That school down the road can provide more than an education for your town’s children. For distributors, reps and manufacturers, schools offer a wealth of electrical product sales if you know how to work the system and get involved on the ground floor.

Many salespeople may drive right past schools and colleges on the way to big accounts such as electrical contractors or industrial plants. And despite the uncertainty of spending by school districts and universities because of budget crunches exacerbated by the COVID-19 crisis, over the next few years the educational market will still provide some exciting sales opportunities.

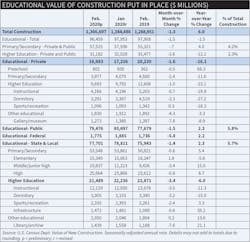

On a national basis, the latest U.S. Census Bureau Value of New Construction data for the construction of public and private K-12 school was reasonably robust on a year-over-year (YOY) basis through February, at $57.5 billion, a +4% increase over Feb. 2019. New construction at colleges and universities was not nearly as strong, at approximately $31.2 billion, a -12.1% drop from Feb. 2019. See the chart below for data on various key segments of the educational market.

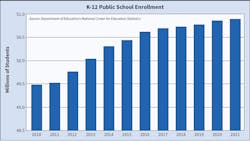

Another way to measure the health of the educational market is through enrollment figures. As you can see in the charts on pages 20-21, data from the National Center for Education Statistics on the numbers of new K-12 students entering classrooms and college students enrolling in classes is expected to grow gradually over the next few years. These enrollment increases will require consistent upgrades to existing facilities.

Location, location, location. You need to look at enrollment statistics on a school district-by- school district basis because enrollment trends are always moving in different directions in different areas of states and different regions of the country. For instance, according to government data, K-12 enrollment growth in many states in the Midwest and Northeast doesn’t look nearly as strong as in Sunbelt states like Florida, Texas and North Carolina, or in other states enjoying huge population gains that bring in thousands of new students each year. For example, Texas (+38,000); Florida (+26,000); and Washington (+14,300) are expected to lead the nation in K-12 public school enrollment gains from 2020-2021, according to the Department of Education’s National Center for Education Statistics (www.nces.ed.gov). On the flip side, enrollment in California (-29,600); Michigan (-13,600); and Illinois (-12,700) is expected to drop during this time frame. Leading local economic indicators that run parallel to school enrollment data are population growth and building permits. When these data points are flashing green, you can bet the school market is doing well because new residents and their children are moving into the area.

Major new construction or renovation projects in K-12 schools are heavily dependent on local or state bond issues voted on by residents. It’s far from a given that these bond issues always pass, particularly in areas with declining enrollments. For example, in early March, California votes rejected the state’s massive $15 billion Proposition 13 bond issue. According to American School & University magazine (www.asumag.com), some municipalities and community colleges did pass sizable local bond issues, including bond issues in Sacramento ($750 million); Fresno ($325 million); and Dublin ($290 million).

University construction is fueled by endowments. Public colleges and universities also rely on bond issues for some of their funding, and the big California state bond proposal turned down by voters in March affected the state’s university system, forcing some schools to look for local bond funding.

Colleges and universities also rely on endowment to fund big construction projects. Big universities have billions of dollars in their endowment funds. According to the 2020 Dodge Construction Outlook, in 2018, Harvard had the largest endowment at $38.3 billion. Because many of these endowments can be fairly heavily invested in the stock market, universities may see some financial challenges over the next few years because of the market’s recent plunge. Administrators may not be as willing to tap into funds for new construction or renovation until the stock market recovers.

Even if the indicators mentioned here are trending negative in your market, opportunities still exist in the retrofit of existing schools. According to some government statistics, 75% of all public schools are at least 25 years old, and in many school districts, the building stock is badly in need of renovations to lighting, HVAC and voice-data-video (VDV) and security systems. Electrically speaking, this means a ton of potential sales in the upgrade of equipment, from load centers at the service entrance to the power wiring and various low-voltage systems throughout the entire building.

The core distribution systems in schools require many of the same products used in the commercial, retail, government or industrial facilities with which electrical distributors are more familiar. But the school market requires a slightly different package of products because of how schools operate and the many learning activities the electrical and electronic systems at that educational facility must support.

