Electrical Wholesaling’s editors are always looking for feedback on how the content they develop for the print magazine and www.ewweb.com resonates with their readers. And whether it’s the Omniture web traffic reports that we use to evaluate how many folks read the online content on www.ewweb.com and how much time they spend there, or the conversations we have with readers at industry events, one thing is clear: Electrical Wholesaling’s Electrical Pyramid is far and away one of the most popular resources we have published in the past 20 years. The “Big Three” articles for Electrical Wholesaling are our annual Market Planning Guide in November; the Top 200 ranking of the industry’s largest distributors published each June; and the Electrical Pyramid.

It’s more than a little humbling to hear the presidents and CEOs of some of the electrical industry’s largest electrical manufacturers use the Electrical Pyramid to educate members of their boards of directors about the channels of distribution in the electrical market, and quite gratifying to learn that some professors in the nation’s schools of industrial distribution use it in their college-level classes to introduce students to this industry.

Amazon for Business. Industry observers may differ in their opinions about how effectively Amazon for Business (the new moniker for AmazonSupply) can compete in a contractor-oriented market that still values local inventory and expertise, but it’s undeniable that most electrical contractors and other electrical end users want the same online purchasing experience in the workplace that they get in their consumer transactions. The multi-billion dollar question is how well Amazon for Business will provide it. Electrical Wholesaling’s editors hear reports of Amazon recruiting technical electrical expertise from electrical distributors and manufacturers, and of national distributors testing out Amazon’s online storefront. The company is very definitely positioning Amazon for Business as a storefront for distributors and manufacturers in the B2B market. One thing is for certain — it’s not cheap to sell through Amazon for Business. According to information on its website, “professional sellers” pay a 12% “referral fee” for any industrial products sold through www.amazon.com, as well as a $39.99 monthly subscription fee. However, Amazon makes online shopping super-easy, whether it’s for books or circuit breakers, and when you consider attractive shipping promotions like free two-day shipping for orders over $49 or next-day shipping in some situations and you can see why Amazon will be a force to reckon with in the future.

The move to online shopping seems to be impacting LED lighting products more than any other individual product groups. Type in, “Where can I buy LED lamps online?” and you meet some online competitors who you don’t see at meetings around the electrical circuit, companies with websites like www.1000bulbs.com,www.superbrightleds.com, www.earthled.com and wwwledlight.com, as well as www.ebay.com, www.amazon.com, and www.snapdeal.com. If your company plays in the LED market, check out these companies and analyze the strengths and weaknesses of their go-to-market strategy for customers in the electrical business.

NEW TO THE ELECTRICAL PYRAMID?

The Electrical Pyramid was initially sketched out on a paper tablecloth in a Sausalito, Calif., coffee shop in 1994 by the late EW Chief Editor Andrea Herbert, as she and the magazine’s braintrust at the time tried to figure out how to illustrate the many changes the industry was going through then. We constructed the first Electrical Pyramid brick-by-brick in that coffee shop, inspired by the magnificent view of San Francisco Bay, great coffee, and the fact that the coffee shop was once a hangout for several famous 1960s-era San Francisco rock bands who would jam all night long at a nearby recording studio and stop by to cure a bad case of the munchies.

We brought that coffee-stained sketch back to our Overland Park, Kan., office and converted it into a magazine article that immediately caught the attention of industry leaders. Distributors and manufacturers started using it in their training sessions for new employees. One Texas A&M University professor asked us to enlarge it so he could use it as a teaching aid for the classes he taught in industrial distribution. The president of the National Association of the Electrical Distributors (NAED), St. Louis, at that time sent us an angry letter asking us to never publish it again because he didn’t like the fact that we were telling readers there were other companies out there selling electrical products besides members of his association. Then as now, the 470 or so NAED distributors that operate more than 5,000 locations are by any measure the largest and most influential distributors of electrical supplies. Their exact share of the total market for electrical products is tough to estimate, but they most likely sell no less than 60% to 65% of all electrical products.

And that in many ways is exactly what EW’s Electrical Pyramid is all about — it’s the clearest way we have found to illustrate the fact that manufacturers have other options to sell electrical products, and that if full-line electrical distributors want to continue being the largest single channel for electrical products in the United States, they better be darn good at what they do, or they will be replaced by other companies that do a better job of providing local sales support, credit, warehousing and delivery.

BUILDING YOUR OWN ELECTRICAL PYRAMID

EW’s Electrical Pyramid is a snapshot of the electrical market as a whole. It can be an even more valuable tool when you “localize” it to analyze the channels of distribution in your geographic market of choice. So get out your paper tablecloths, magic markers and whiteboards and start drawing your own electrical pyramids (See “10 more Ideas for How to Use Your Own Electrical Pyramid” on this page.) EW’s editors think this article does a pretty good job of summarizing the biggest channels to distribution in the electrical market. If you find other bricks in the pyramid, draw them in and send them to us at [email protected]. We will include them in our next edition of Electrical Wholesaling’s Electrical Pyramid.

