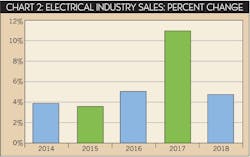

Reviewing history over the past 15 years it looks like the electrical industry peaks about every five years. Unfortunately, 2016 will not be the fifth year of the cycle. As the Chicago Cubs say, “Wait ‘til next year!” In our view, the year you can look forward to is 2017, when we are expecting a banner year with industry sales advancing 11% from the previous year.

The issue is that in this case, the “previous year” just happens to be 2016, the subject of our forecast. So 2016 is what electrical distributors have to go through to get to the fifth-year peak in our industry cycle. I suppose I could look if this pattern holds for the past 40 years for which we have data. But I wouldn’t bet the ranch that a five-year cycle is how the industry behaves. That would be too simple.

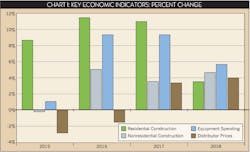

I can tell you though that what we see ahead is consistent with that five-year cycle. Just track the demand drivers — residential and nonresidential construction, and spending for business equipment. And don’t forget that there is another critical indicator that is sometimes overlooked in tracking industry growth.

Pricing Puzzles

At the macro level we often take the industry price index for granted. But at the micro level, where the rubber meets the road, prices are crucial to individual transactions. It’s the thousands upon thousands of transactions at the prices clearing the micro markets that determine the actual overall industry price level. It’s the overall U.S. price level that we track and forecast in order to get to the overall electrical industry forecast.

This gets tricky when commodity prices making up the overall industry price index are falling as they are now, and it raises questions about whether the markets are “overpriced.” It’s a question that really is about what is happening in the individual trading areas, not at the macro level. The market cannot be overpriced for the entire industry.

We do know that distributor prices are falling and in fact are negative for this year. That addresses the prices that distributors have to pay for their products. That is a given to distributors from their vendors.

The issue of whether the market is overpriced at the trading area level is best left to industry consultants like Channel Marketing Group, Raleigh, N.C., who work with individual distributors and vendors in solving these kinds of problems. The price index is made up of many commodities including many whose prices are not falling, so the question of whether the market is overpriced is a specific issue relating to specific products and markets.

Our goal now is to give you our best estimate of what we see in the performance of the electrical industry for this year and through the next few years.

Effectively, the main source of electrical industry growth this year is from the residential sector.

Next year we expect all three key drivers to ramp up, with prices dragging industry performance down by nearly 2%. And in 2017 we expect industry sales to react to the positive changes in these drivers.

This sales forecast is consistent with the overall performance in the key industry drivers, including industry prices.

There is no question that there are differences at the trading area level and in a number of areas the issues are extremely complex. But I am convinced that by the time the industry reaches its peak in 2017, these complexities will be less intense. Double-digit sales growth has a way of bringing out the best in the electrical industry.

About the Author

Herm Isenstein

Herm passed away in Sept. 2019 at the age of 86 from brain cancer. He was a good friend to the editors on the staff of Electrical Wholesaling and a prolific writer for the magazine for 15 years.

During his 30-plus years in the electrical industry, Herm Isenstein was the premier economist in the electrical wholesaling industry If you have any questions about DISC's subscription-based data services, contact Chris Sokoll, DISC's president at at 346-339-7528.