From the largest industrial conglomerate in smokestack America to the smallest machine shop in an industrial park a market exists for electrical supplies that accounts for roughly 18% of all sales through electrical distributors. This market will account for almost $18.4 billion in electrical product sales in 2011, according to Electrical Wholesaling magazine’s “2017 Market Planning Guide” (EW, Nov. 2016).

When people think of the industrial market, too often they just think of massive industrial plants — assembly lines building minivans; steel plants with huge vats pouring molten steel into forms; or colossal factories cranking out the products that fill the shelves of every Main Street shop or big-box retailer. But a huge portion of the industrial market is in the smaller but more numerous manufacturers that produce products built into other products — the seat covers for that minivan; the machinery that mashes and molds that steel into other products; the packaging for those items on a store’s shelves; and for zillions of other types of products or businesses. Thousands of smaller customers exist in a broad array of industries, including pulp, paper and timber; chemical manufacturing; refinery operations; bottling; packaging; machine-tool building; food processing; military and aerospace products; and heavy industrial and construction equipment.

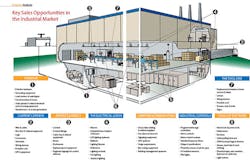

These industries have an enormous appetite for electrical products such as lighting equipment; wire and cable; fittings; connectors; terminals; conduit and wiring systems; motors and motor controls; hazardous locations equipment; sensors; programmable logic controllers (PLCs); circuit breakers and fuses; switchgear; voice/data/video (VDV) products; power conditioning equipment; signaling equipment; building management systems; machine-vision systems; bar coding equipment; and electricians’ supplies.

Don’t forget some of the new-generation products such as IoT-enabled sensors that monitor manufacturing lines, lighting, HVAC systems and related building automation networks; LED lighting systems; the products needed for on-site energy generation systems like standby generators, photovoltaic (PV) panels; and natural gas or cogeneration-fueled turbines that produce energy off of the pubic power grid; Check out the illustration on pages 18-19 to see how these products might fit into a typical industrial application — and provide a sales opportunity for your company.

Selling a package of products ranging from tiny wire terminals to towering motor control centers and the latest in IoT technology, as well as stocking and talking knowledgeably about the hundreds of related products, is not an easy task. This article provides an overview of the industrial market for newcomers to the electrical wholesaling business, as well as for industry veterans who want to brush up on the basic trends shaping this market or discover new strategies for scaring up industrial sales opportunities.

While the electrical systems are often much larger in industrial facilities than in the commercial market, with a few notable exceptions such as PLCs, industrial sensors and hazardous locations equipment, the products used in the industrial market are in the same basic product families as those used in commercial applications.

Electrical products designed for industrial applications often are a bit brawnier than their brethren in the commercial world, but that’s usually a function of the size of the electrical system and the sometimes atrocious living conditions they must endure. Electrical products in industrial applications are tortured with extreme heat or cold, oily mists, corrosive liquids or gases, water, dust and grime, or potentially explosive environments. That’s why industrial electrical products and systems must be carefully protected with the proper wiring systems, enclosures, junction boxes, or, in the case of wire and cable, tough insulation.

To get a fix on where the best sales opportunities are in the industrial market, let’s first take a look at the other key trends shaping this business:

The key market indicators that track the industrial market reflect a business that’s growing but is still far below historical levels. One thing about the industrial market has held true over the years — when it’s strong, business can be very, very good for the electrical wholesaling industry. But when your industrial customers are suffering from a dearth of demand for their products and they are not building new production lines or refurbishing existing facilities, business is tough. You also must factor in the smaller industrial base in the United States, because so many companies have moved offshore to countries that offer less-expensive manufacturing.

That being said, the industrial market still exists in the United States, and in some areas of the country it’s doing quite well, like the market areas where auto manufacturers are building new factories or renovating existing facilities, like in parts of Michigan, South Carolina and in Reno, NV, where Tesla is building its first Gigafactory. And when the auto industry is expanding, it also creates sales opportunities in feeder industries. Along with the auto plants themselves, you have hundreds of companies manufacturing equipment for new cars, including tires, seats, headlamps, sound systems and a gazillion other OEM products

According to the South Carolina Chamber of Commerce, South Carolina has approximately 250 automotive-related companies and suppliers. And in Michigan, General Motors and Ford have announced major expansion of existing plants, and last year a Detroit News article said, “Ford’s new product campus will double the number of employees who work in the area now, from 12,000 to 24,000. Renovations will include “connected facilities” with the latest wired and wireless hardware; a central green area that links buildings; and energy-saving features like geothermal heating and cooling. The centerpiece will be a new 700,000-square-foot Design Center with studios and an outdoor design courtyard.”

