When you ask someone what’s new in the electrical industry these days, there’s a good chance the urge to merge will be part of the conversation. This year’s Top 100 ranking highlights just how big a deal mergers and acquisitions are in the electrical market. By our count, more than 60 firms previously ranked on our list since 1980 have been acquired (see table below).

Click on file to download an Excel spreadsheet of this year's Top 100

Because of all these acquisitions, Electrical Wholesaling’s editors made the difficult decision to pare it down from 150 companies to 100 companies. I have been working on this listing since we ranked 250 companies, and am sorry to see the names of so many well-known family businesses leave the list, but I know that the vast majority of them have found good homes with their new parent companies.

Acquisitions and mergers tend to go in cycles, but there’s no doubt that we are currently in one of the more acquisitive cycles the industry has ever seen. In the past two years alone, Sonepar or one of its subsidiaries has acquired seven large independent distributors, including most recently Electric Supply Center, Burlington, MA, as well as Madison Electric Co., Warren, MI; Standard Electric Co., Saginaw, MI; Electrozad, Windsor, ON; Billows Supply, Philadelphia; Sunrise Electric Supply, Addison, IL and Electric Supply of Tampa, Tampa, FL. Other national or super-regional distributors were active acquirers, too, including Rexel, which in 2023 or 2024 bought Buckles-Smith, Santa Clara, CA; Teche Electric, Lafayette, LA; and Talley Inc., Los Angeles, a large VDV specialist.

Graybar Electric, Consolidated Electrical Distributors and Border States Electric also bought some big distributors. Graybar acquired Shepherd Electric Supply, Baltimore, MD, and Blazer Electric Supply, Colorado Springs, CO; CED bought Parrish-Hare Electrical Supply, Irving, TX; and Border States Electric acquired Dominion Electric Supply, Arlington, VA, and Winston Engineering, West Hollywood, CA.

Not every remaining independent distributors sees the growth of the largest distributors as an insurmountable obstacle. Some respondents said smaller distributors can still react faster to market opportunities and may have better access to local talent.

At Inline Electric Supply, Huntsville, AL, Bruce Summerville, president said, “We are one of the last multi-location independent distributors left in our area of the country. My perception is that fact, along with us being a 100% ESOP, gives us an advantage in recruiting new ‘A players’ to our team. The bigger guys that we are competing with are probably going to put a bit of a squeeze on our margins, but overall I am confident that we will be able to outperform them due to having better and more qualitied people.”

Richard Booth, Electrical Division manager for Coburn Supply, Beaumont, TX, says the acquisitions sometimes give larger companies advantages with their vendor relationships. “Big-name companies come in to play with stronger vendor relationships than an independent regional has in some cases,” he wrote in his response. “It forces the smaller distributor into corners we have to fight out of. Vendors who promised to work with you as you entered a new market now back out of that agreement when the larger national chain gobbles up the competition."

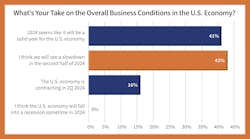

A Slowing Economy in the Second Half of 2024?

This year’s companies have seen plenty of challenges. On average, EW Top 100 distributors are fairly optimistic about the 2024 business climate, but 43% of respondents see business slowing in the second half of 2024. Sixteen percent of respondents said they already saw signs in 2Q 2024 that the economy is contracting. On a positive note, none of the respondents see a recession anytime in 2024.

While 39% of respondents saw their sales growing between 1% to 5% in 2024 and 10% were forecasting flat sales, 37% of respondents saw their sales growing at better than a 10% clip. Average annual sales increase for electrical distributors typically range between 4% to 8%.

Another concern for many Top 100 distributors is the continuing issues with switchgear delays, which are putting a crimp in project completion. In fact, 59% of respondents said they didn’t see lead times returning to normal until 2025.

Despite these challenges, Top 100 respondents were definitely investing in their companies to position themselves for future growth. Several distributors were replacing or upgrading their ERP systems, including Butler Supply, St. Louis; CEEUS Inc., West Columbia, SC; Chelsea Lighting, New York; Clayton Engineering, Wheeling, WV; and Metro Wire & Cable Corp., Sterling Heights, MI.

A surprising number of companies were opening up new branches. Top 100 distributors told EW that they opened up at least 123 branches in 2023 and 2024, led by City Electric Supply, Dallas, which opened up 40 branches over the past two years. Since 2018, the company has opened at least 181 branches in North America. Winsupply, Dayton, OH, was also in expansion mode and opened seven branches in 2023 and plans to launch 15 more this year. Border States Electric has opened at least seven new branches over the past year and Elliott Electric Supply, Nacogdoches, TX, opened five locations in 2023 and has plans for “many more” in 2024. In total, the 100 full-line or specialty distributors operate no less than 6,846 branches in North America. If you count hybrid distributors W.W. Grainger, Lake Forest, IL, and Fastenal, Winona, MN, that total rise to 8,284 locations.

Data Centers, EV Factories and Chip Plants Lead List of Top Projects

While there was a general sense from many respondents that sales may slow some in the second half of 2024, many companies were still quite bullish about opportunities in the market because of all the electrical construction spending related to data centers, semiconductor plants and EV or EV battery factories. Not every distributor on this year’s list is fortunate enough to have one of these mega-projects in their backyard. But the billions of dollars in the electrical spend for these projects washing over the electrical wholesaling industry as a whole is covering up the declining demand for new homes and offices in many markets.

