Editor’s note: Electrical Wholesaling’s Electrical Markets 101 series ranks high on the list of the magazine’s most popular articles. Over the next few months, we will be updating our overviews of the electrical wholesaling industry’s largest segments – the residential, commercial and industrial niches. Together, they account for more than three-quarters of all products sold through full-line electrical distributors. In this month’s installment, we present the basics of the residential market.

Every electrical distributor has a different take on the residential market. Many industrially-oriented distributors don’t deal with it. And in many mature suburbs, inner cities or other areas where new residential construction is nonexistent or at a standstill, the residential market may not provide many sales dollars at all. However, in a fast-growing Sunbelt suburb this may be a key market for a distributor.

What the market is depends on how you define it, too. For a residential lighting specialist that doesn’t sell much pipe and wire, the residential market means selling replacement fixtures to homeowners or a “houseful” of fixtures to a new home buyer who has the builder’s lighting fixture allowance to spend.

The market for residential lighting fixtures sold through full-line electrical distributors, residential lighting specialists, home centers, hardware stores and department stores operates differently than other aspects of the electrical market, primarily because of the retail nature of this business and the fact that the customer is most often a homeowner. Despite massive competition from home centers in this market, distributors expect to sell billions in residential lighting fixtures this year.

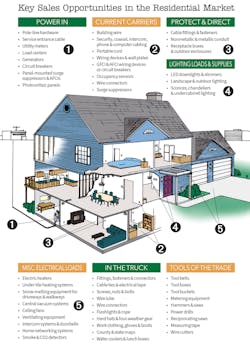

Lighting may be the most visible segment of the residential market, but the wiring system hidden behind the walls of your home generates far more sales for full-line electrical distributors. The key products in this segment of the residential market include service-entrance equipment; load centers; circuit breakers; connectors; fittings and fasteners; wiring devices and wallplates; building wire; service entrance cable; and low-voltage wiring for home entertainment centers and man caves, plus security, sound, intercom, phone and home networking applications.

Solar. Newer to the potential product mix are products like wireless security systems, backup power generators and photovoltaic (PV) systems. Solar panels are still very pricey for many homeowners, as a residential PV system can easily cost more than $30,000 and the ROI can approach a decade. But in regions of the country with high electricity rates, various utility rebate programs packaged with local, county or state financial incentives can drive down that ROI to seven years or less. At press-time, solar advocates and lobbyists were pushing for the extension of the Solar Investment Tax Credit (ITC), which provided a 30% federal tax credit through 2019 for the installation of a residential solar system. It’s currently scheduled to step down to 26% in 2020; 22% in 2021; and be eliminated in 2022.

The U.S. residential solar market is finishing up its busiest year ever, with 712 megawatts (MW) installed through 3Q 2019, according to the latest U.S. Solar Market Insight report from Wood Mackenzie Power & Renewables and the Solar Energy Industries Association (SEIA). According to the report, “The increase in residential installations helped the U.S. solar market grow 45% year-over-year and contributed to 15 states having their best quarter ever for residential solar. States with smaller solar markets such as Idaho, Wyoming, New Mexico and Iowa all saw record residential growth due to continued price declines and improvements to the economic competitiveness of solar across the country. California continues to lead the nation in residential solar installations, due in part to a new mandate by the California Building Standards Commission. It requires that after Jan. 1, 2020 new homes up to three stories tall must have solar panels. An article in Fortune magazine said 9% of California’s existing single-family detached homes now have solar panels.

One of the most recent developments in the solar market is the launch of Tesla’s new Solarglass Roof. According to a post on www.theverge.com, these new PV roof tiles, the third version Tesla has released, “will cost around $42,500 for a 2,000-square-foot roof with 10kW of solar capacity before tax credits (or about $21.25 per square foot) and come with a 25-year warranty.

Electric vehicle charging stations. You may be starting to see demand for electric vehicle charging stations or new housing developments that have EV charging stations in the garage, solar panels on the roof and storage batteries to store excess PV-generated power and even send that power back out onto the utility grid through a net metering arrangement where the homeowner gets paid for the power they produce. Elon Musk’s new solar roof and PowerWall battery storage system utilize this concept. Suppliers of electric vehicle chargers include ABB, ChargePoint, ClipperCreek, Eaton, Leviton, OpConnect, and Schneider Electric.