If you want to get a snapshot of the industrial market’s health on a national basis, here are several good economic indicators to track:

- Capacity utilization

- Machine-tool orders

- Purchasing Managers Index

- Non-defense durable goods orders, excluding transportation

- Manufacturing employment

- Manufacturers’ shipments

- Baker-Hughes rig count (if you are interested in the oil & gas market)

Published each December, Electrical Wholesaling’s annual “National Factbook” tracks many of these indicators. You can access the magazine’s most recent analysis at ewweb.com, by typing “national factbook” into the search engine at the top of the right column.

Capacity Utilization. This statistic follows manufacturers’ industrial capacity and how much of it is being used. According to the Federal Reserve Board, total capacity utilization is currently at 75.4%, below the 1972-2016 industry average of 79.9%. As rule of thumb, when the capacity utilization number hits 80%, manufacturers will look to expand capacity. In recent months, the number seems to have stagnated around 76%, but it’s still up from the 67.3 % level it dropped to during the recession. Check this website for current data: www.federalreserve.gov/releases/g17/Current/.

Machine-Tool Orders. Published by the Association For Manufacturing Technology (AMT), this is an important leading indicator because it measures the sales of the machines on the factory floor that do the actual shaping, cutting, bending, forming and perform other manufacturing processes. Orders for Jan. 2017 totaled $252.21 million, down from December’s $425.18 million. This indicator often has wild swings, so don’t get too freaked out when you see monthly numbers fluctuate by 20 percent or more. To track monthly data go to www.amtonline.org.

Manufacturers’ New Orders - Nondefense Capital Goods Excluding Aircraft. If you want to find out the total monthly sales of big-ticket items such as automobiles, refrigerators, computers and other electronic equipment, track the durable goods orders posted each month by the Department of Commerce at www.census.gov/indicator/www/m3/index.html. Most economists look at subsets of these numbers, particularly Manufacturers’ New Orders: Nondefense Capital Goods Excluding Aircraft. This data strips out the volatility of orders for aircraft and defense spending which tends to appear in huge lumps that skews that month-to-month increases of the rest of the data. In its “FRED” treasure trove of economic statistics, the Federal Reserve Bank of St. Louis offers this report in an easy-to-digest downloadable format through this link: https://fred.stlouisfed.org/series/NEWORDER.

Purchasing Managers Index (PMI). The Institute for Supply Management (ISM), formerly known as the National Association of Purchasing Managers (NAPM), offers a wide variety of statistics on the purchasing activity of manufacturers and service companies at its Web site, www.instituteforsupplymanagement.org. One of the many useful statistics on this site is the Purchasing Managers Index, which tracks purchasing activity on a national basis, as well as by industry. Many economists rely on this data as leading indicator of future industrial purchasing. Any reading over 50 in the index points toward a healthy purchasing climate, and the index has been over 50 points since March 2016. It’s been on a real tear since Aug. 2016, and hit 57.7 in February.

Maintenance, repair and modernization of electrical systems continue to account for about half of all electrical work performed in industrial facilities. New construction of industrial facilities often directly depends on demand for the products that the plant produces. It’s also affected by local or national economic trends and the financial health of that company. As in any new construction market, distributors ride the ups and downs of new industrial facility construction. When the construction of new industrial facilities is hot, the sales potential is huge. But when customers are not building new facilities, distributors must take advantage of the more consistent demand for electrical products needed for the repair, retrofit and modernization of existing buildings.

The nice thing about this market is that it’s seldom as cost-sensitive as new construction work. The gross sales dollars may not be as big, but the profit margins tend to be much higher. Customers need distributors that can react immediately on their demands for repair products, and price is seldom as much of an object when a key assembly line is down because of a malfunctioning electrical component.

A relatively small group of manufacturers produce huge amounts of the products for the industrial market. Full-line electrical distributors aren’t big players in the industrial market unless they stock at least one of the following lines: ABB, Rockwell Automation/Allen-Bradley Co., Schneider Electric, Eaton, Siemens, or GE Distribution & Control. ABB, Siemens, Eaton, GE and Schneider provide not only industrial control and motor-related products, but broad distribution equipment and switchgear packages, too. GE announced its intentions late last year to sell its Industrial Solutions division, which does about $3 billion in annual revenue.