One other key thought to remember before you dig into the valuable exercise of building your own electrical pyramid: Remember that there really isn’t any right or wrong combination of channels of distribution. EW’s Electrical Pyramid is in some ways more like a kaleidoscope than a snapshot of the electrical channel, in that the bricks in it shift on a product-by-product or market-by-market basis.

For instance, a manufacturer that wants to grow in the New York-New Jersey metropolitan area may have entirely different Electrical Pyramids for the five boroughs of New York and suburban Westchester County or Long Island in New York and Bergen, Hudson and Passaic Counties in New Jersey because the channels of distribution and local buying influences can be very different. And the bricks in the pyramid that a local electrical distributor will build to analyze his competition for a slice of that same market will look different from that manufacturer’s pyramid.

The Electrical Pyramid is going to be much more valuable if you build your own and customize it to your own unique market needs. But like lots of things, the devil is in the details. It’s a fun exercise, so don’t be afraid. Here’s how to get started.

Schedule at least a half-day. Invite your management team and best strategic thinkers to this session. If you can do it off-site in a conference room, all the better, but if time or budget don’t allow it, find a quiet room in your building where you can spread things out a bit.

Bring the right equipment. If you are leading the discussion and are a white-board type of guy or gal, you will have fun with this assignment. Bring ample erasable markers — you will be building an Electrical Pyramid brick-by-brick and will be thinking on the fly. Or, if you aren’t into white boards, get hold of a large roll of newsprint from an art supply or craft store and bring along a handful of markers. Other resources you should have on-hand include laptops (internet access a big plus in this meeting); copies of this article; and sticky notes. If a PDF of this article would be helpful for the session, contact EW at [email protected]. The analysis in this article will provide a high-altitude overview of the various channels (bricks) in each tier of the pyramid. Your job in this exercise is to bring this analysis down to ground level for the market area under discussion, and identify all of the key players in it.

If you want to get really creative and make it a fun hands-on exercise, you may even want to try bringing along some large wooden building blocks, and Legos or Duplo bricks. Assign the person in the room with the most artistic talent with the job of inscribing each brick with the channel of distribution under discussion.

Assign one person to be the “scribe.” If you are going with the building block idea, you have your man or woman. But make sure you have someone who is copying down all of the ideas sure to be flying around the room.

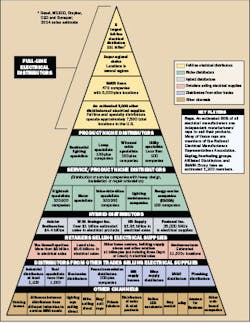

Build your pyramid level-by-level, starting with full-line distributors. Here’s where you will need a copy of EW’s Electrical Pyramid illustration shown on page 15. You may find it easiest to start at the top with full-line electrical distributors and work your way down through the seven tiers shown in the illustration. The rest of this article will walk you through each tier:

- Full-line electrical distributors

- Product niche distributors

- Service/product niche distributors

- Hybrid distributors

- Retailers selling electrical supplies

- Distributors from other trades selling electrical supplies

- Other channels

- Web-based companies

If you are a distributor, go around the room and start listing all competitors. Group them by national chain, regional chain or local independent. If you are an electrical manufacturer or independent manufacturers’ rep, do the same thing, but you may want to group them by the amount of business you do, don’t do or want to do with them. Depending on the type of analysis you are doing you may also want to pencil in which buying/marketing groups the distributors are in, if any.

And don’t forget to factor in the huge role independent reps play in any local market. Depending on your position in the market (distributor, rep, manufacturer, consultant, etc.) you may or may not want to list and profile all of the independent manufacturers’ reps in the market, and possibly the factory-employed field salespeople who cover the market as well.

You may find that creating an Electrical Pyramid leads to the creation a “customer pyramid,” where you analyze your market’s key accounts by size, type of company, market focus, the level of service required and how they buy product. And remember psychologist Abraham Maslow’s “hierarchy of needs” pyramid from that Psychology 101 class, which illustrated our basic need for food, water, shelter, companionship, respect, etc.? You could draw up a customer’s “hierarchy of needs,” where you illustrate the importance of price, delivery, education, return policy, etc.

Okay, now the hard work starts. Compiling a list of distributors (or reps) in your market may unearth a few surprises and provide some valuable information. But to make this information really work for you, now sketch out a profile for each of these companies and drill down to their strengths and weaknesses. The basic company profile should include key management personnel; estimated sales volume; market share; and primary market focus. You also need to get answers from your assembled team to questions such as:

- “What value-added services does this company provide that we currently don’t offer?”

