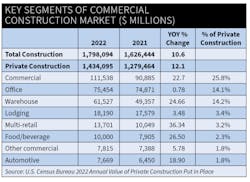

This month’s article focuses on one of the most important of all markets for electrical products — the commercial construction market. The products used in this market cut across virtually all product categories, including lighting; wire and cable; fittings; connectors and terminals; conduit, cable tray and wiring systems; wiring devices; motors and motor controls; distribution equipment; circuit breakers and fuses; switchgear; voice-data-video (VDV) products; power conditioning equipment; signaling equipment; building management systems; and electricians’ supplies.

With this selection of products, it’s easy to see why few markets are nearer and dearer to an electrical distributor’s heart than new construction and retrofit work in the commercial market. It’s a huge market that sweeps across big cities, small towns and rural areas — from Main Street America to malls and strip shopping centers. The biggest applications include office buildings, stores and shopping centers, hotels, banks, theaters, museums, sporting facilities, data centers and other public buildings.

Commercial construction probably accounts for a bigger selection of products from a distributor’s warehouse shelves than any other market. Depending on how you define this market, it accounts for approximately 26% of a typical electrical distributor’s business, according to Electrical Wholesaling’s most recent reader surveys.

The more commercial profitable jobs often get obscured by the “trophy” jobs. Everyone likes to drive by the biggest construction project in town and say to anyone who will listen, “We worked on that project.” But for every office tower, stadium or other landmark job, there are probably dozens of smaller — but more profitable — jobs that get done quietly, don’t go out to bid and never quite hit the radar screen in the market. Don’t overlook the small projects or retrofit work that may still be available even in the slowest of economic times.

While spending on nonresidential construction picked up momentum toward the end of 2022, the American Institute of Architects (AIA) expects construction spending will moderate in 2023 and slow significantly in 2024, according to its Consensus Construction Forecast panel, which is made up of leading construction economists. The panel is projecting commercial construction to increase +2.6% in 2023 but contract -1.4% in 2024. These economists also see office construction dropping -0.5% in 2023 and -0.7% in 2024. The AIA Consensus Construction Forecast combines the forecasts of Economy.com, FMI ConstructConnect, Associated Builders and Contractors, Wells Fargo Securities, Markstein Advisors and Piedmont Crescent Capital.

Dodge Construction Network says in its 2023 Construction Outlook that, “Commercial construction will see a pointed falloff in activity during 2023 as starts decline -3% to $153 billion and square footage falls a more substantial -15% to 921 million sq ft.”

Dodge also says the warehouse sector is overbuilt and will decline in 2023, and that the outlook for retail, hotels and offices will continue to be soft because of the impact of COVID-19. Data centers will be a strong segment of the commercial market, according to the Dodge forecast.

5 TRENDS TO WATCH

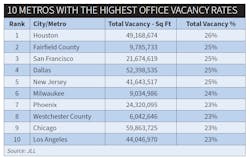

#1. Telecommunicating is reshaping the commercial real estate market and it will dramatically impact the amount of new office construction and the configuration of existing office space

In a post on its website (https://info.pcxcorp.com/blog/how-the-rise-of-remote-workers-are-impacting-the-construction-industry) PCX Holding, a division of Hubbell Industrial Control that designs and manufactures prefabricated electrical power distribution systems, outlined the challenges and opportunities telecommuting presents the commercial construction market.

“As telecommuting becomes more popular, the construction industry is going to have to adapt,” the post said. “Having a big office in a high rise doesn’t have the appeal it once did, and more corporations are going to seek ways to economize on their office space. Office space will be redesigned to accommodate more communal work spaces and fewer offices and cubicles. There will be less emphasis on large urban headquarters and more emphasis on smaller offices with coworking space. Smaller offices will help companies reduce their carbon footprint as well.

“You also can expect to see other construction industry trends emerge. Fewer commuters means that less parking will be required. It also will encourage companies to locate offices where property is less expensive and where they receive greater tax incentives.”

#2. Renovation work may account for a bigger share of the commercial market

“We’re seeing this increased growth in the reconstruction share across all major building categories. Architecture firms reported that in 2021, 62% of their revenue from commercial and industrial facilities came from reconstruction projects, up from 38% 15 years ago.”