Integrated-supply arrangements evolved and survived. A decade ago, you could not pick up an industry publication without reading about a new integrated supply agreement. In these arrangements, noncompeting distributors of industrial, MRO and construction products band together to offer mutual customers a single-supply source for many MRO needs. These integrated-supply partnerships tend to target the largest industrial customers, but they also work for large companies with multiple facilities such as Fortune 500 service companies and utilities.

During the dot-com era, more than a dozen of these groups existed, as dot-com companies from outside the distribution industry with names like purchasingcenter.com, totalmro.com, and equalfooting.com, thought they could replace existing channels of distribution by taking all of this business online.

These dot-com entrepreneurs burned through their venture funding, and many distributors with an interest in integrated supply or national accounts are now part of at least two large groups, each with a slightly different background and focus: Vantage Group, Crystal Lake, Ill.; and SupplyForce, King of Prussia, Pa. SupplyForce was spun off from the Affiliated Distributors (AD) buying/marketing group as a separate company in 1999. It bought another group, Vanguard National Alliance (VNA), in 2014. According to its website, “the SupplyForce network has more than 200 local distributors representing more than 2,500 locations with over $5 billion inventory and combined annual revenues exceeding $22 billion. The distributor members of SupplyForce represent thousands of manufacturers in the electrical, industrial, safety, pipe valves and fittings, power transmission, bearings and other MRO categories.”

Vantage Group is owned by several large distributors — Rexel and its Platt Electric Supply business on the West Coast, and its NEDCO Electric Supply and Westburne Electric Supply units in Canada. Crescent Electric Supply and its Interstate Electric Supply and Stoneway Electric Supply businesses, are in Vantage, as are McNaughton-McKay Electric Co. and Broken Arrow Electric Supply.

More electrical contractors are being hired to do on-site maintenance work at manufacturing facilities. This trend has been happening for years because your industrial customers can cut operating costs by farming out their electrical service work. This is an important trend for electrical distributors, because it can change the buying influences. Check with industrially-oriented electrical contractors in your market to see if they are involved in this type of work.

As the automation of the factory floor has evolved over the past 30 years, end users have been able to monitor, collect and process unprecedented amounts of information. For years, distributors provided the hardware that made this happen, such as programmable logic controllers, sensors, relays, pilot lights, variable speed drives, enclosures, cabling and related connectors.

But as the need to collect and process this information increased, distributors’ customers began asking for high-speed communications systems to carry information from the factory floor to the corner office, or to other facilities. Along with conventional industrial communications networks constructed of shielded twisted-pair cable, coaxial cable or fiber-optic cabling, IP-enabled sensors now send data wirelessly to the cloud over the internet. It’s one example of how the IoT is now changing the electrical market.

The automation software that customers use requires expertise in both software and hardware. It’s no longer enough to just provide the “nuts-and-bolts” for the factory floor. Distributors’ customers are looking for a one-stop solution in supply and software programming. In fact, the software has become such a big part of the sale that products such as PLCs that were once considered the highest of high tech have become commodities.

All of the major players in industrial automation have built up their software capabilities. As Electrical Wholesaling reported in its Dec. 2016 issue, “Manufacturers in the industrial automation space have grasped the potential of building a robust industrial data platform and this year actively positioned themselves through acquisitions and internal structural changes to pursue the industrial IoT (IIoT) as a primary emphasis for future growth. We’re now seeing a high-stakes race among large industrially oriented electrical manufacturers to realize the IIoT’s potential, each seeking to establish a standard software platform for gathering and interpreting data in the manufacturing, process, infrastructure, utility and related industries.”

Examples of this move include GE’s billion-dollar investment in its Predix industrial software platform and acquisitions of Bit Stew Systems and Wise.io; and Schneider’s growing portfolio of industrial software tools, including Wonderware for visualization and production management, Avantis for asset management, and SimSci for process design. ABB is building out its industrial software under the brand ABB Ability, and in 2016 Siemens announced a huge software deal with the $4.5 billion acquisition of Mentor Graphics as part of its own bid to digitize heavy industry. Wilsonville, Ore.-based Mentor sells software and hardware design-automation tools for the development and testing of advanced electronic systems.

This trend means that distributors either must have the programming capabilities on staff or partner with companies such as systems integrators that have this expertise. Remote management of an industrial facility’s electrical system over the web helps alert maintenance personnel of blown breakers, power fluctuations, energy usage and dozens of other electrical measurements.

OSHA has gotten more serious about trying to stop electrical accidents on the job. The Occupational Safety and Health Administration (OSHA) continues to enforce its regulations to make industrial plants safer workplaces, and these regulations have created sales opportunities for electrical distributors. The “lockout-tagout” rules require industrial facilities to use specially designed lockout tags to ensure the circuits electricians are working on cannot be inadvertently energized by other workers. Other requirements call for proper signage, GFCI protection of many electrical circuits, and frequent inspection of portable cords to ensure that they are always in safe working order.