- On the flip side, “Which services do we offer where we have a clear advantage?”

- Who are their biggest accounts?

- With which customers are they most vulnerable?

Full-Line Distributors – Five largest account for 31% of total market. The electrical wholesaling industry continues to consolidate, and over the last few years the five largest national distributors, (Sonepar, WESCO, Graybar, Rexel and Consolidated Electrical Distributors (CED)), have increased their market share to 31% of a $100 billion-plus market and the Top 200 largest distributors (see EW’s June issue) now account for 65% of total sales. To learn more about the largest full-line electrical distributors, check out last month’s issue or EW’s new online capsule summaries for the 50 biggest distributors at www.ewweb.com.

Product Specialists – Lamp specialists are coming on strong. Now move down to the next tier of the Electrical Pyramid. Go around the room and get people to brainstorm about all of the niche distributors in your market area that focus on a specific product category. The biggest product specialists typically include residential lighting, lamps, wire and cable and utility products. Others include fuses, voice-data-video (VDV) products and utility supplies. You may be surprised by how many product specialists in your market area compete with you on a few product lines. Depending on how in-depth you want to go with your analysis, you may or may not want to develop company profiles for each of these product specialists.

Pay special attention to the lamp specialists in your market. These companies do much more than just stock hard-to-find or oddball lightbulbs. Like most other product specialists, in the big scheme of things, their market niche may only be a few inches wide compared to the thousands of stock-keeping units (SKUs) that full-line distributors stock. But their market penetration and expertise within their specialty runs many miles deep compared to electrical distributors, and many lamp specialists nowadays are experts in state-of-the art lighting systems and carry a broad array of lamps, ballasts and a growing assortment of lighting equipment. These specialists could very well emerge as the channel of choice on LEDs because many of them have watched this product area for years and have a ton of insight into it. The trade association for these lamp specialists, the National Association of Independent Lighting Distributors (NAILD), Buffalo, N.Y. (www.naild.org), has more than 60 distributor members and over 30 manufacturer members.

Service/Product Niche Distributors – Find out what ESCOs and lighting maintenance companies are doing in your market. Service/product niche distributors have a heavy emphasis on design, installation or repair. Although they sell electrical supplies, product sales may not be their primary function. These companies focus on providing a complete service solution to their customers.

Pay special attention to ESCOs, which provide the most sophisticated package of design, financing, technical assistance, audit and, in some cases, installation services in the energy market. The sale of electrical products is a relatively small piece of the overall package of products and services that ESCOs provide. Many ESCOs are looking for distributors to provide local warehousing support and logistics for their lighting retrofit projects. The National Association of Energy Service Companies (NAESCO), Washington, D.C., offers some good insight into the world of ESCOs at www.naesco.org.

You should also pencil in lighting-maintenance companies into this tier of your pyramid. These companies, which typically have contracts for the maintenance and retrofit of lighting systems in stores, parking lots and other retail or commercial facilities, are emerging as skilled players in the energy game.

If you want to get a sense of how far these companies have evolved, check out the training resources at www.nalmco.org, the web-site for the National Association of Lighting Maintenance Companies (NALMCO), Ankeny, Iowa. NALMCO’s training resources help school its members in the latest in energy-efficient lighting systems. Some full-line electrical distributors are now members of NALMCO, including Border States Industries, Fargo, N.D.; Facility Solutions Group, Austin, Texas; and Graybar Electric Co., St. Louis.

Hybrid Distributors – Don’t overlook Grainger and Fastenal. Grainger and Fastenal are tough to categorize because they don’t carry a full line of electrical products. But they are definitely competitors to full-line distributors because of their intense focus on the industrial MRO and facility maintenance markets, rock-solid balance sheets and progressive internal operations. Electrical products probably account for somewhere in the neighborhood of 20% of Grainger’s total sales. But because of its sheer size, willingness to invest in its e-business capabilities, distribution network and branch infrastructure, the company is a formidable competitor for full-line distributors. If you have a Grainger branch in your neighborhood, add a brick to your pyramid for them.

By some measures, Fastenal may be a peripheral player in the electrical market. But with 4.7% of its $3.7 billion in sales ($175.5 million) in electrical products; more than 13,000 electrical stock-keeping units (SKUs) listed on its website www.fastenal.com; 42,000 SKUs overall; and 2,627 branches – slightly less than the combined number of branches run by Sonepar, Rexel, WESCO, Graybar and CED in North America — you need to keep an eye on them. And if you want to learn about something really interesting, do some research on the company’s FAST Solutions vending program, where it has more than 46,000 vending machines (19 different varieties) already installed in customer locations. Add another brick to your pyramid for them.

