One of the best kept secrets in B2B has been the role of the distributor in building a manufacturer’s brand. That role is so powerful even COVID-19 is not able to stop it.

Maybe manufacturers don’t want to acknowledge it — or perhaps distributors themselves are unaware of the role they play. However, in this COVID-19 environment when so many things seem to be grinding to a halt, that role and its power is exposed. And the fact is distributors become even more important to building and maintaining a brand than any other channel or process you can think of. This article will explore the many reasons why this is so.

Manufacturers stop advertising during a crisis. You’ve heard the saying, “Never let a crisis go to waste.” Manufacturers never let it go to waste. When a crisis hits, they stop advertising, marketing, PR, training — everything. When they do that, they injure their brand, sometimes critically.

Distribution, however, doesn’t stop because business goes on. It may not continue at the same pace, or in the same way, but it continues. And therefore, the distributor continues to build brands — if that manufacturer’s brand stays true to the distributor relationship. But if the manufacturer stops, the distributor can’t stop. Accessibility governs the distributor’s world, so if the brand isn’t there, the distributor will satisfy his customer with one that is available. Plain and simple.

The unforeseen consequences of stopping brand marketing and advertising is that the brand leaves the door wide open for another brand — any brand — to enter and dominate the market. That action takes place in the distribution channel, and it’s happening right now.

Contractors and end users don’t stop buying. Who would argue the devastating effects of the virus on our economy? However, many projects are still moving. Fulfilling the requirements of those projects will bring the contractor and the distributor together, but will the brands be there?

For example, manufacturers should still be holding counter-days at distributor branches (which, by the way, in most states were declared essential businesses). They just need to get creative and use something other than the traditional table-inside-the-counter-area approach. Some manufacturers are doing their counter-day promotions in distributors’ parking lots using a tailgate party format.

Distributors are getting in on the act, too. One distributor thought of having “construction site” days — lunch time equivalents of training, only with real product demonstrations for the construction crews. Buying lunch and holding attention during the day at the site while following the COVID-19 safety guidelines can work miracles in sustaining a brand — or building new ones.

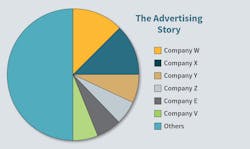

COVID-19 is the perfect storm for new brands. In any market, the brand players almost always line up as shown in the pie chart on the right. The “wanna be” brands (Others) typically make up the largest slice of a market pie, and the major brands each have a larger slice (W, X, etc.).

If one — just one — of the majors (and sometimes more than one like now) stops marketing and advertising, what do you think happens? For one thing, the audience being marketed to doesn’t stop buying. They do not suspend their work and wait until the brand comes back into the marketplace. This means if a manufacturer’s brand isn’t there, in that distributor’s channel when the contractor comes calling, what will the distributor do? You guessed it: he will give it to one of the other leaders or a wanna be.

Second, by leaving the market, the brand opens the door for one of those “wannabes” (or one of the other leaders) to take share. In the current environment when major brands have ground to a halt, that means the wannabe, with courage, can step in and take share away. The market lineup easily can be overturned. The phrase, “Fortis Fortuna Adiuvat” comes to mind (“Fortune favors the Bold”).

People need products now. Availability is repeatedly the most important product characteristic a brand can have. In other words, projects demand products, and if what they want isn’t there, they will find something else — the perfect storm for new brands.

The distributor is in the eye of the storm. Distributors sit at the crossroads of activity. The leverage of the distributor is giving the manufacturer brand the order and financing the manufacturer with that order. If the lines the distributor has been carrying have abandoned the market, the distributor will find new brands. Indeed, some of the larger distributors will source their own line of products when necessary.

The conversations opened up between new brands and distributors during such times often lead to overturning established brands with new ones. Mergers and acquisitions of manufacturers themselves also help a new brand (Will the real lighting brand please stand up?), as those mergers cause confusion in the marketplace. Confusion, also, is opportunity knocking for brand building at the distributor level.

Early warning system for brands. The distributor more than any other channel sees the interest and reaction to a manufacturer’s brand. This makes the distributor “brand-sensitive.” How many manufacturers really tap into their distributors for such information to hone their approach? Probably not enough.