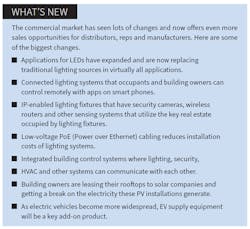

It’s tough to get hard numbers on exactly how big the commercial retrofit market can be for electrical distributors and their customers. But no one will dispute that it’s sizeable and that it can often be more profitable than new construction work because it usually doesn’t go out to bid. According to Electrical Wholesaling reader surveys, commercial/office maintenance supplies and commercial/office retrofit business account for approximately 9% of the average distributor’s sales, while new office construction is 9.5% of sales. One of the biggest sources of commercial retrofit work is energy-efficient lighting systems. The inherent cost savings of the more efficient LED lighting systems blended with utility rebates and federal, state or local tax incentives can often push the return on investment (ROI) for energy-efficient lighting systems to three years or less.

#3. Data centers are still the hottest segment of the commercial construction market

Amazon, Microsoft, Google, Facebook and other tech firms or social media companies are each spending hundreds of millions of dollars on data centers. The total construction value of many data centers can easily range between $500 million and $1 billion, and when you consider that the electrical portion of these jobs is typically no less than 10%, these jobs represent a nice chunk of change for electrical distributors.

WESCO Distribution, Pittsburgh, and its Anixter business unit focus on helping customers solve supply chain issues related to data center projects. The company bolstered its package of data center solutions with the Sept. 2022 acquisition of Rahi System Holdings, Fremont, CA, which according to the press release on the purchase “serves the full life cycle of data center solutions by helping customers manage and simplify technology.”

#4. Distributors are differentiating themselves by offering preassembled products and systems to electrical contractors

To help their contractor customers save time and labor, some electrical distributors are offering presassembled electrical products as a value-added service. Graybar Electric Co., St. Louis, and Rexel USA, Dallas, are two distributors with innovative preassembly services.

Graybar urges contractors to “always be installing” so they can focus on the most profitable portion of any job – using their time and expertise on the job-site to install products, and not on non-productive tasks like having highly paid electricians working on time-consuming tasks like assembling fixture whips’ installing fittings into steel boxes; or assembling enclosures. A promotional video on Graybar’s website says electrical contractor spend up to up to 40% of their time working on nonproductive tasks, which impacts project profitability.

Rexel also focuses on project profitability with its preassembly services, which it provides for electrical, lighting, solar, automation & control and voice-data-video products. One of its promotional flyers for this service says, “We’ll handle the labor; you reap the savings. On the jobsite, time is money. You need to keep your high-valued labor focused on the most important tasks. With Rexel’s Pre Fab services, we deliver pre-assembled components built to your specifications right to your jobsite. We do all the work while you save time and labor cost on repetitive installation. You get consistent quality at a lower cost.”

#5. Some savvy electrical distributors are going the extra mile to help out electrical contractors with their job-site logistical challenges

The company’s executive team said logistical element of a typical lighting job is often complicated by some unique shipping challenges. Lighting fixtures are often shipped by manufacturers on a part-by-part basis in dozens of different boxes, and electrical contractors must assign someone on the job-site — often at hefty wage rates that can hit $50 per hour in the Texas market — to unpack the boxes, inspect for damages and piece together the fixtures.

Lonestar Electric Supply developed a customized cloud-based system to track fixture shipments that offers real-time mobile access for both employees and customers, and an innovative logistical support system where it brings these shipments into a special logistics warehouse and a dedicated crew inspects all products for damage, labels all shipping boxes with special job and location codes, and then holds the products for the job until the contractor needs them on the job site.

Summary. Although the commercial construction market may economic headwinds over the next year, it will remain a key market for electrical distributors, contractors, manufacturers and independent manufacturers’ reps.

About the Author

Jim Lucy

Editor-in-Chief of Electrical Wholesaling and Electrical Marketing

Jim Lucy has been wandering through the electrical market for more than 40 years, most of the time as an editor for Electrical Wholesaling and Electrical Marketing newsletter, and as a contributing writer for EC&M magazine During that time he and the editorial team for the publications have won numerous national awards for their coverage of the electrical business. He showed an early interest in electricity, when as a youth he had an idea for a hot dog cooker. Unfortunately, the first crude prototype malfunctioned and the arc nearly blew him out of his parents' basement.

Before becoming an editor for Electrical Wholesaling and Electrical Marketing, he earned a BA degree in journalism and a MA in communications from Glassboro State College, Glassboro, NJ., which is formerly best known as the site of the 1967 summit meeting between President Lyndon Johnson and Russian Premier Aleksei Nikolayevich Kosygin, and now best known as the New Jersey state college that changed its name in 1992 to Rowan University because of a generous $100 million donation by N.J. zillionaire industrialist Henry Rowan. Jim is a Brooklyn-born Jersey Guy happily transplanted with his wife and three sons in the fertile plains of Kansas for the past 30 years.