MARKET SIZE

While the main focus in the electrical wholesaling industry tends to be on the much larger commercial and industrial markets, the residential market is still an important niche. It accounts for an estimated $23.2 billion in sales for 2020 — 19% of total distributor sales — according to data from Electrical Wholesaling’s 2020 Market Planning Guide.

Hot markets. It’s an interesting market segment to analyze because its growth is tied to an interesting kaleidoscope of factors, including demographic trends, interest rates, preferences for living in urban or suburban locales, and constantly advancing computer and home entertainment technology. Hot markets for homebuilding have a direct correlation with sunshine and population growth, and it’s interesting to note that most of the 50 Metropolitan Statistical Areas (MSAs) that added the most new residents from 2013 to 2018 were in sunny or vacation-oriented/outdoorsy states, with more than half in Florida (8); Texas (4); California (7); Utah (3); and South Carolina (3) (see chart on p. 16).

When you measure the residential market by the number of single-family building permits, you will find it’s fairly consolidated. Through Oct. 2019, the 10 MSAs with the most permits accounted for 20% of the total; the 25 largest markets accounted for 32%; the 50 largest MSAs had 41% of the national total; and the 100 largest MSAs (out of the 384 that had permit activity) had 48% of the action.

The residential market is the most local of businesses, with a surprisingly small handful of MSAs accounting for a big share of the total market for single-family homes and multi-family projects. One of the most helpful tools for understanding which MSAs are growing the fastest is the “Housing Hotness Index,” which is the ration of building permits per 1,000 residents. This allows you to size up market not based on their total housing activity, but by how much homebuilding is going on in the MSA compared to how many people live there.

When measuring a market with this ratio by comparing just single-family building permits to the population of a market, the 10 most active metros in terms of single-family housing in the “Hotness Index” are: The Villages, FL; Myrtle Beach-Conway-North Myrtle Beach, SC-NC; Boise City, ID; Punta Gorda, FL; St. George, UT; Daphne-Fairhope-Foley, AL; Greeley, CO; Coeur d’Alene, ID; Raleigh, NC; and Austin-Round Rock, TX.

Home builders and building product manufacturers must be tuned in to the sometimes finicky tastes of Millennials now entering their prime home-buying years in their 30s. They are starting to buy starter houses, townhouses and condos in droves and are loading them with granite countertops, home entertainment wiring, high-speed Internet cabling and wireless home security systems. On the other end of the demographic spectrum, home builders need to provide retiring Baby Boomers with patio homes in maintenance-free communities and vacation areas and condos in downtown urban environments with the features they need.

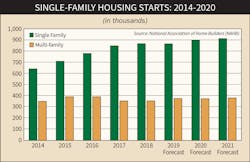

Housing won’t soon hit the record numbers it saw before the recession when total starts topped 2 million in 2005 and single-family starts hit 1 million every year. Looking forward, the residential market should be strong over the next two years, and two key drivers look good. Interest rates are expected to stay comparatively low and the number of Millennials looking for starter homes and Baby Boomers either downsizing or buying a vacation property should increase over the next few years.

According to forecasts by the National Association of Home Builders (NAHB), Washington, DC., total housing starts will increase 2.5% to 1.28 million in 2020, led by a +3.8% increase in single-family starts. Multi-family starts are expected to decline -0.6% to 374,000. NAHB expects a smaller increase in total housing units for 2021, with a +1.9% increase to 1.3 million total starts. NAHB’s website at www.nahb.com and its Eye on Housing blog are great sources for data and analysis of the residential market.

Multi-family. The multi-family segment of the housing market, which will account for 5% of all construction in 2020 according to FMI Corp. housing data, has sizzled in cities like New York, Washington, D.C., Boston, Miami, Dallas, Seattle and San Francisco, as demand for luxury condos loaded with the latest in lighting control, security, home theaters and home automation systems created all sorts of business opportunities for electrical contractors and design and specification professionals. Richard Branch, chief economist, Dodge Data & Analytics, says the multi-family housing market peaked in 2018.