One manufacturer brand we know is continually tapping his distributor’s customers — the contractors — which spawns variations of his products year after year and helps his distributors cash in on the new products he develops. This dialogue is valuable for manufacturers and distributors. Imagine what it has done for his brand, which is a passive component (Talk about a commodity market, where he now dominates. You can probably guess who that is).

One of our own manufacturer clients continually monitors their distributors with customer satisfaction studies, as well as “secret shopper” research. By doing this through a third party (us), his customers reveal things they would normally not tell the brand directly.

Such research provides extraordinary insight into their thinking — and opens doors for developing new products as well as enhancing the brand itself. For example, imagine hearing this feedback if you are a brand from one of your distributor customers:

“This type of product has been around for 15 years. The average price on the ones we sell is $600 to $700. This one here is $1,299 from Brand K. They are pricey. Why, I don’t know. Most of the time I don’t sell that brand. I’ve been in the industry 20 years and sold every brand you can name. Brand T is by far the best on the market for this product.”

We were doing the work for Brand T. Such insights deliver powerful information to help shape strategy.

Scale the brand. Distributors give a brand scale. And scale defines and builds the brand in the minds of customers. A brand — any brand — would never achieve such scale selling direct. Harry’s Razors had a great idea: direct to consumer. But do you think they even come close to what a Gillette or Schick sells through distribution?

Visibility, which is the key to building a brand, can be achieved without distribution but at a much higher cost. In-store merchandising, take-one flyers, stores, they all play a role in helping the brand achieve a scale that can’t be duplicated on the Internet alone.

In some research for a buying group, we interviewed several executives at distributors. Inevitably, when asked what they feared most, they answered Amazon — except for one who put it this way:

“Sure, I see Amazon as a threat. But I think Amazon would want to be more than they are. However, they can’t or haven’t figured out how to do relationships. Relationships are the key to our business, relationships with our contractors. Eventually Amazon will figure it out, but until then, they are no match for us.”

What is Amazon except a big online distributor for manufacturers to sell their products and give them exposure? Talk about scalability. However, Amazon is strictly built on price. You can argue they have a service component, but they can’t compete “on the street” with the hundreds of thousands of distributors’ salespeople who own the customer relationship.

Indeed, each “traditional” distributor is actually a little Amazon, or could be if they did e-commerce. And, if you combine traditional distributors together in a buying group, you suddenly can outflank Amazon itself with the brick and mortar stores Amazon doesn’t have.

Finding a balance for brand. Marketing is an investment. When do you do marketing? How much do you invest? With whom do you invest it?

For B2B products, there’s the “value-chain participants” — everyone from the architect through the distributor and end user. All audiences are important, but it’s distributor controls the process of getting that product in a building and thus shapes the brand. So where do manufacturers place their marketing emphasis?

More than likely, on the other value chain participants rather than the distributor. Why?

Frankly, the distributor handles not only their brand, but competitive brands. The manufacturer comes to believe that pulling the product through distribution is the way to success, so they market to the other value chain participants, like electrical contractors.

But when a crisis hits, that’s a major mistake, because the distributor feels no loyalty at all. When the brand pulls back on marketing as it has, there is a vacuum created — one that is filled by someone else’s brand. Balancing marketing is always difficult.

Many years ago, we worked for a major billion-dollar company with a fleet of trucks that serviced establishments by picking up their hazardous waste. The chairman of that company had a saying: “Nothing happens until the man gets off the truck.”

In today’s COVID-19-infested world, nothing happens until a distributor writes the purchase order. Who is on that order will be the brands that the distributor knows support his business. Locking down, for a brand, means being locked out when the time comes for business. That’s just Brand Building 101.

Nowakowski is the president of Interline Creative Group, Palatine, IL. You can reach him at [email protected] or 847-358-4848.

About the Author

Jim Nowakowski

President, Interline Creative Group

Jim Nowakowski is president of Interline Creative Group, Palatine, IL. He has written for Electrical Wholesaling for many years, most recently on branding and search engine optimization.

You can reach him at jim.interlinegroup.com or 847-358-4848.