- National Office Vacancy Rates

- Electric Utilities

- Purchasing Managers Index

- Institutional Construction

- AIA Work-on-the-Boards survey

- Electrical Contractor Employment

- Commercial Buildings

- Housing Inventory

- Total Construction

- Housing Starts

- Residential Improvements

- Machine-Tool Orders

- Capacity Utilization

- K-12 Enrollment

- Higher Education Enrollment

Commercial Buildings

This market segment was riding high at a record rate during the 2006 to 2008 era, but McGraw-Hill's Robert Murray is anticipating a 12 percent decline in the construction of office buildings, restaurants and related retail buildings in 2009. While that's a significant decline, it's a decline off a solid level of construction activity. The all-important office market segment is actually pretty healthy because speculative office building didn't surge as high during the good times as it did in past business declines.

- Copper Prices

- National Office Vacancy Rates

- Electric Utilities

- Purchasing Managers Index

- Institutional Construction

- AIA Work-on-the-Boards survey

- Electrical Contractor Employment

- Commercial Buildings

- Housing Inventory

- Total Construction

- Housing Starts

- Residential Improvements

- Machine-Tool Orders

- Capacity Utilization

- K-12 Enrollment

- Higher Education Enrollment

Housing Inventory

As a measure of the number of vacant new homes and existing houses for-sale-by-owner on the market, this statistic is every bit as important as building permits and housing starts. And the news is every bit as ugly, with 4.3 million homes for sale in September. While that number is down a bit from earlier in the year, it would still take 9.9 months to burn off the current level of oversupply. This inventory overhang is a big reason housing economists don't expect the housing market to improve much until late next year.

- Copper Prices

- National Office Vacancy Rates

- Electric Utilities

- Purchasing Managers Index

- Institutional Construction

- AIA Work-on-the-Boards survey

- Electrical Contractor Employment

- Commercial Buildings

- Housing Inventory

- Total Construction

- Housing Starts

- Residential Improvements

- Machine-Tool Orders

- Capacity Utilization

- K-12 Enrollment

- Higher Education Enrollment

Total Construction

When you add the 7 percent decline in McGraw-Hill's forecast for total construction spending in 2009 to the 12 percent decline it forecast for 2008, it points directly toward the cyclical nature of the construction market. Before a three-year stretch of declines beginning in 2007, McGraw-Hill data shows a stretch of 10 consecutive years of increases. Interestingly enough, McGraw-Hill expects the commercial, manufacturing and utility market segments to all drop more dramatically than the residential market in 2009.

- Copper Prices

- National Office Vacancy Rates

- Electric Utilities

- Purchasing Managers Index

- Institutional Construction

- AIA Work-on-the-Boards survey

- Electrical Contractor Employment

- Commercial Buildings

- Housing Inventory

- Total Construction

- Housing Starts

- Residential Improvements

- Machine-Tool Orders

- Capacity Utilization

- K-12 Enrollment

- Higher Education Enrollment

Housing Starts

No surprises here. The housing market is still a trainwreck mired in one of the deepest downturns in the history of homebuilding. You have to dig deep to find statistics quite as low for annual single-family and total housing starts, as the forecasts for 2009 and 2010 are about half the amount of activity this market saw during its go-go years from 2003-2006. NAHB expects 784,000 total housing starts in 2009 and 1 million total housing starts in 2010.

- Copper Prices

- National Office Vacancy Rates

- Electric Utilities

- Purchasing Managers Index

- Institutional Construction

- AIA Work-on-the-Boards survey

- Electrical Contractor Employment

- Commercial Buildings

- Housing Inventory

- Total Construction

- Housing Starts

- Residential Improvements

- Machine-Tool Orders

- Capacity Utilization

- K-12 Enrollment

- Higher Education Enrollment

Residential Improvements

The most current number available for the amount of work remodeling contractors and weekend warriors are doing on homes are unfortunately only available through year-end 2007. Sales were holding up just fine through that time period, but economists will watch this number closely for 2008 and 2009 because it's a good indicator of consumer spending. Home Depot and Lowe's have cut back on their expansion plans during the past year because of the expected decline in home improvement sales.