There’s no doubt it can be a lucrative market to service. Several years ago, Graybar Electric Co., St. Louis, added several new branches in or near college towns because of how much construction so often seems to be underway on university campuses.

In addition to the products mentioned in this article, industry observers expect the COVID-19 crisis to require major additions to the access control and air-handling systems for all sorts of buildings, and K-12 and university buildings are no exception. Start listening for rumblings about the installation of no-touch security access systems to eliminate physical contact at schools and universities, as well as potential changes to air-handling systems for increased air movement to reduce the spread of the coronavirus.

Another stimulant for this niche is green construction. While full-on, LEED-certified construction does not appear to be as popular as it was several years ago because of the cost of certification, along with the obvious energy-saving benefits of green construction come the PR benefits “going green” offers schools and universities. Green is a big issue with educational construction because it plays so well to administrators, students, parents and other members of the educational community.

The charts above highlight some of the key products that distributors can sell to schools. Of the products listed, most of the action is in the following product areas:

- Energy-efficient lighting systems and related products

- Dimming systems

- Wireway, surface raceway and underfloor duct

- Upgraded grounding systems to protect computer equipment from interference from power wiring and other equipment

- VDV wiring systems for computers, WiFI networks, video, television, security, intercom and fire alarms

- Surge suppressors and power conditioning equipment to protect electronic equipment

- Vandal-proof lighting

- No-touch access security systems

The school market is seldom an area in which a distributor develops a specialty because the day-to-day sales potential just isn’t as high as with core customers such as electrical contractors or industrial plants. But when a new school is being built, an addition to existing facilities is underway or a lighting or VDV upgrade is on the drawing boards, distributors should know what will be expected of them if they win the bid. Following are the key strategies electrical distributors should focus on to build a business in the school market.

Familiarize yourself with the bidding process. Because most major construction projects at public schools are financed by local or state funds, an open bidding process is used. Once the architect and engineering firm complete their plans and those plans are approved by the school district, general contractors bid the job. The general contractor that wins the bid then requests bid proposals from the various trades. If he or she believes the bids are realistic, the subcontracts are awarded; if not, the subcontractors bid again. The contractor that wins the bid for the electrical work then puts out his bid for materials to electrical distributors.

VDV work on a project is often treated as a separate bid. Performance clauses regarding maintenance of the power wiring or low-voltage wiring and other specific services are now often part of the contract, as are 24-hour-emergency service clauses, a two-hour-response time for fixing problems or a technical-support hotline.

Treat a school system as you would any other key account. The school construction market many never represent a large portion of your business. But it’s so close to the core customer groups for many electrical distributors that it makes sense to service it just like you would other key accounts, with a salesperson consistently calling on the key buying influences in the market and at the school system.

Tap into your community’s grapevine for early news of a school project. Your network of local contacts in the community can also help you get an early lead on new school projects. The new construction or retrofit work at schools is often well publicized through town meetings and local media coverage of those meetings. Most of the time this work must go to vote before the community for approval, so you will find out about an approved project far in advance of when the work starts.

“If distributors get in on the ground floor, they can not only help with the construction phase, but with the MRO,” one electrical manufacturer told Electrical Wholesaling several years ago. “For a distributor it should be a constant goldmine,” he says. “A typical school room has a television monitor, fire-alarm, intercom and time systems, a computer for the teacher, and more computers at work stations for the kids. There are always renovations, too. For instance, with a wire management system in a school, the ‘go-with’ opportunities are tremendous. Not only are you selling a surface wiring system, but you have to have a proper grounding system and better separation between clean and dirty power.”

Find out which manufacturers are calling on your market’s buying influences. Lighting manufacturers, VDV companies and other manufacturers focusing on the school market often have field salespeople calling on specifying engineers in your market to get their products specified. If you haven’t met these field engineers, make it a point to do so.

Talk to the right people in the school district. For the big project work and retrofits, find out who calls the shots on equipment purchases. The person with this purchasing power often reports to the superintendent and may be called the business manager or energy manager, says John Wilson, formerly a senior Sylvania executive who had years of experience selling lamps to school districts. He always told distributors they need to increase the number of people they call on at a school district. “Don’t just talk to the maintenance guy at the local high school who is working on a budget,” he said. “You have to get to the business manager or the energy manager. Some schools are more sophisticated and have an engineer.”