Click here to see related article on top projects for Top 100 distributors

Wesco, Pittsburgh, reported on some very large projects in its response. “Wesco has booked more than $250 million in large projects in just Q1 2024 alone, including a $30-million contract to support the world's first zero-carbon emissions integrated ethylene cracker,” it said. “A large EV manufacturer has awarded Wesco a $100 million contract to provide power distribution units, fiber-optic cable, cabinets and other data center materials to a large EV manufacturer. And a national renewable contractor has partnered with Wesco on a $125-million, five-year contract to deliver high-voltage breakers for a renewable project.”

Larry Swink, the president and CEO of Jackson Electric Supply, Jacksonville, FL, said some big projects are coming to his city very soon. “The Four Seasons Resort project in Jacksonville, represents a significant development that will impact the local market upon its anticipated opening in 2026,” he said in his response. “This project, a collaboration between Four Seasons Hotels and Resorts and Shahid Khan, owner of the Jacksonville Jaguars, is set to become a pivotal component of the downtown Jacksonville Shipyards redevelopment and is the largest private investment project in the city's history. It's located near the St. Johns River, adjacent to the Sports Complex and the proposed ‘Stadium of the Future.’”

All of the action in electric vehicles is creating business opportunities for Top 100 distributors and their customers, and respondents said that EV charging stations for commercial, retail or municipal applications were the most promising product area for 2024-2025, followed by the sale of lighting controls retrofits for commercial, retail or municipal applications and preassembled electrical products or systems.

By the Numbers

The 2024 Top 100 distributors account do a combined total of $95 billion in revenues – 65% of estimated industry sales of $145.3 billion. The largest distributors do the lion’s share of sales, with the Top 10 distributors on this year’s list doing an estimated $75.5 billion in sales for a 52% share of total industry sales. At least a dozen distributors on this list do at least $1 billion in annual revenues, and in total companies on this year’s list employ 126,700 workers (counting Grainger and Fastenal) and 93,173 employees if you just count full-line distributors and electrical product specialists.

Methodology. In putting together the 2024 Top 100, company data was gathered during April 2024 -May 2024 through a SurveyMonkey survey of electrical distributors, public documents and information on individual distributors' websites.

Many of these companies asked us to use their sales data confidentially and only for placement on the listing. We are glad to do that. Over the past three years, we have had more distributors ask us to use their sales data confidentially, so when you see a “NA” (Not Available) for 2023 revenues, that most often means we have the data but are not releasing it publicly.

Where Electrical Wholesaling editors had a employee count for a company but not a sales figure, we used the survey sales-per-employee average from 62 full-line distributor respondents of $971,254 per employee to estimates sales for placement on the listing. That sales-per-employees figure is up +3.3% from the 2023 number of $940,393.

We were able to supplement this data with revenue and company information for publicly held companies including Fastenal and W.W. Grainger, and collected corporate data from some distributors’ websites, so we are able to present a robust ranking of the industry’s largest distributors.

Several large full-line electrical distributors are not included in this year's ranking that would most likely would have ranked amongst the 50 largest in the listing because we have not received surveys back from and were unable to find any other reliable data to estimate their sales for placement. These companies include Colonial Electrical Supply, King of Prussia, PA; Electric Equipment Co., Raleigh, NC; and Granite City Electric Supply, Quincy, MA.

We received survey data from more than 90 distributors, which is down from previous years. Working with fewer responses and all of the acquisitions that took about a dozen independent distributors off of the list pushed EW’s editors toward the decision to limit the list to 100 companies. The smaller list also eliminated some respondents from placement, and we apologize to those companies that took the time to respond but weren’t ranked.

Because 2023 was the last year Electrical Wholesaling was published in print, this is the first year our ranking of the largest distributors is available only online. We are still experimenting with different formats to get the ranking and the list to readers and hope you enjoy the listing this year.

MORE COVERAGE ON ELECTRICAL WHOLESALING'S 2024 TOP 1OO AVAILABLE HERE

Click on the links below to learn more about 2024's Top 100 Electrical Distributors.

Mega-Projects Reign Supreme on 2024 Construction Scene for Top 100 Distributors

Although some areas of the construction market are having a quiet year, Top 100 distrbutor are keeping quite busy supplying some humongous trophy jobs. Click here

2024 Sales-per-Employee Leaders

Sales-per-employee is one of the metrics to look at to judge a company's operational efficiency and profitability. Click here

Electrical Wholesaling's 2024 Top 100 Distributors By the Numbers

About the Author

Jim Lucy

Editor-in-Chief of Electrical Wholesaling and Electrical Marketing

Jim Lucy has been wandering through the electrical market for more than 40 years, most of the time as an editor for Electrical Wholesaling and Electrical Marketing newsletter, and as a contributing writer for EC&M magazine During that time he and the editorial team for the publications have won numerous national awards for their coverage of the electrical business. He showed an early interest in electricity, when as a youth he had an idea for a hot dog cooker. Unfortunately, the first crude prototype malfunctioned and the arc nearly blew him out of his parents' basement.

Before becoming an editor for Electrical Wholesaling and Electrical Marketing, he earned a BA degree in journalism and a MA in communications from Glassboro State College, Glassboro, NJ., which is formerly best known as the site of the 1967 summit meeting between President Lyndon Johnson and Russian Premier Aleksei Nikolayevich Kosygin, and now best known as the New Jersey state college that changed its name in 1992 to Rowan University because of a generous $100 million donation by N.J. zillionaire industrialist Henry Rowan. Jim is a Brooklyn-born Jersey Guy happily transplanted with his wife and three sons in the fertile plains of Kansas for the past 30 years.