Although he expects declines of -11% in 2019 and -15% in 2020, this housing niche was riding along at a high level and was enjoying several of its busiest years since the Great Recession. Over the past few years, multi-family housing data has been skewed by an unprecedented explosion of activity in New York and some other metros. According to Dodge Data, through the first nine months of 2019, New York had $12.9 billion worth of multi-family housing construction, more than double that of Washington, D.C., in second place. Los Angeles and Miami round out the top four markets for multi-family housing.

THE CUSTOMERS

To make the most of the residential market, you will need to first understand how the residential market works. Distributors work closely with two key customers in this market. For those distributors that focus on new construction and renovation, it’s the electrical contractor. Those companies with residential lighting showrooms focus on the homeowner. You also should get to know the builders in your market area. They work on a very tight production schedule, and the more you know about what they expect from their subcontractors, the better off you and your contractor customers will be. Builders also will sometimes buy bulk lighting fixtures and some other electrical products directly from distributors.

Depending on your region of the country, the national homebuilders may or may not have a major influence. The 2007-2009 recession crushed the homebuilding market, and the big builders aren’t producing houses at anywhere near the pace of the go-go years of 2005-2006, when the 200 largest home builders would close more than 500,000 new homes a year, according to Builder Online (www.builderonline.com). Check out the chart on page 26 see the 10 largest homebuilders in the Builder Online ranking.

If you look at the articles and posts on www.builderonline.com and other web-sites or publications aimed at home builders, the electrical products featured most often include high-end lighting and dimming systems, structured wiring systems, security systems and solar equipment. Manufacturers of these products are interested in forging relationships with builders, and you should be, too. Let’s now look at how to build relationships with these customers and buying influences.

Keep your promises. Distributors don’t have any great secrets in building relationships with electrical contractors. The biggest factor is, and has always been, service. Sure, contractors probably are more price-conscious than any other customers. And, yes, in the residential market they can get many of the products you sell from home centers. But for the long haul, contractors in your market need a dependable source for supplies. They need a distributor who may not always be the cheapest on each and every product but is the most reliable supplier in town.

As much as and probably more than any other customer, electrical contractors need the electrical distributor to deliver the right products on time and in the right location. Whether that be a delivery to the job site or a pick-up at the counter, the electrical contractor depends on the distributor to come through. That’s because contractors are on a tight time schedule at the job site. If they can’t finish the wiring, it has a chain-reaction effect, holding up the sheet-rockers, painters, trim carpenters, and so-on down the line. If the electrical contractor is gumming up the works on a new home, his boss at the construction site — usually the general contractor or builder — isn’t going to be happy with him and may not use him in the next phase of the development. When this happens, you don’t need too much imagination to figure out what that contractor will think of the electrical distributor who made him late.

If builders in your market area are offering structured systems in their developments, this adds another step in the construction process — and puts additional pressure on the time line. That’s why many builders prefer to deal with one electrical contractor (and by extension, a sole source of power and home-networking or structured wiring supplies) to wire traditional wiring and structured wiring systems.

Don’t underestimate the power of credit. Why do contractors continue to do business with distributors when they can buy so many of the products they sell from Home Depot and other home centers? Credit is definitely one of the key reasons. Electrical contractors, particularly smaller electrical contractors, value a credit line from a dependable supply source. They need credit to keep working, and those credit lines on Visa, MasterCard or the store credit cards they get at the home centers only go so far.

Sure, contractors can often be a bigger credit risk than other customers. And while every distributor has either heard of or has had personal experience with an unscrupulous contractor running up a credit line and then skipping town, these horror stories are fortunately more the exception rather than the rule. Why do contractors have financial problems? Most often it’s because they fall victim to inadequate cash flow, the cyclical nature of the construction market, unscrupulous general contractors or poor business management on their own part.

Small residential contractors can turn into big commercial/industrial contractors. The saying, “From tiny acorns do mighty oaks grow,” applies directly to contractors. That new contractor in town doing a few residential service calls and trying to crack the new construction market may not add much to your company in the way of sales or profits today. But when these companies grow, they often expand past the residential market into the commercial or industrial markets. As they grow, so too does their buying power. They usually remember who did and didn’t offer them credit when they were just starting out, or who helped them get their business off the ground.