Get on the preferred vendor list and then sell up. If a school construction project is state-funded, there may be a preferred or recommended vendor list set at the state level that the local school districts follow. In some product areas, notably lighting equipment, getting on state contracts is a one-way ticket to low-margin business. However, the local municipalities or school districts often can still choose their own brands if they so desire, said Wilson. “They may say, ‘We want to bid locally. We don’t want the state brand.’ This gives the schools that option.”

Sell the dollars-and-cents savings of energy-efficient lighting systems. Schools are particularly receptive to the concept of slashing operating costs by installing more energy-efficient lighting systems. It’s probably going to be your contractor who has the direct contact with the specifying engineers designing a school project or the school administrators that approve it. But you still should be prepared to offer yourself as a local source of lighting knowledge if that’s an area of expertise for your company.

Lighting retrofits are one of the very top facility improvements that schools invest in and rank right up there with installing air conditioning and carpeting. LED lighting, dimming systems, vandal-resistant lighting, theater and sports lighting and energy-efficient exit sign lighting are a few of the top lighting opportunities.

Don’t be surprised if you or your contractor customers find yourselves competing with energy-service companies (ESCOs) on lighting bids. ESCOs bid jobs by offering a one-stop solution to the design, installation and supply of products for not only the electrical portion of the job, but the HVAC segment as well.

Think low-voltage. Computer learning is as big a part of the curriculum as reading, writing and arithmetic. This is great news for any distributors considering a move into the low-voltage wiring market, or companies that already have established businesses in this area. While wireless classrooms and hotspots are now commonplace in classrooms and on campuses — potentially offering new sales opportunities in routers, range extenders and repeaters — distributors’ customers are pulling miles of spaghetti wire through the ceiling tiles to link computer labs to classrooms, and classrooms to the front office or Internet.

And once a base of computer equipment is installed in a school, distributors can expect repeat business as the school reconfigures, updates or adds to its computer network. The surge of interest in teaching computer skills and computer-based learning has made the market for low-voltage wiring, connectors, wall jacks and all the related VDV equipment one of the top opportunities in the school market.

Focus on selling surge suppressors and other power-protection products. Find out what manufacturers of surge suppressors and other power protection products are doing to get this equipment specified on school construction jobs in your market. Schools store data such as grades, test results and other student records on their computer networks, and they need the proper protection so they don’t lose this valuable information. Engineers are specifying surge protection equipment and uninterruptible power systems (UPS) to protect this information. Many retrofit jobs now have surge suppression devices at the subpanel and at the equipment outlet, especially in older buildings.

If school enrollment is on the rise in your market, you will be hearing more about new construction and retrofit work at schools. With the basic sales and marketing strategies discussed in this article, you can be ready for these opportunities when they develop.

About the Author

Jim Lucy

Editor-in-Chief of Electrical Wholesaling and Electrical Marketing

Jim Lucy has been wandering through the electrical market for more than 40 years, most of the time as an editor for Electrical Wholesaling and Electrical Marketing newsletter, and as a contributing writer for EC&M magazine During that time he and the editorial team for the publications have won numerous national awards for their coverage of the electrical business. He showed an early interest in electricity, when as a youth he had an idea for a hot dog cooker. Unfortunately, the first crude prototype malfunctioned and the arc nearly blew him out of his parents' basement.

Before becoming an editor for Electrical Wholesaling and Electrical Marketing, he earned a BA degree in journalism and a MA in communications from Glassboro State College, Glassboro, NJ., which is formerly best known as the site of the 1967 summit meeting between President Lyndon Johnson and Russian Premier Aleksei Nikolayevich Kosygin, and now best known as the New Jersey state college that changed its name in 1992 to Rowan University because of a generous $100 million donation by N.J. zillionaire industrialist Henry Rowan. Jim is a Brooklyn-born Jersey Guy happily transplanted with his wife and three sons in the fertile plains of Kansas for the past 30 years.