New products that do jobs better, faster or at less cost than traditional electrical products will continue to attract customer interest. For instance, IoT-enabled equipment is now a reality; new types of cable tray systems offer customers more options in wiring systems; the move toward modular electrical equipment has increased the demand for multiple-contact connectors; and ever-more efficient lighting systems offer solid ROIs. They offer real-world benefits to your customers — and provide a solid sales opportunity.

What It Takes to Win in This Market

With these fast-changing trends, as well as the overwhelmingly technical nature of many of the products, the industrial business can quickly become quite confusing for newcomers to the electrical industry or the industrial market. Don’t despair. The following basic sales strategies have withstood the test of time in the industrial market. You can increase your chances for survival in the industrial jungle by committing to the following basic concepts.

Know thy customer. It all starts with homework. For starters, you must determine a customer’s product needs. That means you have to find out what type of equipment is already installed and who manufactured those products. You also must know which employee or employees have the most impact on the purchasing decision and what these buying influences want from an electrical distributor. Develop a standardized customer profile to help gather the appropriate information.

Know thy competitors. Identify your customer’s primary suppliers, and familiarize yourself with the services, strengths and weaknesses of those competitors.

Know thy stuff. If you don’t really understand the technical basics of the products you sell, travel with a company product specialist, inside salesperson, independent rep or factory salesperson who does. The industrial market is the most technical of all the market arenas in the electrical wholesaling industry, and product expertise is a huge value-added benefit that you must offer the customer.

Experience the applications. There’s no substitute for getting out on the plant floor and learning more about the working environment where your company’s products live. Many of these products are specifically designed for the industrial market’s adverse environments. Knowing the neighborhood can help you make more informed product recommendations and keep your customer in line with the necessary National Electrical Code (NEC) regulations, particularly in the area of hazardous locations. Touring plants on a regular basis will help you keep abreast of any changes in equipment, or upcoming repair, retrofit, modernization or new construction work. If a customer will let you, don some coveralls and spend a full day on the plant floor to check out their world. It will be a great opportunity to familiarize yourself with the electrical system, meet the plant personnel and get a feel for the flow of how things work. The customer will usually appreciate your interest.

Be there or be square. Service sells in this market, because the cost of a malfunctioning assembly line can be measured in thousands of dollars per minute. If your company is in the MRO market, it isn’t a player unless it offers 24-hour emergency service and delivers on its promises to keep salespeople accessible through cell phones, texts, e-mail, and all other modern and not-so-modern tools of communication.

Build sales by helping customers save energy — and cold cash. The potential cost-savings of energy-efficient products hits home in the industrial market. Energy-efficient lamps, lighting controls and related lighting equipment; variable-speed drives; energy-efficient motors; PLCs and power-monitoring equipment can slash operating costs for your customers.

Offer your customers regulatory relief. As mentioned earlier, OSHA and NEC regulations often create sales opportunities for electrical distributors. On your plant tour, check to see if the present electrical system and any planned modernization fall under the classification system in the NEC’s Chapter 5 for hazardous locations. And while on that tour, don’t forget to look for applications for lockout-tagout devices, signage or new portable cords so you can save your customer a headache or two when confronted by an OSHA inspector.

Next Month: Utility Market 101

About the Author

Jim Lucy

Editor-in-Chief of Electrical Wholesaling and Electrical Marketing

Jim Lucy has been wandering through the electrical market for more than 40 years, most of the time as an editor for Electrical Wholesaling and Electrical Marketing newsletter, and as a contributing writer for EC&M magazine During that time he and the editorial team for the publications have won numerous national awards for their coverage of the electrical business. He showed an early interest in electricity, when as a youth he had an idea for a hot dog cooker. Unfortunately, the first crude prototype malfunctioned and the arc nearly blew him out of his parents' basement.

Before becoming an editor for Electrical Wholesaling and Electrical Marketing, he earned a BA degree in journalism and a MA in communications from Glassboro State College, Glassboro, NJ., which is formerly best known as the site of the 1967 summit meeting between President Lyndon Johnson and Russian Premier Aleksei Nikolayevich Kosygin, and now best known as the New Jersey state college that changed its name in 1992 to Rowan University because of a generous $100 million donation by N.J. zillionaire industrialist Henry Rowan. Jim is a Brooklyn-born Jersey Guy happily transplanted with his wife and three sons in the fertile plains of Kansas for the past 30 years.