Teach contractors about business basics. Electrical contractors may be wiring wizards, but they often have trouble running a business. Accounting, bookkeeping and budgeting are usually second-nature to many electrical distributors. But contractors with no business background may struggle with these basic business skills. Have contractors sit down with your financial manager to get some basic business tips. Contractors often have a lot to learn about marketing themselves, too, and if your company has a marketing person on staff, he or she may have advice for customers in this area, too. Think about how you can help an electrical contractor market themselves with social media, if that’s one of your areas of expertise. You should also encourage these customers to join community organizations like the Kiwanis or Chamber of Commerce. This will give them the opportunity to develop professional relationships with accountants, bankers and lawyers they may someday need to use in their business.

Be prepared to offer some technical help. Although contractors have been pulling building wire for so long they can do it blindfolded, if an unusual installation does come up, they will need information from the distributor or the manufacturer’s rep on that product. Providing technical assistance in newer markets like home theater, solar or home security can make a distributor look like a champ.

Get a grip on the technical basics. For salespeople and other employees new to the electrical market, or for those employees not too technically inclined, studying the residential market is helpful because the technical functions of these products are easier to understand than those in the commercial and industrial markets.

The first step in learning more about the fundamentals of electricity is to take a course or read one of the many books published on this subject. Manufacturers or trade associations also often provide training material on this area. The Electrical Products Education Course (EPEC) is a great training program offered by the National Association of Electrical Distributors (NAED), St. Louis. You can find more information on EPEC at www.naed.org. BlueVolt, Portland, OR, also offers a ton of technical training on products at www.bluevolt.com.

Once you feel comfortable with electrical theory, the next step is to get a feel for how these fundamentals actually work in an electrical system. Home wiring is a great place to see these fundamentals in action because residential systems use relatively basic electrical circuitry.

Work with builders to alert your contractor customers to opportunities in the structured wiring market. As mentioned, home builders may be looking for one contractor to handle power wiring and home theater or home networking systems for computers, home entertainment and security systems. If you can supply home-networking supplies along with traditional products, you can increase your sales-per-house.

Use what you learn in the residential market to build sales with other customers. The residential market is important to study because it offers a solid foundation in the customer-service basics that so often determine the distributor of choice in a particular area.

When dealing with homeowners, product knowledge separates distributors from home centers. The rules of the game may be somewhat different in the residential lighting market. But product knowledge is still a key value-added service that distributors can offer, whether they are selling fuses or chandeliers. This is an issue in the residential lighting market because of competition from home centers. It can be tough to compete with home centers on price for many of the basic fixture styles. To survive, many residential lighting distributors have focused on areas where home centers are weak such as the high end of the market, lighting design and on offering knowledgeable sales assistance.

PRODUCTS WITH AN EXTRA EDGE

Many of the electrical products used in residential construction haven’t changed much, but over the past few years, several relatively new products designed for the residential business have hit this market. You should make sure your contractor customers are aware of them. The most popular new products with electrical contractors these days seem to fall in three distinct categories: energy-saving products; labor-saving tools that allow them to save time, money and effort on the job site; and products required by the National Electrical Code or federal, state or industry safety regulations. Here are some examples of these products.

Arc-fault circuit interrupters (AFCIs). To reduce the number of electrical fires caused by parallel arc faults in branch circuit wiring, the National Electrical Code (NEC) requires arc-fault circuit interrupter (AFCI) protection device in an increasing number of residential applications. The AFCI protection device must de-energize and protect the entire circuit from an arc fault, according to Mike Holt, NEC consultant for EC&M magazine. The only device that can do this is an AFCI circuit breaker. For more information on AFCIs, check out Holt’s website at www.mikeholt.com and talk with your local electrical inspectors about where they are required in your market.

Surge suppression equipment. Because so many homes are loaded with sensitive electronic equipment, your customers may be asked to install surge suppression equipment at the service entrance.

