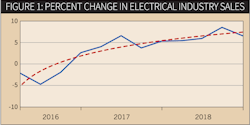

We are almost at the half-way mark this year and electrical sales are on the upside of the industry business cycle. Anytime we get close to 7% gains, the electrical industry is exceeding historical performance by a big margin.

The last year industry sales hit the 7% mark was 2012. We probably won’t get 7% growth this year, but we will come close — about 6.6% according to DISC Corp.’s most recent forecast in May. (See Fig. 1)

These figures don’t lie but they don’t tell the whole story, either. There are lots of ways to surface industry sales numbers, but the best way is to peel back the underlying layers of information so we understand why it is what it is. The electrical industry is construction-driven and there are only two primary construction indicators — residential and nonresidential. Simple?

Not so fast. Most businesses concentrate on a few market segments, such as commercial construction or residential construction. But as a whole, electrical distributors spread out over all segments. So, if you are scratching your head and wondering why you are not growing nearly 7%, here’s one reason why: The electrical distributor-served residential market was in the doldrums last year (residential construction was only up 1.7%) and it isn’t expected to advance more than 2.5% this year.

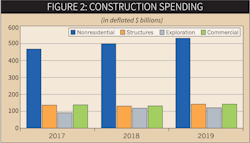

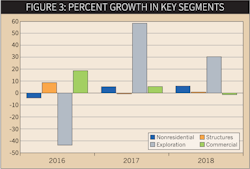

Here’s another reason why: Nonresidential construction growth this year, as it was last year, is highly concentrated in only one segment: oil (and mining) exploration. In 2017, exploration was nearly 20% of total nonresidential construction spending.

Construction spending. Nonresidential construction expenditures were up 5.5% last year with exploration up a whopping 58% (See Figure 2.). Nonresidential spending for “structures” (buildings) was down fractionally last year. This year spending for structures is expected to increase just 1%. Oil exploration is a segment of nonresidential spending but not part of the buildings category.

The point is that spending for nonresidential buildings is weak. And the only reason nonresidential construction spending is in plus territory is because of the strength in exploration. If you serve the oil exploration market, you are having a great year. If not, you could be scratching for orders. (These are in deflated dollars so we are looking at physical volume – and that is what you move out the door).

What we are left with for this year, at least, are two key market segments served by electrical distributors (residential and nonresidential) that are not contributing much to electrical industry growth. The main engine of electrical industry growth this year is investment in commercial and industrial equipment. Tack on about 2.5% for price and that’s DISC’s 6.6% forecast for this year.

Commercial construction accounted for $133 billion of the total nonresidential spending in 2017 but about the same this year. Meanwhile, exploration accounted for $86 billion in 2017 but $113 billion this year. As you can see in Figure 3, the percent growth in the critical elements in nonresidential construction is very uneven.

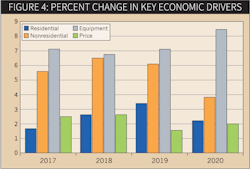

The industry’s key economic drivers. Equipment investment is a key driver of electrical industry sales, and this year it’s being supported by the recent tax cut. The indicators shown in Figure 4 are totally responsible for growth in the electrical industry. However, they operate independently of each other. Equipment is responding to among other factors, the tax cut, which does not at all hit the residential market.

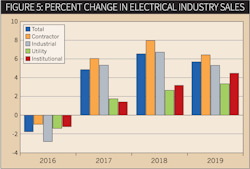

Summary. The bottom line is that this year industry sales are very much influenced by two main factors. Most important is the tax cut which gives industry sales about a two-point boost it would not otherwise have. Secondly, nonresidential construction growth would be significantly less if not for the large gains in oil exploration. See Figure 5 for DISC’s forecast for percent change in overall industry sales.

The author is president of DISC Corp., the industry’s leading provider of electrical sales forecasts. If you have any questions about subscribing to DISC’s subscription-based data services, contact Isenstein at 203-799-3673 / [email protected].

About the Author

Herm Isenstein

Herm passed away in Sept. 2019 at the age of 86 from brain cancer. He was a good friend to the editors on the staff of Electrical Wholesaling and a prolific writer for the magazine for 15 years.

During his 30-plus years in the electrical industry, Herm Isenstein was the premier economist in the electrical wholesaling industry If you have any questions about DISC's subscription-based data services, contact Chris Sokoll, DISC's president at at 346-339-7528.