On the numbers, a difficult December closed out a difficult 2018.

Whether you look at nonferrous metals; precious metals (except palladium); energy; or equities, 2018 was a bummer, with many markets down in double-digit percentage points. And if the figures themselves weren’t enough to make us cringe, recent news reports should make us shudder as the New Year gets underway.

Apple announced slowing sales of the iPhone in China, sending its share price, and the overall market sharply lower; China’s PMI index fell below 50 for the first time since May 2017; a recent Bloomberg headline announced, “A Fifth of China’s Homes Are Empty – That’s 50 million Apartments.”

CNBC reports that auto sales in China declined again, and we would have to go back to the Asian Financial crisis of 1998-1999 to see the last time China experienced this level of weakness.

And, of course, every report has to include the ongoing trade war as a key factor, and trigger point of the downturn. But this is critically important, particularly now, because China has become the “Big Guy” in the room as it represents fully 50% of global consumption of industrial materials.

There is no question that new trade tariff barriers are contributing to weakness, but several more issues are helping to stir trouble in the pot.

On the European side, Brexit is and has been a big thorn in the side of the Continent, getting more painful by the day; France is experiencing riots from overarching government policies; Germany is facing economic weakness for the first time in a long time; Italy is looking like Greece a few years ago; and the EU has been preoccupied with keeping itself together.

Within the United States, despite an exceptionally strong unemployment report for December, we also saw a sharp decline in the ISM Index (the Institute for Supply Management’s Purchasing Managers Index) within both manufacturing and non-manufacturing; and housing starts and building permits have been edging lower, as have new home sales, as well as existing home sales. And now, because of the government shutdown, updated statistics are not coming out.

As relates to copper specifically, let’s take a look at the market from an entirely different vantage point. That is to say, while we continue studying the fundamentals of the market as we have for many years, the technical approach has evolved to be our guiding light.

Taking this a step further, earlier this year, an analysis of the fundamentals would have advised us to be long in copper as inventories were falling, reflecting the global market in deficit. Indeed, the International Copper Study Group reports that refined copper was in a 369,000-metric tonne deficit during the first nine months of 2018.

But apparently the market didn’t get that message, as Jan. 2018 saw the monthly average price at $3.19, which as we look back was the high-water mark for the entire year. Taking the technical approach a step further and recognizing that this can only be said with the benefit of hindsight, perhaps 2018 was just a correction of a more important move in the market. Stay with me on this as it’s getting a bit more involved than we had intended. Here it goes:

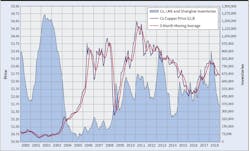

Take a look at the copper chart on the previous page. The record high monthly average occurred in Feb. 2011 at $4.49. From that peak, the price fell to a low of $2.01 in Jan. 2016. Thus, over about five years, the price fell $2.48, or 55%.

From that low point, copper advanced $1.18 or nearly 60% to the $3.19 high set in January. Thus, one could say that the $1.18 advance was an almost 50% correction of the $2.48 decline.

So, if the move from Jan. 2016 to Jan. 2018 was just a technical correction of the Jan. 2011-Jan. 2016 decline, we may see a further retracement back to lower levels. This would not be very different from what occurred in the 1996 to 1997 period, following the unfortunate massive trading debacle.

Nevertheless, there’s no point in trying to guess how low the market may go, or when it may reach bottom, so we won’t even try. What we will say, though, is to the extent copper does continue moving lower, it’s in the process of digging a deeper and stronger foundation for its next move to a much higher level.

A frequent contributor to Electrical Marketing and Electrical Wholesaling, John Gross is publisher of The Copper Journal and one of the nation’s leading experts in metals pricing. If you would like to learn more about how to manage your wire and cable inventory in this volatile market environment, contact him at [email protected] or at 631-824-6486.

About the Author

John Gross

President

John Gross is president of J.E. Gross & Co., Inc, the management consulting firm he established in 1987. In addition to his consulting activities, Gross has worked with global leaders in the metals industry over the past thirty-five years. He began his career in metals in 1973 when he joined U.S. Metals Refining Company, a division of Amax Inc., where he rose to become manager of administration. In 1981 he joined Hudson Bay Mining and Smelting as manager of trading and in 1983 became a futures broker with Johnson Matthey, specializing in metals on Comex and the London Metal Exchange.

He joined BICC Cables Corp. in 1985, now owned by General Cable, where he became V.P. of strategic metals for their North American operations. He was also director of metals management with Scott Brass, a producer and manufacturer of copper and brass strip products.

Gross is a graduate of Hofstra University, and is a highly decorated Vietnam Veteran. He has held memberships in several trade organizations; was a director of the American Copper Council, and served as a member of the Comex Advisory Committee. He is very active in industry affairs, and has written extensively on the metal markets, industry issues.