- Copper Prices

- National Office Vacancy Rates

- Electric Utilities

- Purchasing Managers Index

- Institutional Construction

- AIA Work-on-the-Boards survey

- Electrical Contractor Employment

- Commercial Buildings

- Housing Inventory

- Total Construction

- Housing Starts

- Residential Improvements

- Machine-Tool Orders

- Capacity Utilization

- K-12 Enrollment

- Higher Education Enrollment

Machine-Tool Orders

Machine-tool orders offer a quick read on the health of the industrial market because they reflect the sales of the equipment on the factory floor that manufacturers use to shape, mold and form metal for use in their products. This indicator historically has a lot of “bounce” to it, so don't get freaked out by double-digit declines or too giddy by double-digit increases. For instance, the $439.5 million in September machine-tool orders was up 32 percent from August but down 1.4 percent from the total of $445.6 million reported for September 2007.

- Copper Prices

- National Office Vacancy Rates

- Electric Utilities

- Purchasing Managers Index

- Institutional Construction

- AIA Work-on-the-Boards survey

- Electrical Contractor Employment

- Commercial Buildings

- Housing Inventory

- Total Construction

- Housing Starts

- Residential Improvements

- Machine-Tool Orders

- Capacity Utilization

- K-12 Enrollment

- Higher Education Enrollment

Capacity Utilization

Another indicator of the slowdown in Industrial America is capacity utilization, which is basically a measure of the current output versus potential output of U.S. factories. After topping the 80 percent utilization rate generally considered to be the point where factories begin expanding their facilities or retrofitting existing manufacturing lines for two years, this figure now stands at 76 percent. The last time this figure dipped this low was during the 2001-2002 recession.

- Copper Prices

- National Office Vacancy Rates

- Electric Utilities

- Purchasing Managers Index

- Institutional Construction

- AIA Work-on-the-Boards survey

- Electrical Contractor Employment

- Commercial Buildings

- Housing Inventory

- Total Construction

- Housing Starts

- Residential Improvements

- Machine-Tool Orders

- Capacity Utilization

- K-12 Enrollment

- Higher Education Enrollment

K-12 Enrollment

School-related construction continues to look solid because of far-reaching demographic trends. The children of Baby Boomers will continue to fill classrooms in near-record numbers for the next decade. While the local areas' construction climates vary due to the credit crunch and local demographic trends, over the long haul K-12 schools will remain one of the strongest segments of the construction market. The Sunbelt is seeing the biggest growth in educational building, with Texas, Florida, Georgia and California leading the pack.

- Copper Prices

- National Office Vacancy Rates

- Electric Utilities

- Purchasing Managers Index

- Institutional Construction

- AIA Work-on-the-Boards survey

- Electrical Contractor Employment

- Commercial Buildings

- Housing Inventory

- Total Construction

- Housing Starts

- Residential Improvements

- Machine-Tool Orders

- Capacity Utilization

- K-12 Enrollment

- Higher Education Enrollment

Higher Education Enrollment

The song remains the same for colleges and universities, as the children of Baby Boomers graduate from high school and move on campus. From 2008 to 2010, American School & University magazine forecasts $40.7 billion in new construction and retrofit work on college campuses, one of the hot spots in the overall construction market. These new classrooms, housing, eating and athletic facilities will be loaded with the latest in energy-efficient lighting, voice/data/video systems and security networks, creating a bonanza of electrical sales opportunities.

- Copper Prices

- National Office Vacancy Rates

- Electric Utilities

- Purchasing Managers Index

- Institutional Construction

- AIA Work-on-the-Boards survey

- Electrical Contractor Employment

- Commercial Buildings

- Housing Inventory

- Total Construction

- Housing Starts

- Residential Improvements

- Machine-Tool Orders

- Capacity Utilization

- K-12 Enrollment

- Higher Education Enrollment

About the Author

Jim Lucy

Editor-in-Chief of Electrical Wholesaling and Electrical Marketing

Jim Lucy has been wandering through the electrical market for more than 40 years, most of the time as an editor for Electrical Wholesaling and Electrical Marketing newsletter, and as a contributing writer for EC&M magazine During that time he and the editorial team for the publications have won numerous national awards for their coverage of the electrical business. He showed an early interest in electricity, when as a youth he had an idea for a hot dog cooker. Unfortunately, the first crude prototype malfunctioned and the arc nearly blew him out of his parents' basement.

Before becoming an editor for Electrical Wholesaling and Electrical Marketing, he earned a BA degree in journalism and a MA in communications from Glassboro State College, Glassboro, NJ., which is formerly best known as the site of the 1967 summit meeting between President Lyndon Johnson and Russian Premier Aleksei Nikolayevich Kosygin, and now best known as the New Jersey state college that changed its name in 1992 to Rowan University because of a generous $100 million donation by N.J. zillionaire industrialist Henry Rowan. Jim is a Brooklyn-born Jersey Guy happily transplanted with his wife and three sons in the fertile plains of Kansas for the past 30 years.