Structured wiring systems. One of the most exciting new opportunities for your customers in the residential market is the installation of home networking for computers, security and home entertainment applications. Products for these applications include but are not limited to nonmetallic enclosures, data cable and jacks, USB receptacles, routers, modems and repeaters.

Cable fasteners. NEC Art. 300.4(D) requires that building wire be placed 1 1/4-inch from the edge of the stud to protect it from drywall screws or nails.

Metal-stud boxes and bushings. In some other areas of the United States, metal-stud construction has replaced wood studs as the primary frame of the building. This has created new sales opportunities for the bushings required to protect the cable from the sharp edges of the stud and for special boxes for steel-stud construction.

Weatherproof outlet covers. NEC regulation 410.57 requires the use of outlet covers for outside receptacles to protect them from the elements.

GFCI equipment. More areas than ever in the home must now be protected by ground-fault circuit interrupters (GFCIs), as the 2020 National Electrical Code has added additional applications for these products. Generally speaking, GFCIs are required in bathrooms, kitchens, basements and outdoors. Check out the product offerings from manufacturers of wiring devices and GFCI circuit breakers. A related NEC rule calls for GFCI protection of portable cords, which can be a nice add-on sale.

Safety products. Hard hats, safety goggles and signage are just a few of the many safety products you can sell to residential electrical contractors.

Dimming products. Dimmers and dimming systems offer the opportunity to sell more than just a wall switch. For instance, contractors can “sell up” on residential service calls to replace a dimmer that’s burned out. Some manufacturers provide demonstration dimming systems for contractors to bring out on these service calls. This product niche is changing fast with the introduction of lighting control apps for smart phones that homeowners can use to control lighting when they are not in their homes.

Top-shelf lighting. LEDs are a giant factor in the residential market, as in other electrical business niches. In addition to ceiling fixtures and downlights, don’t forget applications for undercabinet lighting and landscape lighting.

USB outlets. Homeowners can never get enough USB charging stations for their smartphones and tablets, and the combo receptacles that offer USB ports are popular.

Generators. The increasing frequency of blackouts, brownouts and longer term outages caused by wildfires, hurricanes, tornados and other natural disasters has driven demand for generators in residential applications.

Solar panels & related equipment, EV charging stations and storage batteries. As mentioned earlier, these products are emerging.

Poke-through outlets for granite countertops. This is an up-and-coming product area that offers access to power in the kitchen applications.

Snow-melting equipment. This product can be sold in upscale residential construction projects in the northern climates where snow and ice are a problem. Snow-melting systems are installed beneath walkways or driveways to keep these areas passable during colder weather.

Labor-saving tools. Electrical distributors have good reasons to carry tools that can save time and labor on the job. Contractors have an innate love for tools and are always interested in what’s new in this area. Tools are also an excellent product line to merchandise in the counter area because many customers buy them on impulse.

Solid sales opportunities abound in the residential market if you stick to the basics of customer service and explore these hot product areas.

Next month: Commercial Market 101

About the Author

Jim Lucy

Editor-in-Chief of Electrical Wholesaling and Electrical Marketing

Jim Lucy has been wandering through the electrical market for more than 40 years, most of the time as an editor for Electrical Wholesaling and Electrical Marketing newsletter, and as a contributing writer for EC&M magazine During that time he and the editorial team for the publications have won numerous national awards for their coverage of the electrical business. He showed an early interest in electricity, when as a youth he had an idea for a hot dog cooker. Unfortunately, the first crude prototype malfunctioned and the arc nearly blew him out of his parents' basement.

Before becoming an editor for Electrical Wholesaling and Electrical Marketing, he earned a BA degree in journalism and a MA in communications from Glassboro State College, Glassboro, NJ., which is formerly best known as the site of the 1967 summit meeting between President Lyndon Johnson and Russian Premier Aleksei Nikolayevich Kosygin, and now best known as the New Jersey state college that changed its name in 1992 to Rowan University because of a generous $100 million donation by N.J. zillionaire industrialist Henry Rowan. Jim is a Brooklyn-born Jersey Guy happily transplanted with his wife and three sons in the fertile plains of Kansas for the past 30 years.