You may also want to include Anixter International Inc., Skokie, Ill., on this tier of your pyramid if they have any locations nearby. They could also be called a product specialist because of their primary emphasis on wire and cable, but they also sell a line of fasteners and provide some unique customized supply chain services for customers. EW’s editors put them in this tier.

Another hybrid distributor to watch is HD Supply, Atlanta. The company is one of the largest distributors of utility products in North America and many of the financial metrics measuring the company’s performance have turned positive over the past few months after quite a while in the red. You may be surprised to learn that the company’s stock is up 26% over the past year and a whopping 88% over the past two years.

Retailers selling electrical supplies. Keep an eye on what Home Depot and Lowe’s are doing. When you figure that Home Depot or Lowe’s does an estimated 10% of their total sales in electrical products, you realize why you still have to watch what these big boxes are doing in their electrical aisles. It’s true that a huge chunk of their electrical business is in residential fixtures, which may or may not be a concern. And although all of the talk about home centers going after the contractor market in a big way seems to have died down a bit, both still provide home installation services and Lowe’s appears to have a fairly large residential solar installation play in its Sungevity service.

And here’s an interesting side note that shows just how big electrical sales are at Big Orange. Home Depot’s 2015 10K says its Electrical aisles account for 6.8% ($5.65 billion) and its Lighting aisles account for 3% ($2.5 billion) of total sales.

Distributors from other trades selling electrical supplies. That distributor down the street may be a competitor. When you have at least 1,000 industrial distributors, 1,000 tool specialist distributors, and more than 200 specialists in power transmission products in the United States, you know some electrical sales are flowing through these often-overlooked channels. If you have any of these types of distributors in your market, as well of distributors of electronics components, HVAC equipment, plumbing supplies or other specialty distributors, they may be worth further study to see what kinds of electrical products they might be stocking.

It makes a lot of sense to get to know the distributors from other trades in your local market area. In a sense, you are in the same business but are just shipping different stuff in the boxes. Find some non-competing distributors from other trades and compare best practices in sales, warehousing, delivery, e-business and operations. You may also want to consider joining the National Association of Wholesaler-Distributors (NAW), Washington, D.C., which provides some terrific venues for networking with distributors from other trades and an insider’s perspective on legislative issues of interest to distribution firms.

Other channels. Always changing but always growing. Any single brick in this level of the pyramid probably may or may not account for a ton of electrical sales in your market. This level of the Electrical Pyramid may be toughest to track because it’s where the new and potentially competing channels of distribution first start out.

Do you have any reps in the spec-grade lighting niche selling direct? Pencil them in. And if solar is growing in your market area, find out who is selling the photovoltaic (PV) equipment. It might be a small PV contractor who is also a dealer for a limited number or lines.

Another hotly debated sales channel is the manufacturers selling direct. Outside of providing large quantities of wire and cable for massive projects in the utility market; gigantic turnkey switchgear or automation projects; spec-grade lighting packages; and now LED lighting solutions, this historically hasn’t been a widespread issue in the mainstream electrical wholesaling industry. However, we expect more lighting manufacturers to sell their customized LED lighting solutions direct to end users.

Online merchants. Depending on your market position, these bricks in the pyramid may be changing the fastest. The most obvious bricks here include www.amazon.com, www.ebay.com and the online LED merchants mentioned earlier.

Summary. After you finish building your own Electrical Pyramid, check out www.ewweb.com for some additional information that the magazine’s editors have posted on some of the fastest growing alternative channels of distribution. Just type “2015 Electrical Pyramid” into the search engine.

About the Author

Jim Lucy

Editor-in-Chief of Electrical Wholesaling and Electrical Marketing

Jim Lucy has been wandering through the electrical market for more than 40 years, most of the time as an editor for Electrical Wholesaling and Electrical Marketing newsletter, and as a contributing writer for EC&M magazine During that time he and the editorial team for the publications have won numerous national awards for their coverage of the electrical business. He showed an early interest in electricity, when as a youth he had an idea for a hot dog cooker. Unfortunately, the first crude prototype malfunctioned and the arc nearly blew him out of his parents' basement.

Before becoming an editor for Electrical Wholesaling and Electrical Marketing, he earned a BA degree in journalism and a MA in communications from Glassboro State College, Glassboro, NJ., which is formerly best known as the site of the 1967 summit meeting between President Lyndon Johnson and Russian Premier Aleksei Nikolayevich Kosygin, and now best known as the New Jersey state college that changed its name in 1992 to Rowan University because of a generous $100 million donation by N.J. zillionaire industrialist Henry Rowan. Jim is a Brooklyn-born Jersey Guy happily transplanted with his wife and three sons in the fertile plains of Kansas for the past 30 years.